From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Insights: Neutral Sentiment Amid Variable Plant Activity

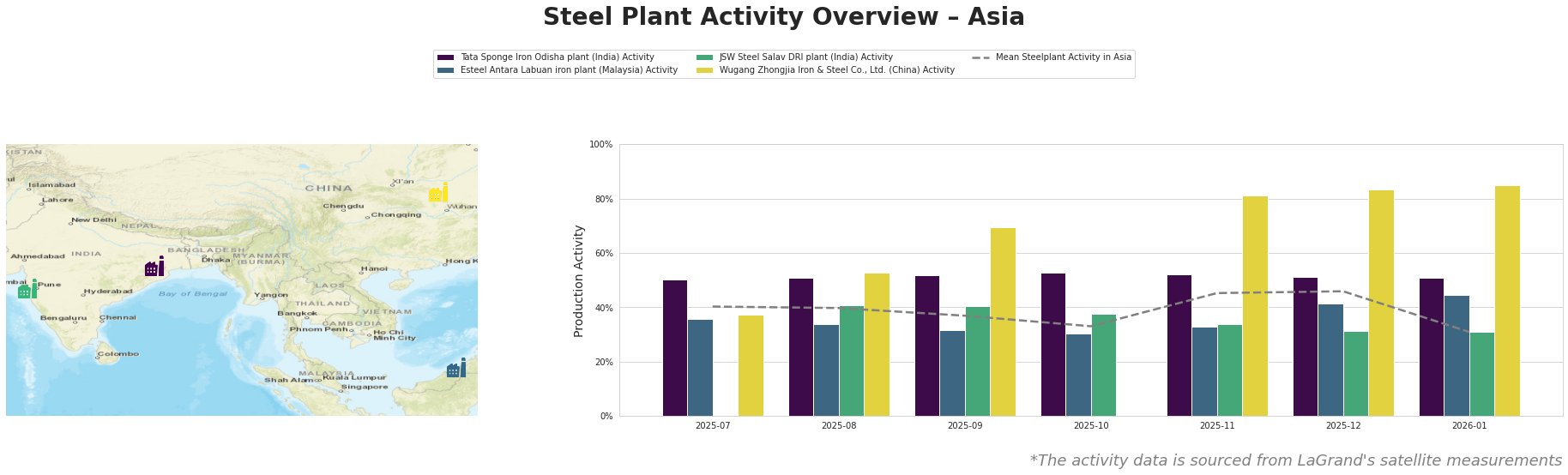

Recent activity in the Asian steel market remains neutral, reflecting shifts linked to geopolitical developments and operational fluctuations. Notably, the article Opec forecasts slight demand growth slowdown in 2027 highlights an anticipated deceleration in demand across Asia, which may impact regional steel consumption patterns. Correlating with this sentiment, satellite data reveals mixed operational shifts in several key steel plants.

Measured Activity Overview

The mean activity of steel plants in Asia varies notably, with peaks and valleys observed. For instance, Wugang Zhongjia Iron & Steel Co., Ltd. saw a maximum activity of 85% in January 2026, underscoring its robust output amidst broader uncertainty. Conversely, the JSW Steel Salav DRI plant demonstrated a decline from 81% in November 2025 to a low of 31% in January 2026, reflecting potential supply chain constraints or operational adjustments. No direct correlation can be established between the recent activities and the cited articles, especially in terms of trading dynamics and market fluctuations noted in the US naphtha market braces for disruption article.

Tata Sponge Iron Odisha Plant

The Tata Sponge Iron Odisha plant operates a DRI system, contributing a steady output primarily focused on iron production. Its activity remained relatively high in July 2025 at 50%, peaking to 53% in October 2025, before stabilizing at 51% by January 2026. However, the 3% decline in late 2025 contrasts with wider activities across Asia without direct links to current geopolitical developments or economic forecasts, as outlined in the Opec forecasts slight demand growth slowdown in 2027.

Esteel Antara Labuan Iron Plant

Similarly, the Esteel Antara Labuan iron plant experienced fluctuations, peaking at 42% in December 2025 before rising to 44% in January 2026. The changing operational percentages suggest a responsive strategy amidst geopolitical tensions, albeit no direct impact from the news articles could be identified, isolating its performance from broader market outcomes noted in the region.

JSW Steel Salav DRI Plant

The JSW Steel Salav DRI plant holds a capacity of 1000 tonnes, with variable activity ranging from a peak of 81% in November 2025 to falling nearly halved as of January 2026. No clear connection arises from the recent articles to elucidate this drop, illustrating an internal operational challenge.

Wugang Zhongjia Iron & Steel Co., Ltd.

Conversely, Wugang Zhongjia Iron & Steel Co., Ltd. maintained a resilient operational performance, marking activity levels of 84% in December and sustaining 85% in January 2026. The strategic positioning of this plant indicates a potential benefit from heightened demands seen in Opec’s forecasts, showing adaptability potentially linked to export strategies.

Evaluated Market Implications

The fluctuations in activity levels across significant plants such as Wugang Zhongjia Iron & Steel Co., Ltd. should alert buyers about potential supply reliability in 2026. Given the article Opec forecasts slight demand growth slowdown in 2027, buyers should consider diversifying sources and engaging with plants demonstrating stable performance to mitigate supply risks.

For immediate procurement strategies, securing contracts or increasing inventories with plants like Tata Sponge Iron Odisha and Wugang Zhongjia Iron & Steel Co., Ltd., which have shown resilience amid fluctuating demands, can be an advantageous approach in a neutral market.