From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Mixed Plant Activity Amidst US Data Disruptions

In Asia, steel plant activity shows a mixed trend. Changes are being observed in plant activity levels, although they cannot be directly linked to the US-centric news articles provided, namely “US corn and soy conditions stabilize as harvest slows,” “Fed shutdown disrupts most USDA data releases,” and “13 times Democrats voted for a short-term continuing resolution under Biden.” The US-related news shows disturbances, but their effect on the Asian steel market has not been established.

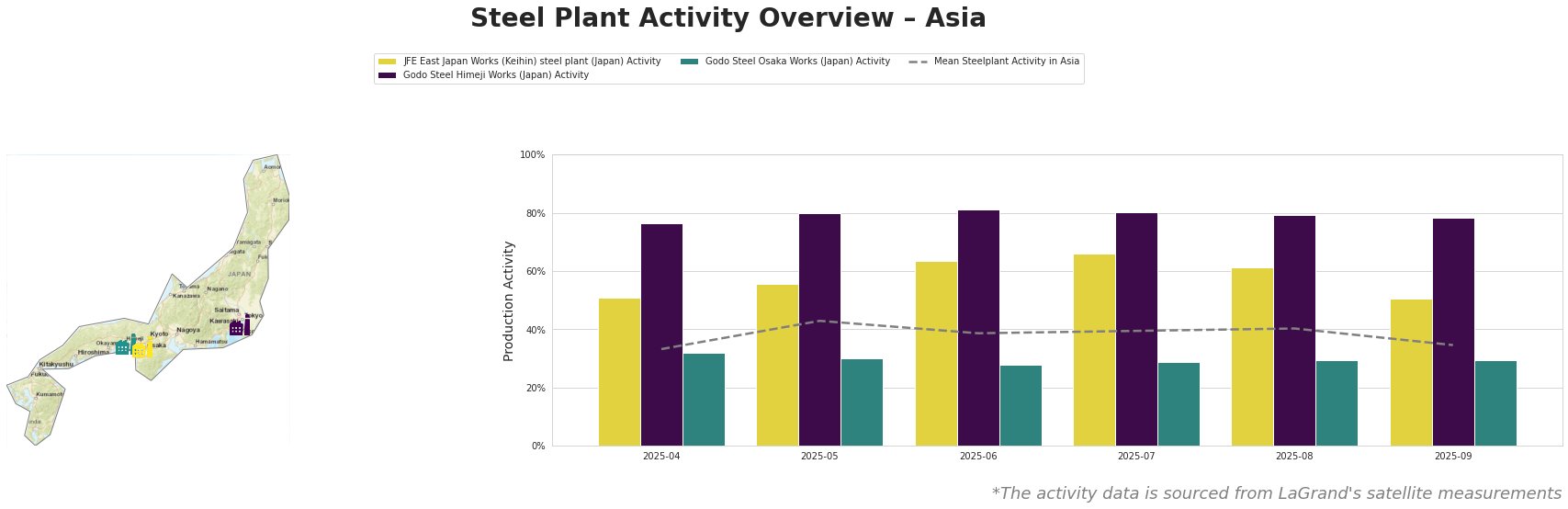

Overall, the mean steel plant activity in Asia fluctuated, peaking at 43% in May and declining to 35% in September.

JFE East Japan Works (Keihin) steel plant, an integrated BF/BOF steel plant with a crude steel capacity of 4075 ttpa, showed a peak activity of 66% in July, dropping to 51% in September. The plant holds Responsible Steel certification. The planned BF and BOF shutdown by FY2023 makes the current satellite data of interest. No direct connection between this activity change and the provided news articles can be established.

Godo Steel Himeji Works, an EAF-based plant with a crude steel capacity of 805 ttpa, maintained a high activity level, fluctuating between 76% and 81%. The plant holds ISO14001 (2020) and Responsible Steel certifications. The observed high activity level contrasts the overall market trend. No direct link between its activity and the provided news could be identified.

Godo Steel Osaka Works, an EAF-based plant, shows comparably low activity with crude steel capacity of 805 ttpa. Activity decreased from 32% to 28% between April and June and then slightly recovered to 30% in September. The plant holds ISO14001 (2021) and Responsible Steel certifications. No direct connection between the steel plant activity and the provided news articles can be established.

Potential for localized supply disruptions exists, primarily linked to JFE East Japan Works (Keihin) steel plant due to the drop in activity. Steel buyers should monitor JFE East Japan Works’ output closely, given its production capacity and the observed decrease in activity. Consider diversifying suppliers for sheets, stainless steel, plates, and pipes to mitigate potential risks. The high activity at Godo Steel Himeji Works may offer a degree of supply security for bars, rebar, wire rod, shapes, and rails.