From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism Fueled by Indian Expansion and Stable Japanese Production

Asia’s steel market sentiment remains very positive, driven by expansion initiatives in India. “POSCO Group, JSW Steel Partner to Assess Indian Integrated Steel Plant” and “JSW Steel and POSCO Group ink advance agreement to construct greenfield steel mill in India” indicate significant investment in new production capacity. While these articles highlight future capacity increases, no immediate correlation to current satellite-observed activity data can be established. However, “India’s JSL commissions Primetals to modernize plate mill” could contribute to maintaining or increasing production levels at Jindal Steel Limited, although we do not have direct satellite data for that specific plant in this report.

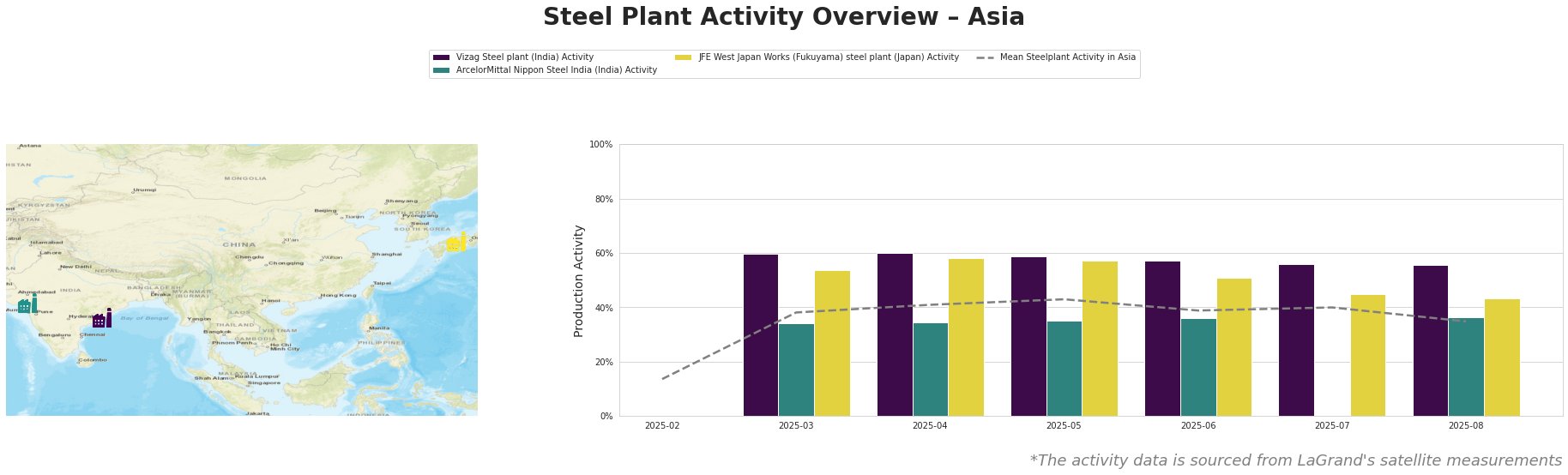

The mean steel plant activity across Asia reached a peak in May at 43% and has since declined to 35% in August.

Vizag Steel Plant (India): This integrated steel plant (BF-BOF route) with a crude steel capacity of 7.3 million tonnes per annum (mtpa) primarily produces semi-finished and finished rolled products for the building and infrastructure sectors. Satellite data indicates a relatively high and stable activity level, ranging between 56% and 60% from March to August. There is no directly observed impact from the news articles on this plant’s activity levels.

ArcelorMittal Nippon Steel India (India): This plant, located in Gujarat, has a crude steel capacity of 9.6 mtpa and uses both BF and DRI-EAF routes. It produces a range of flat products serving various sectors including automotive and construction. Its activity has remained relatively stable at around 35%–36% between March and August. Given the existing partnership between POSCO and JSW, there is no observed influence from the mentioned news on this plant’s short-term activity.

JFE West Japan Works (Fukuyama) steel plant (Japan): This integrated BF-BOF plant boasts a large crude steel capacity of 13 mtpa, producing a diverse range of flat and long products. Its activity has shown a gradual decline from a peak of 58% in April to 43% in August. This decline does not have any direct connection to the provided news articles focusing on Indian steel expansion.

Evaluated Market Implications:

The modernization of the Jindal Steel Limited plant, as announced in “India’s JSL commissions Primetals to modernize plate mill,” could lead to short-term supply disruptions of plates if the upgrade process results in significant downtime.

- Procurement Action: Steel buyers should closely monitor the plate market in India and explore diversifying their supply sources to mitigate potential disruptions from Jindal Steel Limited’s modernization activities, or consider forward purchasing to secure supply.