From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism Despite US Trade Measures: Plant Activity and Procurement Strategies

Asia’s steel market shows overall positive activity, but faces challenges due to US trade actions. The US’s continuation of antidumping and countervailing duties, as reported in “US issues final results of AD review on steel wire rod from China,” “US affirms final determinations in AD/CVD probes on corrosion-resistant steel imports from ten countries,” and “US maintains CVD order on wire rod from China,” is expected to influence the market dynamics. These trade measures, while significant, do not appear to have an immediate, directly attributable impact on the observed activity levels of the selected Asian steel plants, although broader long-term effects on export strategies cannot be ruled out.

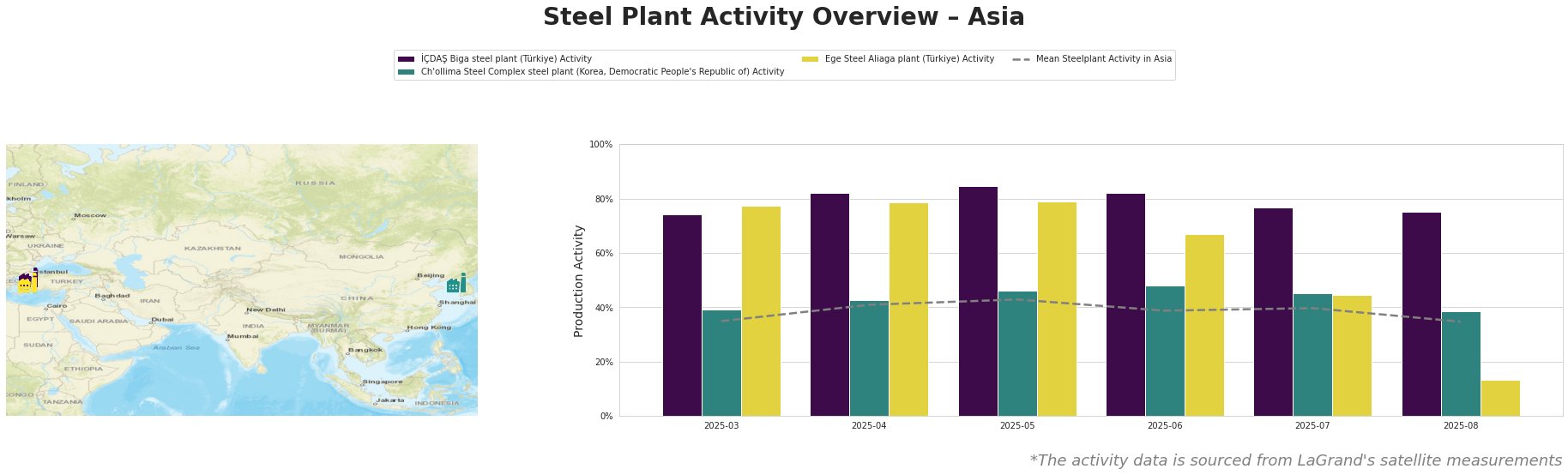

The mean steel plant activity in Asia fluctuated, peaking at 43% in May before dropping to 35% in August. The İÇDAŞ Biga steel plant in Türkiye, a 2.5 million tonne EAF-based producer of semi-finished and finished rolled products, consistently operated at significantly higher activity levels than the Asian average, ranging from 74% to 85% between March and August, closing at 75%. This suggests stable production despite the US trade actions, though a direct link cannot be established. The Ch’ollima Steel Complex in North Korea, with a 760,000 tonne crude steel capacity, showed relatively stable activity, fluctuating between 39% and 48%. The Ege Steel Aliaga plant in Türkiye, an EAF-based mill with 2 million tonnes of crude steel capacity focusing on rebar and wire rod, experienced a sharp decline in activity, plummeting from 45% in July to 13% in August. No direct connection can be established between this decline and the cited US trade news.

Evaluated Market Implications:

Despite the observed fluctuation in average Asian steel plant activity levels and the imposing US trade measures, the İÇDAŞ Biga steel plant continues to display high and consistent production. Conversely, the significant drop in activity at Ege Steel warrants caution. Given the US’s continued imposition of duties on steel wire rod from China and other nations, steel buyers should:

- Prioritize securing wire rod supplies from producers outside of China and the countries targeted by US duties, such as İÇDAŞ Biga, while carefully monitoring Ege Steel’s production recovery. This is particularly relevant for US-based buyers or those supplying the US market.

- Negotiate contract terms that allow for flexibility in sourcing, considering potential shifts in supply dynamics due to trade restrictions. Diversify your portfolio of suppliers, focusing on mills with stable production, like İÇDAŞ Biga, operating outside of the countries directly affected by U.S. trade actions. While Ege Steel offers Turkish supply, its sudden drop in production warrants a cautious approach.

- Closely monitor future trade policy announcements and their potential impacts on regional steel trade flows. While the US trade actions announced in the provided news do not have an explicitly established connection to any current drops in production, they may indicate further restrictions on imports into the US.