From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Falters: China Production Dip Drags Down Regional Activity

Asia’s steel market faces headwinds due to declining production in key regions. The observed decrease in plant activity aligns with reports of production cuts in China, as detailed in the news articles “China’s crude steel production fell 7% in April, m-o-m” and “China has reduced steel production“, indicating a potential tightening of supply. Decreased production in Japan, as reported in “Japanese crude steel output down 6.4 percent in April“, further contributes to the region’s overall negative sentiment.

Measured Activity Overview

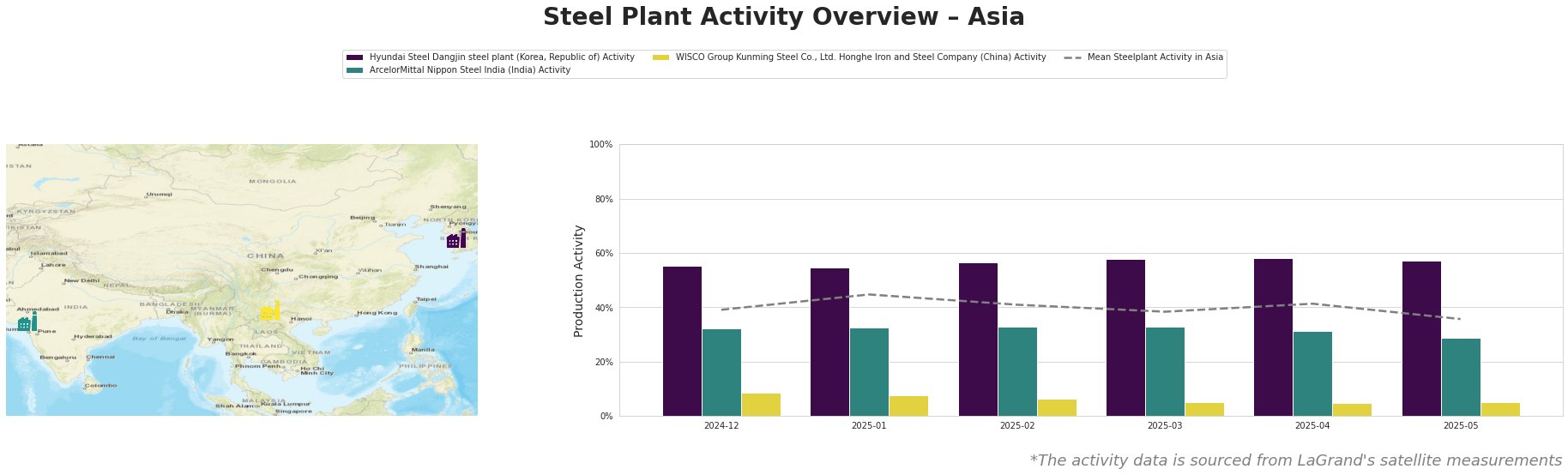

The average steel plant activity in Asia decreased noticeably from 41% in April to 36% in May 2025. Hyundai Steel Dangjin maintains a relatively high activity level (57% in May), consistently outperforming the Asian average. ArcelorMittal Nippon Steel India has seen a gradual decline, dropping from 33% in March to 29% in May. WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company operates at consistently low levels, with activity remaining stable at 5% since April, indicating a potential persistent production cut, which corresponds with the broader Chinese production decreases detailed in “China has reduced steel production“.

Hyundai Steel Dangjin, a South Korean integrated steel plant (BF/BOF/EAF) with a 12.6 million tonne BOF and a 4 million tonne EAF crude steel capacity, primarily serves the automotive and construction sectors. Its activity remained relatively stable around 57-58% throughout the observed period, above the Asian average. The news articles do not provide insight on the operations of South Korean steel plants, and therefore a direct connection cannot be established.

ArcelorMittal Nippon Steel India, located in Gujarat, operates both BF and DRI-based production routes (9.6 million tonne crude steel capacity). Activity decreased from 33% to 29% between March and May. The news articles do not provide insight on the operations of the India steel plants, and therefore a direct connection cannot be established.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company, a Chinese integrated steel plant (BF/BOF) with a relatively small capacity of 1.15 million tonnes of crude steel, shows consistently low activity levels. Its activity remains at 5% since April. This low level of activity potentially mirrors the overall crude steel reduction trend in China as reported in “China’s crude steel production fell 7% in April, m-o-m“, although other specific details are not available.

Evaluated Market Implications

Given the observed activity decline at WISCO Group Kunming Steel in conjunction with the reported production cuts in China (“China has reduced steel production“), there is a potential for supply disruptions of finished rolled products from this specific plant.

Recommended Procurement Actions:

- Steel buyers who rely on supplies from WISCO Group Kunming Steel should immediately investigate alternative supply sources, especially for bar, wire, and hot-rolled strip, due to the plant’s consistently low activity and the reported production curtailments in China.

- Market analysts should closely monitor Chinese steel production data and inventory levels, using the news articles “China’s crude steel production fell 7% in April, m-o-m” and “China has reduced steel production” as triggers for further investigation into specific regional impacts and potential price volatility.