From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Signals Amidst US Import Declines, Plant Activity Shifts

Asia’s steel market presents a mixed picture, with no conclusive evidence of direct impact from declining US steel imports on Asian steel plant activity. “US line pipe imports down 23.3 percent in July 2025” and “US standard pipe imports down 20.3 percent in July 2025” indicate reduced demand for specific steel products in the US, however, no direct correlation could be observed linking this to shifts in activity for the observed Asian steel plants. The article “US cold finished bar exports down 17.9 percent in July 2025” and “US OCTG exports down 10.8 percent in July 2025” further confirms the US import/export declines with no observed influence on the Asian steel market.

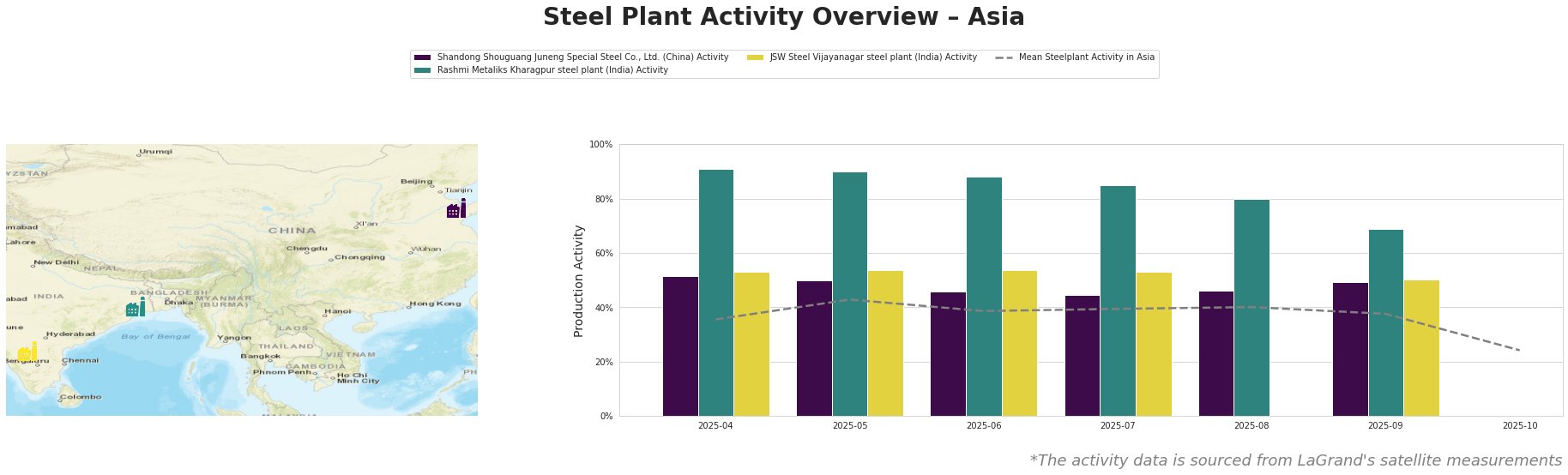

The mean steel plant activity in Asia shows a significant drop to 24% in October after hovering between 36% and 43% for the preceding months. This substantial decrease in October warrants close monitoring.

Shandong Shouguang Juneng Special Steel Co., Ltd., a Chinese integrated steel plant (3.3 MTPA crude steel capacity) producing finished rolled products including petroleum casing and line pipe, saw a gradual decrease in activity from 51% in April to 45% in July, followed by a slight increase to 49% in September. No direct connection could be established between the observed activity levels and the US import news.

Rashmi Metaliks Kharagpur steel plant in India (1.5 MTPA crude steel capacity) which produces DRI, billets and TMT bars, experienced a consistent decline in activity from a high of 91% in April to 69% in September. The steep activity decline suggests potentially significant operational adjustments. No clear linkage to the U.S. import data is evident.

JSW Steel Vijayanagar steel plant, a major integrated steel producer in India (12 MTPA crude steel capacity) making hot rolled, cold rolled, and specialty steel, shows a stable activity level between 50% and 54% from April through September.

Evaluated Market Implications:

The sharp decline in overall average Asian steel plant activity during October, coupled with the steady declines observed at Rashmi Metaliks warrant careful consideration. The data suggests that potential supply disruptions within Asia may be emerging, independent of trends in US steel imports.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor Rashmi Metaliks for updates on operational status and potential supply disruptions. Diversify sourcing strategies for products like TMT bars, if relying heavily on this plant. Buyers sourcing from Asia should explore and secure alternative suppliers to mitigate risks from the October decline across Asia.

- Market Analysts: Investigate the underlying causes of the mean activity decrease across the Asian steel plants in October. Further investigation is required to determine whether the drop in Asian activity is linked to global demand shifts.