From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Signals Amidst U.S. Economic Uncertainty and Varying Plant Activity

Asia’s steel market presents a neutral outlook, influenced by contrasting trends in plant activity amidst global economic uncertainties. The U.S. government shutdown, as reported in “US gov shutdown lowers shroud on jobs, inflation data” and “US services sector stagnates in September: ISM survey,” creates potential indirect headwinds for the Asian steel market, although no direct impact on the Asian steel plants activities observed via satellite imagery can be explicitly connected.

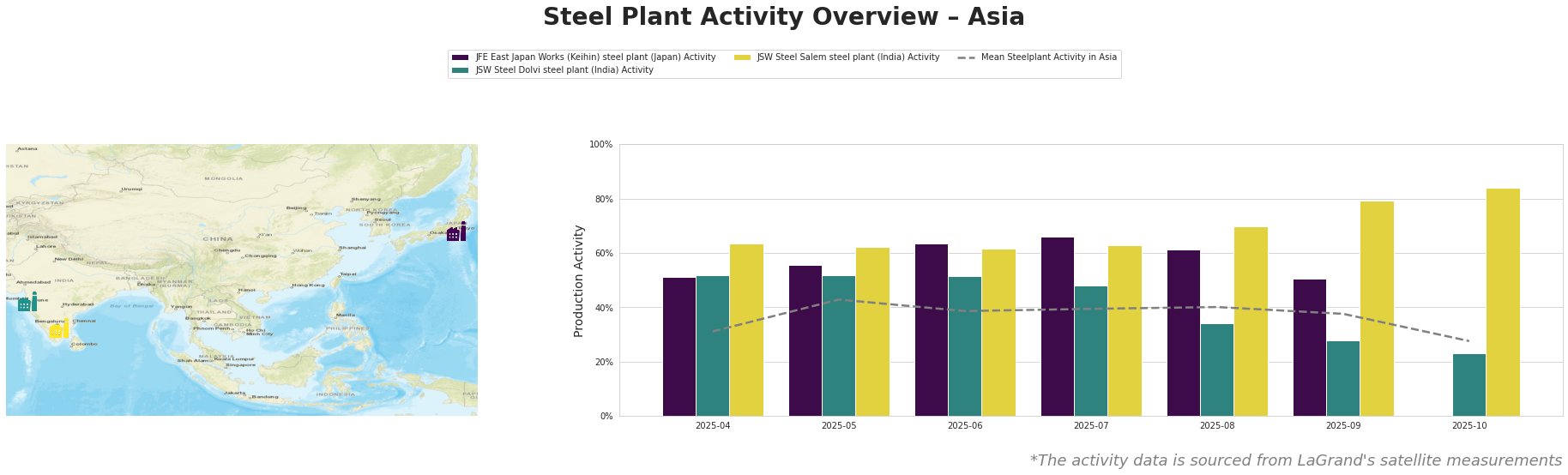

The mean steel plant activity in Asia decreased notably in October to 28.0%, following a more gradual decline from May to September. The JFE East Japan Works initially showed activity above the Asian average, peaking in July (66.0%), before dropping back to 51.0% in September, and missing activity in October. JSW Steel Dolvi displayed declining activity from April to October, falling from 52.0% to 23.0%, well below the Asian average. Conversely, JSW Steel Salem saw consistent growth, reaching a high of 84.0% in October, significantly exceeding the regional average.

The JFE East Japan Works (Keihin) steel plant, an integrated BF-BOF steel plant with a crude steel capacity of 4.075 million tonnes per annum (ttpa), experienced a decrease in observed activity from 66% in July 2025 to 51% in September, and missing data in October. Considering the plant’s planned shutdown of BF and BOF by FY2023, this decrease in activity may reflect ongoing decommissioning, though no direct link can be explicitly confirmed from the provided news. The plant produces sheets, stainless steel, plates, and pipes.

JSW Steel Dolvi, an integrated steel plant in Maharashtra, India, with a crude steel capacity of 5 million ttpa, using both BF and DRI processes, showed a consistent decline in activity from 52.0% in April to 23.0% in October. The plant produces wire rod, cold rolled, bar, hot rolled, specialty steel, and galvanized products. No direct connection between this declining activity and the provided news articles can be established.

JSW Steel Salem, another integrated BF-based steel plant in Tamil Nadu, India, with a smaller crude steel capacity of 1.03 million ttpa, displayed a contrasting trend. Its activity consistently increased, reaching 84.0% in October. The plant produces hot rolled bar and flat products, heat-treated bar, and wire coil. No direct connection between the increasing activity and the provided news articles can be established.

The U.S. government shutdown and potential economic slowdown, as highlighted in “US gov shutdown lowers shroud on jobs, inflation data” and “US services sector stagnates in September: ISM survey,” could indirectly affect demand for steel in Asia, especially for plants like JSW Steel Salem that serve end-user sectors like building and infrastructure and transport, which are sensitive to economic fluctuations. The disruption to US economic data releases adds uncertainty and makes forecasting steel demand more challenging.

Procurement Actions:

* Monitor JSW Steel Salem closely: Given its consistent growth trajectory, assess whether its product range aligns with your procurement needs, but remain cautious about potential disruptions due to global economic uncertainty linked to the US economic situation.

* Evaluate alternative suppliers: Given the observed decline in activity at JSW Steel Dolvi, steel buyers should explore alternative suppliers to mitigate potential supply risks.

* Factor in US economic uncertainty: Due to the potential indirect impact of the US government shutdown on global steel demand, procurement professionals should build flexibility into their contracts and carefully monitor global economic indicators.