From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism Tempered by Shifting Plant Activity Amidst Fluctuating US Imports

Asia’s steel market shows a positive outlook, despite some shifts in production. Recent US trade data reported in “US rebar imports down 11.5% in March 2025,” “US standard pipe imports up 18.8 percent in March from February,” and “US tin plate imports down 5.1 percent in March from February,” may indirectly impact Asian steel producers through changes in global trade flows. Satellite-observed changes in plant activity, however, currently show no direct relationship to these specific US import trends.

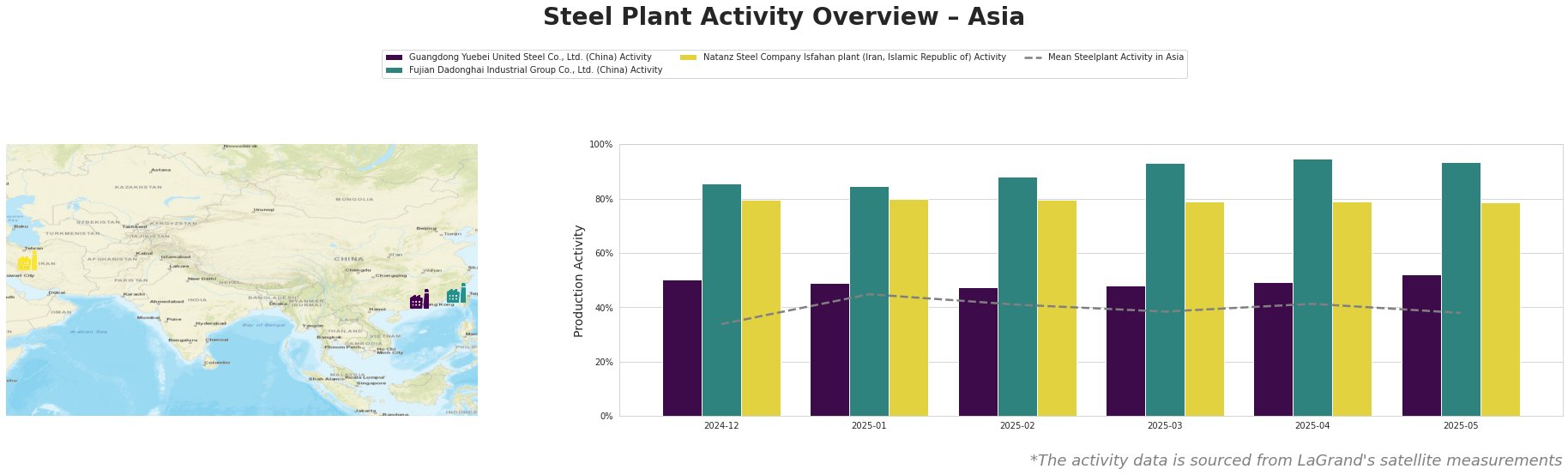

The mean steel plant activity in Asia has fluctuated, peaking at 45% in January 2025 and settling at 38% in May 2025. Fujian Dadonghai Industrial Group Co., Ltd. consistently operated at high levels, reaching 95% activity in April 2025, significantly exceeding the mean. Guangdong Yuebei United Steel Co., Ltd. shows lower activity, ranging from 47% to 52%. Natanz Steel Company Isfahan plant maintained stable activity around 80% throughout the observed period. No direct connection between the US import news and the Asian plant activity could be established.

Guangdong Yuebei United Steel Co., Ltd., a Guangdong-based integrated steel plant utilizing BF, BOF, and EAF technologies with a crude steel capacity of 2000 ttpa and 800 ttpa iron production, primarily produces rebar for building and infrastructure. Activity at this plant has been relatively stable, ranging between 47% and 52%. In May 2025, plant activity rose to 52% from 49% the previous month. It is Responsible Steel certified. No direct link between plant activity and the US import news can be explicitly asserted.

Fujian Dadonghai Industrial Group Co., Ltd., another integrated steel plant located in Fujian, with a crude steel capacity of 2200 ttpa and an iron production capacity of 1750 ttpa, primarily manufactures rebar using BF and BOF technologies. The observed activity for this plant is consistently high, peaking at 95% in April 2025. This plant is also Responsible Steel certified. Given its specialization in rebar, one might speculate on the impact of “US rebar imports down 11.5% in March 2025“; however, there is no explicit evidence connecting these data points.

Natanz Steel Company Isfahan plant in Iran, utilizes DRI and EAF technologies. It has a crude steel capacity of 1000 ttpa and an iron production capacity of 1500 ttpa, manufacturing bar and rebar. Throughout the observed period, the plant’s activity remained stable around 80%. This stability suggests a consistent operational level. It is Responsible Steel certified. No direct link between the observed plant activity and the US import news can be explicitly established.

Based on the data, Fujian Dadonghai Industrial Group Co., Ltd.’s consistently high activity suggests a reliable supply of rebar. For steel buyers focused on rebar, prioritize procurement from Fujian Dadonghai Industrial Group Co., Ltd. to secure supply. Diversify sourcing to mitigate potential disruptions considering that other plants show fluctuating activity. The “US rebar imports down 11.5% in March 2025” and similar import trends do not currently present any direct, traceable effect, but buyers and analysts should remain vigilant to shifts in global trade flows and their indirect effects on the Asian steel market. The stable activity at Natanz Steel Company Isfahan plant may provide an additional, consistent supply option for rebar and bar products.