From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Iron Ore Rebounds Amidst Production Shifts

Asia’s steel market displays a mixed outlook. While “Iron ore prices rebound to two-month high” suggests upward price pressure, Taiwan experiences export declines as detailed in “Taiwan’s iron and steel export value down 8.2 percent in H1 2025.” Satellite data indicates activity fluctuations across key steel plants; however, no direct correlation between these two news events and individual plant activity changes could be immediately established.

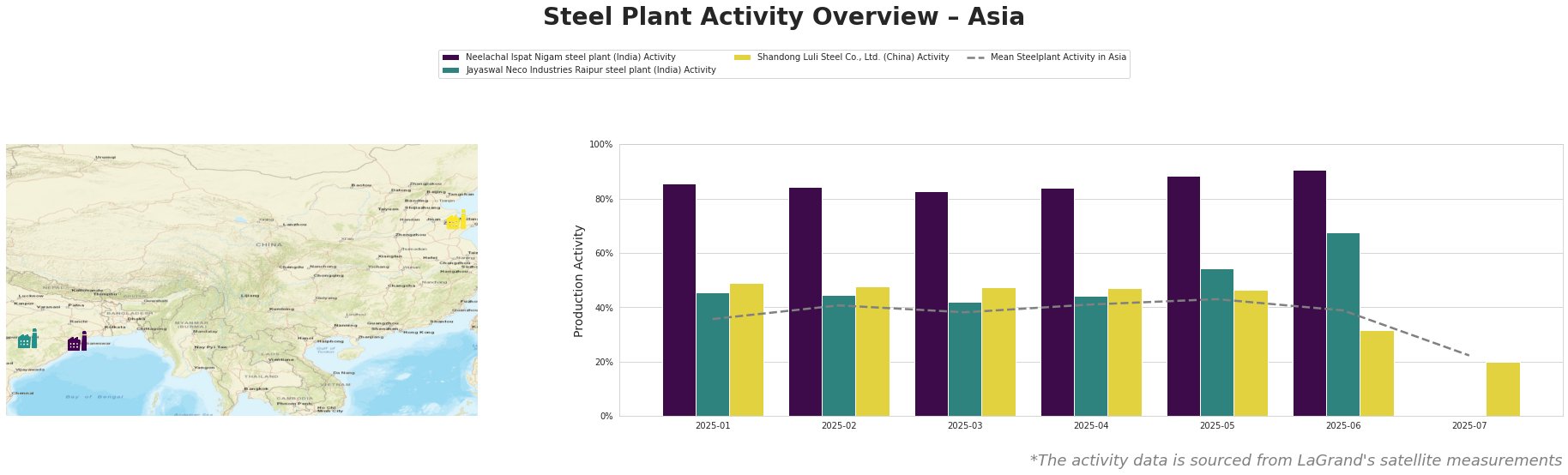

Steel Plant Activity Levels

Observed plant activity reveals divergent trends. Neelachal Ispat Nigam steel plant in India consistently operated at high levels (83-91%) until a significant drop in July, far exceeding the Asian average, possibly indicating upcoming capacity adjustments. Jayaswal Neco Industries Raipur steel plant in India shows an increasing trend, peaking at 68% in June before data stops, suggesting potential production ramp-ups. Shandong Luli Steel Co., Ltd. (China) experienced relative stability and is around the Asian average activity, ending with the sharpest drop in July. The mean activity level shows relative stability until a sharp drop in July to 22%. No direct correlation could be established between the observed plant activity changes and the provided news articles.

Neelachal Ispat Nigam, an integrated BF-BOF plant in Odisha, India, producing 1100 ttpa of crude steel, pig iron, billets, and bars, operated consistently above 80% until the end of June. Activity data for July is missing. This high output could have contributed to the overall billet supply in Asia, potentially influencing import dynamics; however, no direct connection can be made with the news article “Turkey’s billet imports from Malaysia keep climbing.”

Jayaswal Neco Industries Raipur, another Indian plant with integrated BF and DRI operations, producing 1200 ttpa of crude steel, pig iron, DRI, blooms, billets and rolled products, showed increasing activity, reaching 68% in June. This indicates an increase in domestic Indian steel production, which could affect import demand. No direct connection can be made with the provided news articles.

Shandong Luli Steel Co., Ltd. in China, an integrated BF-BOF plant producing 1400 ttpa of semi-finished and finished rolled products, saw a decrease in activity to 20% in July after operating close to the Asian average, potentially reflecting the impact of China’s intentions to curb excess steel capacity cited in “Iron ore prices rebound to two-month high“.

Evaluated Market Implications

The surge in “Iron ore prices rebound to two-month high” coupled with the observed activity decrease at Shandong Luli Steel Co., Ltd. may indicate a strategic adjustment in Chinese steel production, possibly in response to government policies. This potential supply reduction, alongside continued high activity at Neelachal Ispat Nigam until June, may lead to a temporary increase in regional steel prices.

Procurement Action: Steel buyers should closely monitor Chinese policy announcements related to steel production capacity. Consider securing short-term contracts with suppliers outside of China to mitigate potential price volatility resulting from production adjustments. Given the billet import trends described in “Turkey’s billet imports from Malaysia keep climbing,” exploring billet import options from Malaysia or Russia may be beneficial, contingent on specific quality requirements and logistical feasibility.