From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: JSPL Odisha Output Drop Signals Potential Supply Shifts Amidst Global Trade Tensions

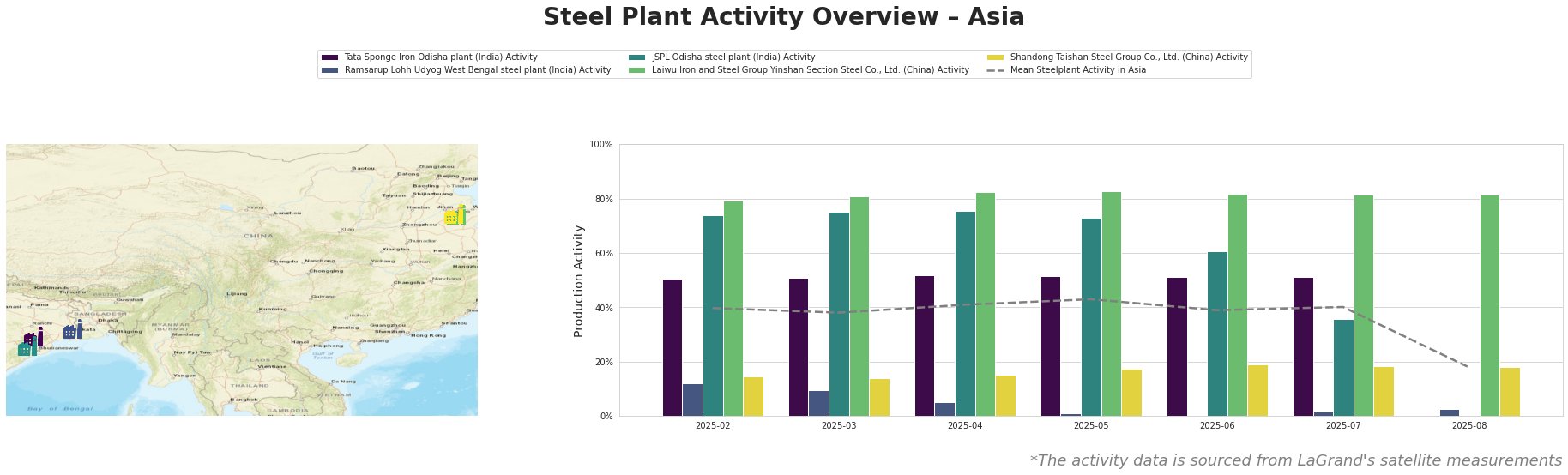

In Asia, steel production dynamics are showing signs of change, particularly in India. JSPL Odisha steel plant activity saw a notable decrease in July and August. The potential impact of global trade tensions, as highlighted in the Swiss news articles “US-Zölle: Können die Bundesräte die US-Regierung noch umstimmen?,” “Hohe US-Zölle in Kraft: So reagiert die Schweizer Politik,” and “US-Zölle: Politiker fordern WTO-Klage gegen Strafzölle,” on Asian steel markets requires close monitoring, although no direct connection to the observed activity levels can be established at this time.

The mean steel plant activity in Asia has shown fluctuations, peaking at 43.0 in May and then decreasing significantly to 18.0 in August.

Tata Sponge Iron Odisha plant, an ironmaking facility utilizing DRI technology with a capacity of 400 ttpa of Iron, has maintained a relatively stable activity level around 51-52% between February and July. There is no data for August. This plant consistently operates above the average Asian steel plant activity levels, except for May.

Ramsarup Lohh Udyog West Bengal steel plant, an integrated BF and DRI plant producing billets, transmission lines, and wires for the energy sector, experienced a sharp decline in activity, dropping to 0% in June and only slightly recovering to 3% in August. This is significantly below the Asian average. The reason for this sharp decrease is not linked to the provided news articles.

JSPL Odisha steel plant, an integrated BF and DRI plant with a crude steel capacity of 6000 ttpa and producing bars and plates for automotive, construction, energy, and transport, showed a significant decrease in activity from 76% in April to 36% in July. Unfortunately, data is missing for August. This drop is the most significant observed and pulls the mean activity in Asia down. No direct connection to the provided news articles can be established.

In contrast, the activity levels at Laiwu Iron and Steel Group Yinshan Section Steel Co., Ltd., a BF-based plant producing section steel and strip steel, and Shandong Taishan Steel Group Co., Ltd., an integrated BF plant producing hot and cold rolled coil, remained high and relatively stable, indicating consistent production in China. Both operate above the overall mean of Asian steel plant activity.

The significant drop in activity at JSPL Odisha, if persistent, could lead to potential supply disruptions, particularly for buyers relying on bars and plates for automotive, building, and energy sectors.

Recommended Procurement Actions:

* Steel Buyers: Given the observed drop in activity at JSPL Odisha, buyers dependent on this plant for bars and plates should immediately assess their inventory levels and explore alternative supply sources to mitigate potential disruptions.

* Market Analysts: Closely monitor JSPL Odisha’s activity in the coming months to determine if the observed decrease is temporary or indicative of a longer-term trend. Simultaneously, observe the impacts of “US-Zölle: Können die Bundesräte die US-Regierung noch umstimmen?,” “Hohe US-Zölle in Kraft: So reagiert die Schweizer Politik,” and “US-Zölle: Politiker fordern WTO-Klage gegen Strafzölle,” to understand its potential influence on the Asian steel market.