From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism Fueled by Tech Earnings & Trade Hopes Despite Activity Dip

The Asian steel market shows overall positive sentiment driven by expectations surrounding tech earnings and potential trade resolutions, even with a recent dip in average plant activity. According to “Marktbericht: Was den DAX in dieser Woche bewegt,” positive US futures and rising Chinese markets due to trade hopes are key drivers. Observed steel plant activity levels provide additional insights, although direct linkages to the mentioned news events are not always immediately evident.

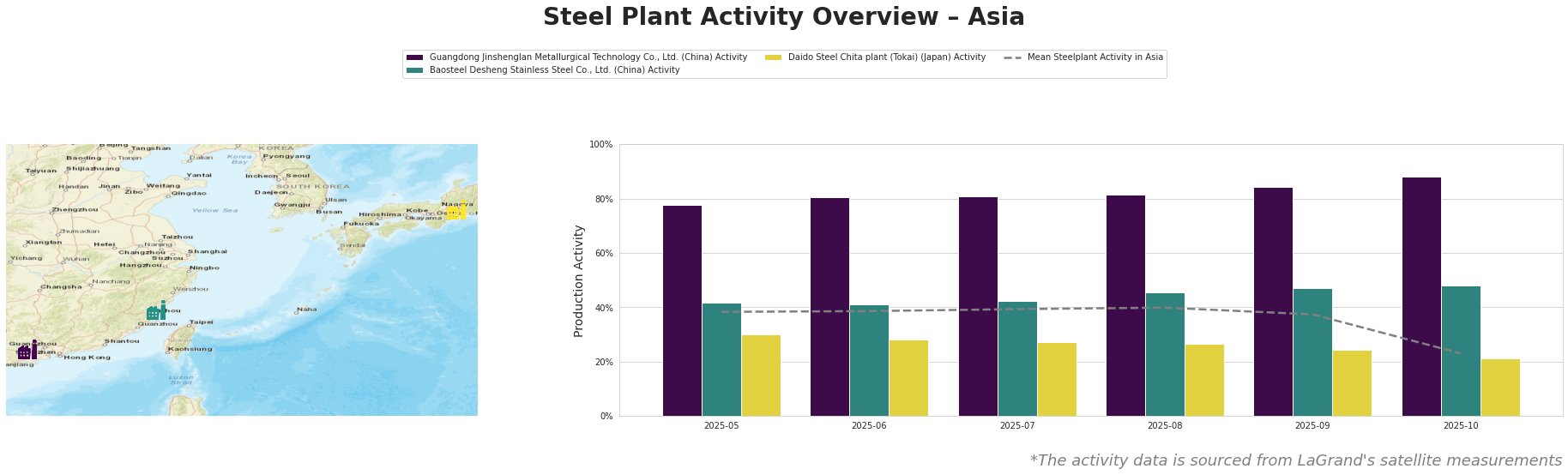

The mean steel plant activity across Asia experienced a significant drop in October, falling to 23% from 37% in September and a high of 40% in August. This decline warrants attention, although its direct correlation to the positive market sentiment mentioned in “Marktbericht: Was den DAX in dieser Woche bewegt” and “BREAKING: Zoll‑Deal auf der Zielgeraden” is not immediately clear.

Guangdong Jinshenglan Metallurgical Technology Co., Ltd., an EAF-based special steel producer with a 1.2 million tonne crude steel capacity, demonstrated consistently high activity levels, peaking at 88% in October. This high activity could be linked to the positive outlook for tech spending outlined in “Apple, Google, Meta, Amazon, Microsoft Earnings Due; Fed Rate Cut, Trump-Xi Ahead“, as special steel may be required for AI infrastructure, however, no direct evidence can be established from the provided news article.

Baosteel Desheng Stainless Steel Co., Ltd., an integrated BF/BOF stainless steel producer with a 3.41 million tonne crude steel capacity, showed a steady increase in activity, reaching 48% in October. This rise could be due to anticipated demand increases from potential US-China trade deal improvements, as reported in “BREAKING: Zoll‑Deal auf der Zielgeraden“, leading to a potential reduction of trade barriers on steel products, but no direct link can be established.

Daido Steel Chita plant (Tokai), an EAF-based specialty steel producer with a 1.5 million tonne crude steel capacity, shows a continuous decline in activity, bottoming at 21% in October. The drop in activity cannot be directly linked to any of the provided news articles.

Given the overall positive market sentiment, strong performance of specific plants like Guangdong Jinshenglan, and the possibility of improving trade relations, steel buyers should closely monitor the supply dynamics. While the mean activity levels have recently dropped, plants such as Guangdong Jinshenglan have increased production which may signal localized price fluctuations in the special steel segment. Procurement professionals should proactively engage with suppliers and secure contracts, especially for special steel grades, to mitigate potential price increases if the tech sector’s capital spending on AI, as discussed in “Apple, Google, Meta, Amazon, Microsoft Earnings Due; Fed Rate Cut, Trump-Xi Ahead“, translates to higher demand.