From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: New Tech Boosts Production, Activity Mixed Amidst Sustainability Push

Asia’s steel market is experiencing a boost driven by technological advancements and a push towards sustainable steelmaking. The expansion is highlighted by news articles such as “ANDRITZ Delivers Cold Rolling Mill to Ansteel Group” and “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group,” indicating increased production capabilities for high-strength and silicon steel. However, activity levels at specific plants show a mixed trend, with no immediate correlation between these new developments and observed production.

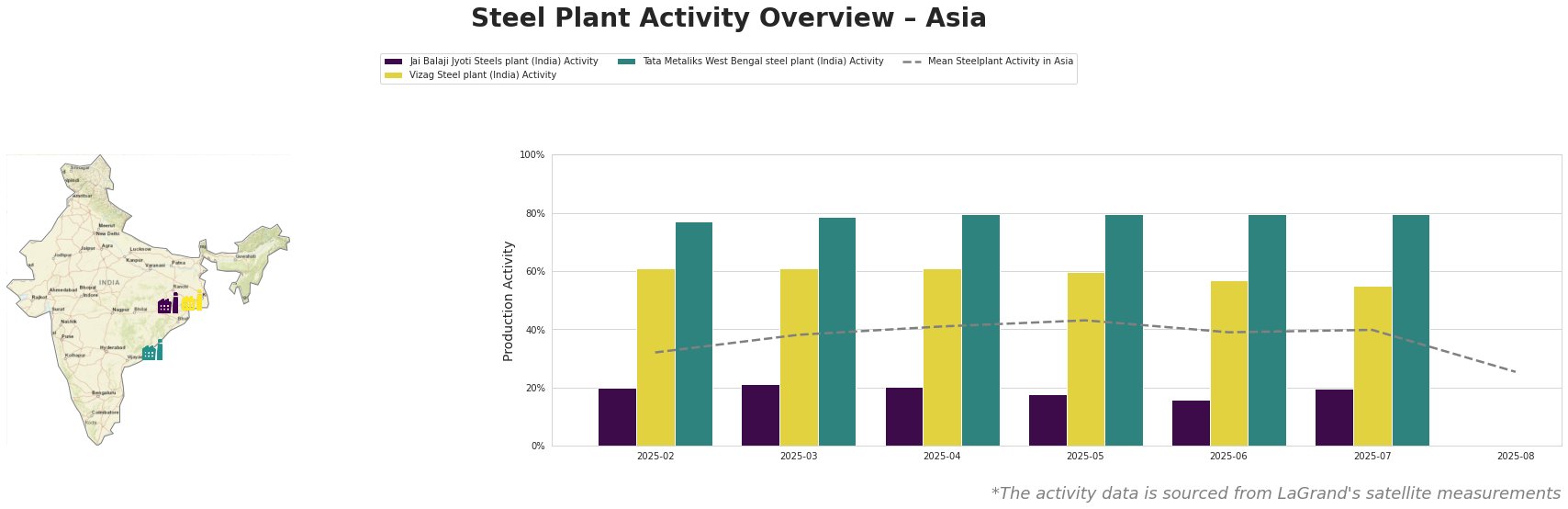

Overall, the mean steel plant activity in Asia fluctuated between 32% and 43% from February to July 2025, before dropping to 25% in August. Tata Metaliks in West Bengal consistently showed high activity, reaching 80% between April and July. Vizag Steel plant maintained relatively stable activity levels, hovering between 55% and 61%. In contrast, Jai Balaji Jyoti Steels experienced a gradual decline, reaching a low of 16% in June before slightly recovering to 20% in July. The significant drop in overall activity across Asia in August cannot be directly linked to the provided news articles.

Jai Balaji Jyoti Steels, an EAF-based plant in Odisha with a DRI capacity of 120 ttpa and crude steel capacity of 92 ttpa, produces billets, bars, and wire rods. Activity at this plant showed a downward trend from February to June, hitting a low of 16% before recovering slightly to 20% in July. There is no clear connection between this activity pattern and the news regarding ANDRITZ’s technological deployments or Hertha Metals’ low-emission steelmaking innovation as reported in “Hertha Metals unveils low-emission steelmaking technology“, suggesting other factors may be influencing the plant’s operations.

Vizag Steel plant, an integrated BF-BOF plant in Andhra Pradesh with a 7300 ttpa crude steel capacity, showed relatively stable activity, ranging from 61% to 55% over the observed period. This plant relies on BF-BOF technology and captive power plants. The steady activity at Vizag Steel doesn’t directly reflect the technological advancements mentioned in “ANDRITZ Delivers Cold Rolling Mill to Ansteel Group” or “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group“, indicating that these developments might be more focused on other regions or types of steel production.

Tata Metaliks West Bengal, an integrated BF-BOF plant producing pig iron and ductile pipes, consistently operated at high activity levels (77-80%). The high activity might reflect strong demand for its specific product lines (pig iron, ductile pipes). Similar to Vizag Steel, the high activity at Tata Metaliks cannot be directly attributed to the news about new steelmaking technologies.

The commissioning of advanced rolling mills by ANDRITZ, as highlighted in “ANDRITZ Delivers Cold Rolling Mill to Ansteel Group” and “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group“, indicates a shift towards high-strength and silicon steel production in China, primarily aimed at new energy vehicles and industrial upgrades. Considering the drop of average activity in August, and the ongoing high activity at Tata Metaliks, steel buyers should secure pig iron supply in advance, and explore possibilities to switch from conventional steel to silicon steel, as it may become more competitively priced due to increased supply in the long term.