From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Government Shutdowns Cloud Outlook Amid Activity Declines

In Asia, the steel market faces uncertainty as government shutdowns in the US disrupt data flows crucial for assessing demand, against a backdrop of declining activity at key steel plants. The “US government shutdown delays construction data“ and “Fed shutdown disrupts most USDA data releases“ articles highlight the potential impact on commodity markets due to delayed data, impacting steel buyers who rely on US construction and agricultural data to gauge demand. No direct link between the “International fossil fuel finance slashed under pledge“ or the “13 times Democrats voted for a short-term continuing resolution under Biden“ articles and the observed plant activity data could be established.

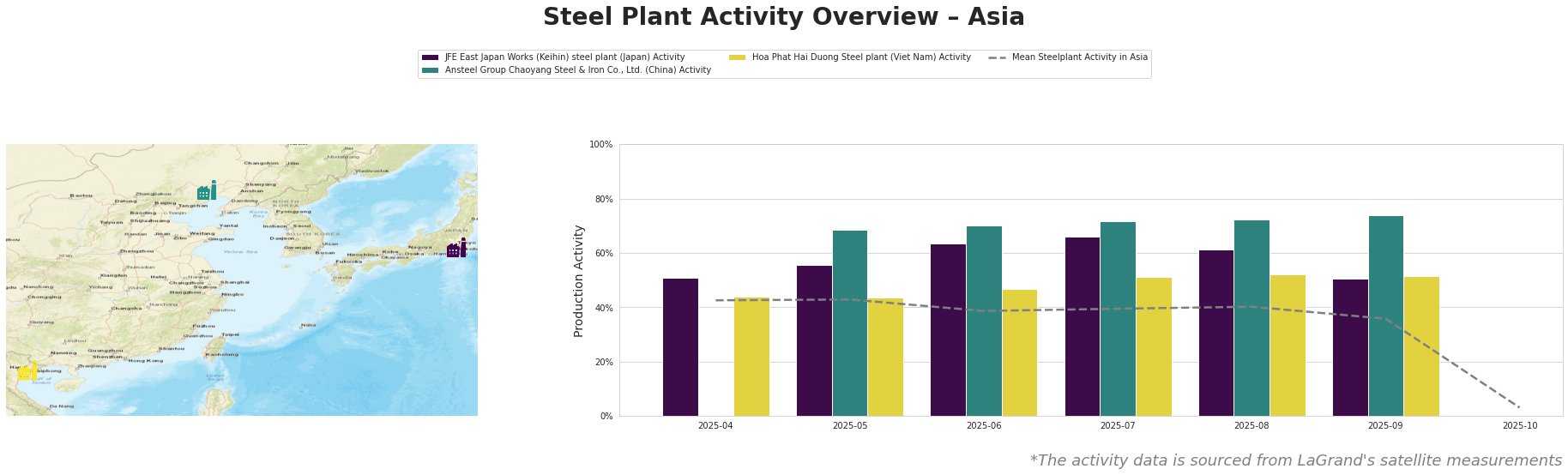

The mean steel plant activity in Asia shows a declining trend, dropping from 43% in April and May to a concerning 3% in October. JFE East Japan Works (Keihin) steel plant in Japan exhibited above-average activity until August, peaking at 66% in July, followed by a significant drop to 51% in September. Ansteel Group Chaoyang Steel & Iron Co., Ltd. in China showed consistently high activity, reaching 74% in September, significantly above the Asian average. Hoa Phat Hai Duong Steel plant in Vietnam displayed relatively stable activity between 44% and 52% from April to September. The sharp decline in overall mean activity in October requires careful monitoring to assess its underlying causes and potential market impact.

JFE East Japan Works (Keihin) steel plant, located in the Kantō region of Japan, is an integrated steel plant with a crude steel capacity of 4.075 million tonnes per annum (ttpa), primarily using BF-BOF processes, but also operating an EAF. Despite the plant’s ResponsibleSteel Certification, satellite data shows a decline from a peak of 66% in July to 51% in September. No direct connection between this activity drop and the provided news articles could be established.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., situated in Liaoning, China, has a crude steel capacity of 2.1 million ttpa, relying on BF-BOF technology. Despite being ResponsibleSteel certified, activity levels remained high and above average peaking at 74% in September. Given the absence of supporting information, no immediate relationship with the news articles could be established.

Hoa Phat Hai Duong Steel plant in Vietnam, an integrated BF-BOF steel plant with a 2.5 million ttpa crude steel capacity producing finished rolled products, maintained relatively stable activity levels. While the overall Asian mean activity declined, Hoa Phat’s consistent output suggests a stable regional demand for its products, mainly construction steel and hot rolled coil. No direct connection between this activity and the provided news articles could be established.

The “US government shutdown delays construction data” is the biggest threat for steel buyers and analysts. This disruption makes near-term demand forecasting difficult, especially for products consumed by the US construction sector. Given the observed activity declines across the region and especially given the strong activity of Ansteel Group Chaoyang, steel buyers should secure supply in the coming weeks to avoid availability issues of Chinese steel, as US importers will be forced to substitute supply from other sources than the US. Analysts should closely monitor alternative data sources for construction activity to compensate for the lack of official releases, focusing particularly on regions with strong export ties to China.