From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Japanese Plant Upgrades Fuel Optimism Despite Regional Activity Dip

Asia’s steel market sentiment remains positive, driven by technological advancements in Japan, although overall regional activity experienced a dip in October. Upgrades to production lines in Japan, as indicated by “SMS Group to supply advanced tube production line to Maruichi in Japan” and “SMS group, Yamato Steel Commission Japan’s First CRS® Roller Straightener“, signal future capacity improvements. These upgrades don’t directly correlate with recent satellite-observed activity, but show an intention to improve production.

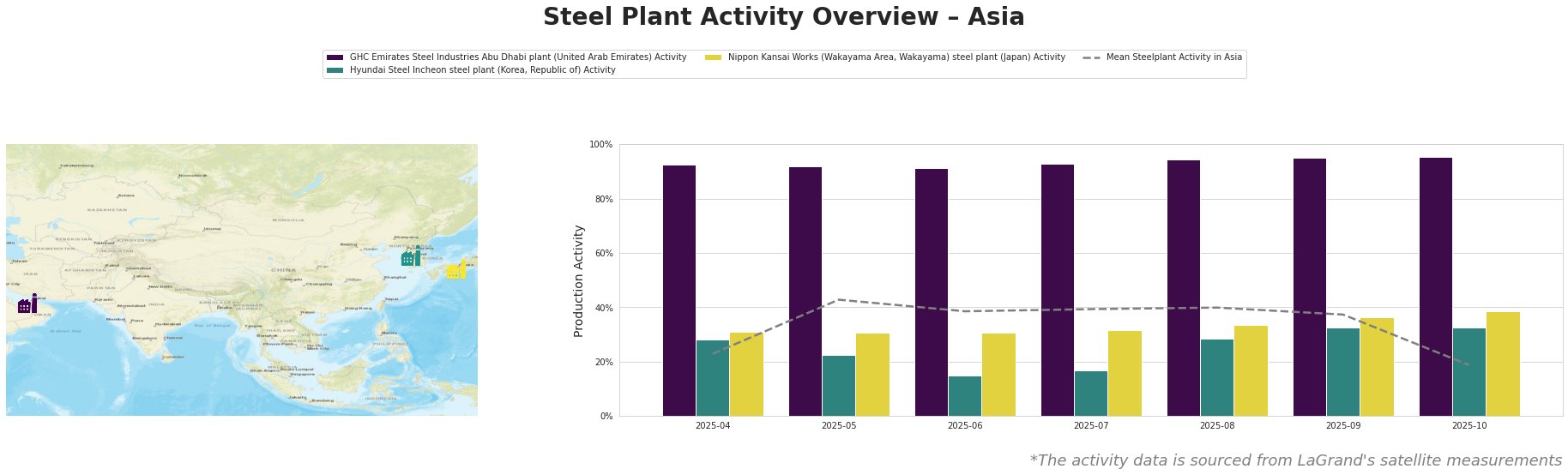

The mean steel plant activity in Asia experienced a significant drop in October to 19.0, down from 37.0 in September. This decrease is significant across the region. In contrast, GHC Emirates Steel Industries in Abu Dhabi consistently shows high activity, hovering around 90%, even as the regional average declines. Hyundai Steel’s Incheon plant in Korea showed fluctuating activity, from a low of 15.0 in June to a peak of 33.0 in September and October. Nippon Kansai Works in Japan shows consistently increasing activity, reaching 39.0 in October, the highest in the observed period.

GHC Emirates Steel Industries in Abu Dhabi, a DRI-based EAF plant with a 3.5 million tonne crude steel capacity, focuses on semi-finished and finished rolled products, including rebar and heavy sections. The plant has shown stable activity levels and is consistently higher than the Asian mean activity, peaking in October at 95%. The stable operation indicates reliable supply from this plant.

Hyundai Steel’s Incheon plant, with a 4.8 million tonne EAF-based crude steel capacity, produces finished rolled products such as rebar and H-sections. Its activity levels have fluctuated, settling at 33.0 in October. This plant’s recent activity has been slightly below the plant’s potential, therefore a connection between activity and output cannot be established.

Nippon Kansai Works, an integrated BF-BOF plant with EAF capacity, boasting 5.49 million tonnes of crude steel capacity, manufactures products like seamless pipes and steel sheet piles. Activity at Nippon Kansai Works gradually increased from 31.0 in April to 39.0 in October. This increasing trend may reflect preparations for increased production following the “SMS group, Yamato Steel Commission Japan’s First CRS® Roller Straightener” initiative aimed at improving product quality and straightening heavy sections and sheet piles.

The commissioning of advanced equipment like the CRS roller straightener at Yamato Steel, as announced in “SMS group, Yamato Steel Commission Japan’s First CRS® Roller Straightener” and “Yamato Steel commissions Japan’s first compact roller straightener“, signals improved quality and potentially increased output of heavy sections and sheet piles. Given this development and the increasing activity at the plant, procurement professionals seeking high-quality heavy sections and sheet piles should prioritize engagement with Nippon Kansai Works. The SMS group’s collaboration with Maruichi, as outlined in “SMS Group to supply advanced tube production line to Maruichi in Japan” and “SMS group to deliver fully automated extruded stainless tube line to Japan’s Maruichi“, indicates that stainless steel tube buyers can anticipate increased availability and potentially competitive pricing from Maruichi starting in the 2027 fiscal year.