From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: FTA Impact Fuels Production Surge Amid EU Concerns

Asia’s steel market demonstrates very positive sentiment, driven by new trade agreements despite some setbacks in EU negotiations. Plant activity is generally high, reflecting increased production, although disruptions due to negotiation outcomes are possible. News articles and satellite data show specific areas of growth and potential concern.

The Asian steel market is buoyant due to new trade agreements, despite challenges in India-EU FTA talks. Production is high in selected plants. This is linked to the news that “India–EFTA Trade Pact Takes Effect Oct 1: $100 Billion Investment, 10 Lakh Jobs Tied To Deal” which should stimulate steel demand. However, the lack of breakthrough in EU-India FTA negotiations, as stated in “‘Missed Opportunity’: EU Envoy Rues No Breakthrough In Latest Round Of India-EU FTA Talks,” casts a slight shadow on the region’s long-term outlook. The news regarding “EU and Indonesia finalize FTA to boost exports and raw material security” is not directly related to observed activity but indicates more competition for Asian steel exporters into Europe. No direct relationship can be established between the plant activity and the news that “FTA Negotiations Underway With Several Countries, Including US, Says Piyush Goyal“.

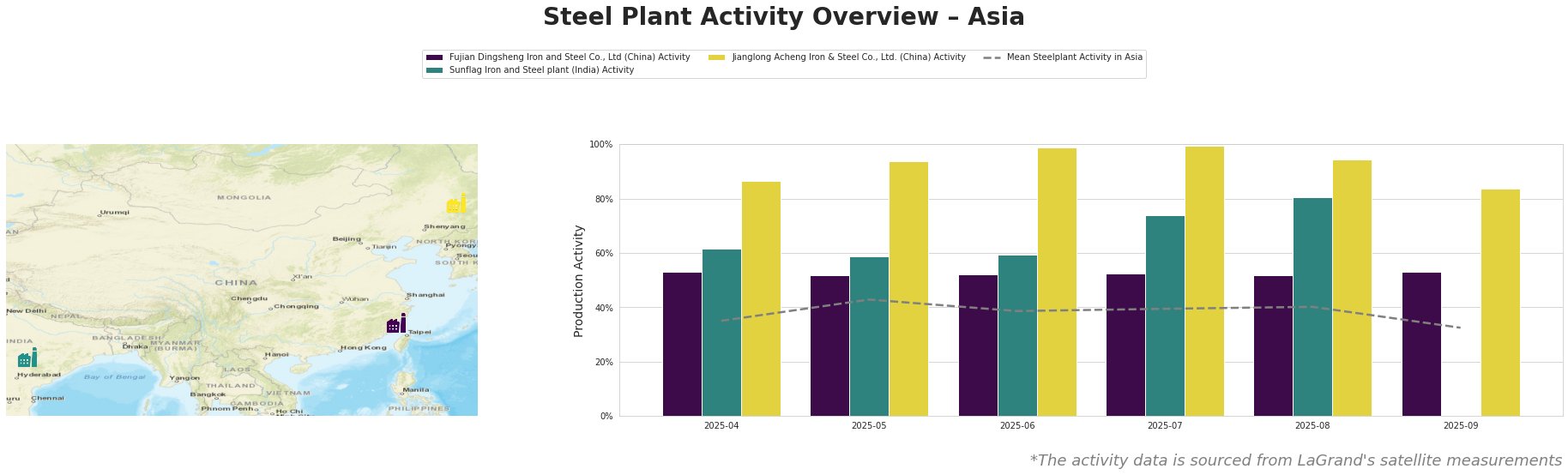

The mean steel plant activity in Asia shows a volatile trend. It peaked in May at 43%, followed by a decline to 32% in September.

Fujian Dingsheng Iron and Steel Co., Ltd, a BOF-based steel plant in Fujian, China producing 1.725 million tonnes of crude steel annually, has maintained a relatively stable activity level, fluctuating between 52% and 53% from April to September, with no significant deviation from the mean. This stability suggests consistent operation, and no direct connections to the provided news articles can be established.

Sunflag Iron and Steel plant in Maharashtra, India, an integrated BF and DRI plant with an EAF, shows increasing activity levels. Starting at 62% in April, it rose to 80% in August. Notably, July showed an increase to 74%. However, activity data is missing for September. Given the “India–EFTA Trade Pact Takes Effect Oct 1: $100 Billion Investment, 10 Lakh Jobs Tied To Deal” this rise is likely a reaction to anticipated increased demand from the EFTA trade agreement.

Jianglong Acheng Iron & Steel Co., Ltd., a BF/BOF-based steel plant in Heilongjiang, China with a 1.1 million tonne crude steel capacity, shows consistently high activity. It operated near peak capacity from May to August (94-100%). However, activity dropped to 84% in September. This activity could not directly be linked to the news.

The ‘Missed Opportunity’: EU Envoy Rues No Breakthrough In Latest Round Of India-EU FTA Talks” may lead to reduced Indian Steel demand from European customers in the medium term.

* Procurement Action: Steel buyers should closely monitor Sunflag Iron and Steel plant activity. Consider securing contracts with this supplier early to capitalize on increased production due to the EFTA trade deal. Given the increase of the Sunflag plant, monitor EAF steel prices, and hedge if possible.

* Procurement Action: Steel buyers should be aware, that European buyers may search for new suppliers in China or Indonesia, increasing competition. Steel buyers should check their contracts and delivery agreements.