From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Indian Production Surge Offsets Import Declines, Scrap Demand Shifts

Asia’s steel market presents a mixed picture as Indian production ramps up while Vietnamese imports contract, impacting global scrap consumption. According to “India’s steel imports down 36% in September, remains net importer,” India’s increased domestic production correlates with a decrease in imports. The article “Vietnam’s steel imports down 15.3 percent in September 2025 from August” highlights a reduction in Vietnam’s steel imports coupled with a rise in scrap imports, coinciding with shifting consumption patterns detailed in “Global scrap consumption fell by 6.9% y/y in 1H2025“.

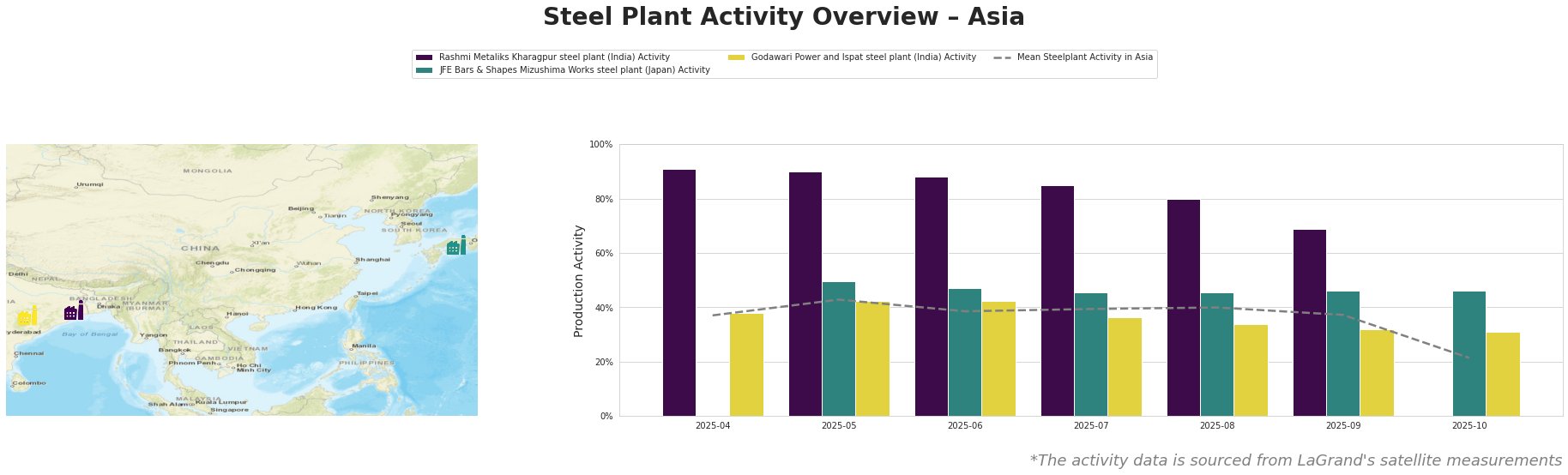

The mean steel plant activity across Asia shows a declining trend from May (43%) to October (21%), with a notable drop in October. Rashmi Metaliks Kharagpur steel plant in India showed consistently high activity levels, peaking at 91% in April but declining significantly to 69% in September. JFE Bars & Shapes Mizushima Works steel plant in Japan maintained a relatively stable activity level around 46-50% from May to October. Godawari Power and Ispat steel plant in India exhibited moderate activity, ranging from 31% to 42%, with a slight decline towards October. The significant decline in the Mean Steelplant Activity in Asia in October cannot be directly attributed to the provided news articles, as no specific information or events are mentioned that directly correlate to the observed data during that timeframe.

Rashmi Metaliks Kharagpur steel plant, located in West Bengal, India, possesses a crude steel capacity of 1.5 million tons per annum (ttpa), primarily utilizing DRI technology alongside a BF. The plant produces a range of products including DRI, pig iron, billets, TMT bars, DI pipes, and wire rod. The plant’s activity demonstrates a decreasing trend, from a high of 91% in April to 69% in September. This decline could reflect increased domestic competition as highlighted in “India’s steel imports down 36% in September, remains net importer,” although this connection is not explicitly stated in the news.

JFE Bars & Shapes Mizushima Works steel plant in Chūgoku, Japan, focuses on semi-finished and finished rolled products such as shapes, flat bars, rebar, and screw rebars, utilizing EAF technology with a crude steel capacity of 950,000 tons. The plant’s activity remained relatively stable around 46-50% from May to October. No direct connection can be established between this stable activity and the provided news articles.

Godawari Power and Ispat steel plant, located in Chhattisgarh, India, has a crude steel capacity of 400,000 tons, utilizing integrated DRI processes. Its product range includes billets, wire, DRI, and blooms. Activity has gradually decreased from 42% in May/June to 31% in October. While “India’s steel imports down 36% in September, remains net importer” reports increased overall Indian steel production, Godawari’s specific decline suggests localized factors influencing output, although no direct connection can be established based on the provided news.

The increasing steel production in India, as highlighted in “India’s steel imports down 36% in September, remains net importer,” may lead to reduced import reliance and potentially more competitive pricing for Indian-origin steel products. Steel buyers should closely monitor the Rashmi Metaliks Kharagpur steel plant’s production trends, as its declining activity, coupled with the nationwide increase in steel production, could result in supply fluctuations or pricing adjustments for its TMT bars and wire rod products. Furthermore, Vietnamese steel buyers should evaluate the increasing availability and potentially lower costs of steel scrap, as indicated by “Vietnam’s steel imports down 15.3 percent in September 2025 from August” and “Global scrap consumption fell by 6.9% y/y in 1H2025”, potentially shifting sourcing strategies towards scrap-based steel production. Due to the mean activity levels decline, it is prudent to monitor global steel prices and inventory levels due to an anticipation of restricted supply.