From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Indian Iron Ore Imports Surge Amid Stagnant Steel Prices; Plant Activity Varies

The Asian steel market is currently experiencing a mixed landscape, with India facing a surge in iron ore imports due to domestic shortages, while steel prices remain stagnant. According to “India increases iron ore imports amid shortage of high-quality raw materials“, iron ore imports have more than doubled in India. At the same time, “Indian steel market stagnation worsens in Nov’25, outlook remains gloomy” highlights the continued decline in Indian steel prices, reaching five-year lows. The satellite data provides additional context to these developments, with plant-specific dynamics that require a detailed examination.

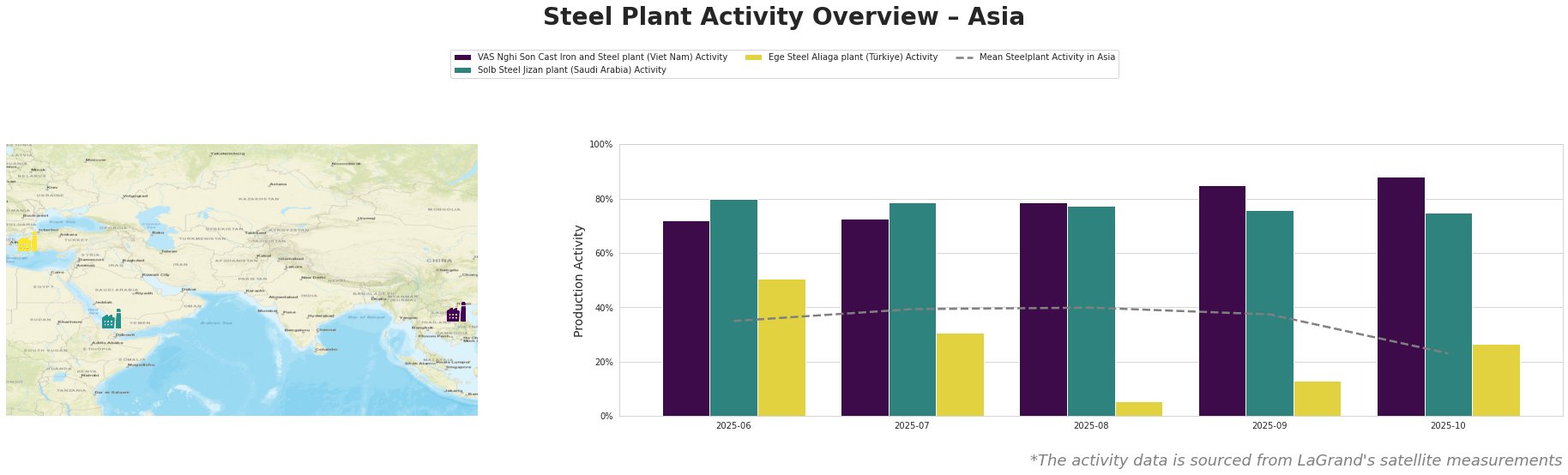

The mean steel plant activity in Asia experienced a sharp decline in October 2025, dropping to 23.0% from a high of 40.0% in August. VAS Nghi Son Cast Iron and Steel plant in Vietnam, on the other hand, saw a continuous increase in activity, reaching 88.0% in October. Solb Steel Jizan plant in Saudi Arabia showed a gradual decrease from 80.0% in June to 75.0% in October. Ege Steel Aliaga plant in Türkiye experienced significant fluctuations, dropping to 5.0% in August before recovering to 27.0% in October.

VAS Nghi Son Cast Iron and Steel plant, a 3.15 million tonne EAF-based steel plant producing semi-finished and finished rolled products like rebar and wire rod, has shown steadily increasing activity over the observed period, reaching 88% in October. While the news articles do not provide a direct explanation for this increased activity, it could be inferred that the plant is capitalizing on regional demand, potentially related to the Indian market shifts, but this cannot be confirmed from the provided information.

Solb Steel Jizan plant, a 1.2 million tonne EAF-based plant producing billet, rebar, rebar in coil, and wire rod, has shown a slight decline in activity from 80% in June to 75% in October. There is no direct link to any of the provided news articles that explains the observed decrease.

Ege Steel Aliaga plant, a 2 million tonne EAF-based steel plant producing rebar and wire rod, experienced a significant drop in activity to 5% in August before rebounding to 27% in October. Again, no direct connection to the provided news articles can be established.

The surge in Indian iron ore imports, as highlighted in “India increases iron ore imports amid shortage of high-quality raw materials,” suggests that steel mills are actively seeking to secure raw materials despite the challenges of stagnant steel prices described in “Indian steel market stagnation worsens in Nov’25, outlook remains gloomy”. Vale lowers its forecast for iron ore production in 2026” could further exacerbate supply constraints, particularly high-quality ore.

Evaluated Market Implications:

The increase in Indian iron ore imports coupled with Vale’s reduced production forecast suggests potential supply pressures for high-quality iron ore. However, the stagnant steel prices in India, despite increasing raw material costs (as mentioned in “Indian steel market stagnation worsens in Nov’25, outlook remains gloomy”), are compressing margins for steel producers.

Recommended Procurement Actions:

-

For steel buyers focused on the Indian market: Given the increased iron ore import demand and stagnant steel prices, steel buyers should closely monitor the supply of finished steel products, specifically rebar and wire rod from the EAF route as Indian steel plants face a cost-price squeeze. Actively negotiate contracts with producers who are vertically integrated or have secured long-term iron ore supply agreements to mitigate potential price volatility of raw materials.

-

For market analysts: Closely analyze the Indian steel market for any potential government interventions or policy changes aimed at addressing the supply-demand imbalance of iron ore. Monitor the effectiveness of the planned 30% export duty on low-grade iron ore from October 2025, and assess its impact on domestic steel production and import dynamics.