From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Insights: Emissions Rising Despite Declining Consumption in a Shifting Landscape

Steel activities across Asia face a neutral outlook amid rising emissions in China’s steel sector and a projected fall in consumption. As reported in “Emissions in China’s steel industry increased by 7.1% y/y in November“ and “Rolled steel consumption in China will fall by 5.4% y/y in 2025 – forecast,” emissions have surged while consumption trends downward amid a struggling construction industry. The observed decline in activity aligns with significant regulatory changes and the ongoing real estate crisis.

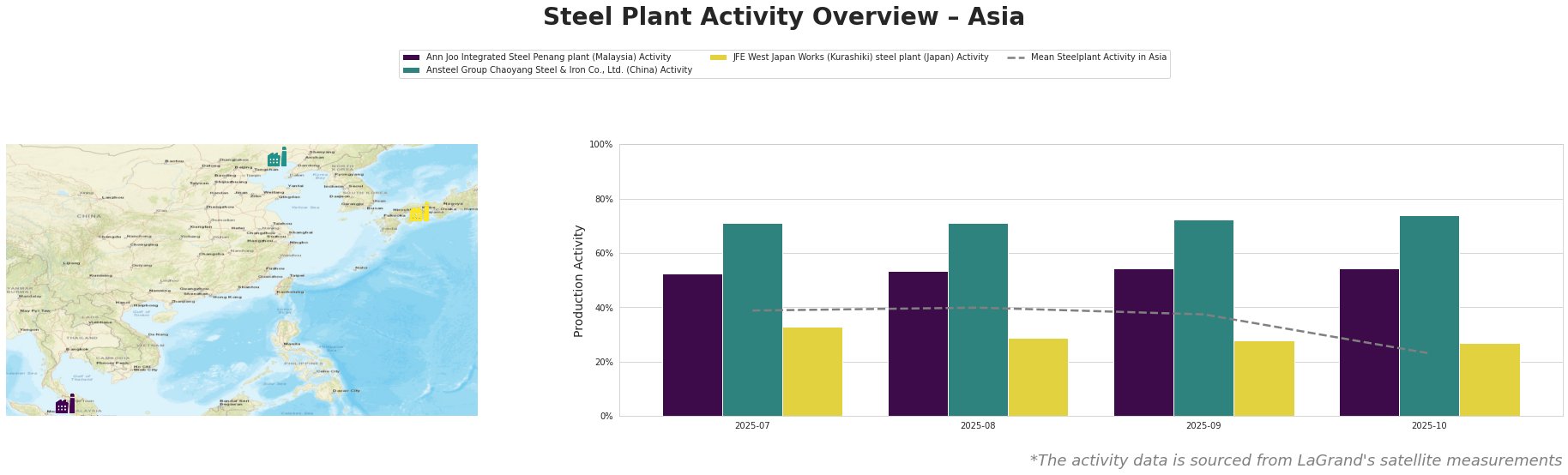

The mean activity for steel plants in Asia shows a notable drop from 39% in July to 23% by October 2025. The Ansteel Group Chaoyang Steel plant experienced a peak activity of 74% in October, in line with higher emissions noted in “Emissions in China’s steel industry increased by 7.1% y/y in November.” Conversely, JFE West Japan Works shows a decline from 33% to 27%, illustrating challenges amid changing dynamics, though specific links to regional news are less prominent.

The Ann Joo Integrated Steel Penang plant, maintaining steady activity between 52% and 54%, has not established explicit connections to recent developments. This stability could suggest resilience amid overall market fluctuations.

Facing a projected consumption decline of 5.4% in 2025, steel buyers should be vigilant regarding potential supply disruptions, especially from Ansteel as it continues to ramp up export levels despite domestic weakness, a trend highlighted in “China will maintain control over steel production and exports in 2026-2030.”

Given the uncertainties, it is advisable for procurement professionals to consider securing long-term contracts with manufacturers in non-impacted regions, such as Ann Joo, and to monitor price volatility closely. They should also consider adapting procurement strategies to account for potential shifts in supply due to increasing regulatory pressures in China, as these may further hinder the availability of steel products in the upcoming years.