From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Facing Headwinds: Activity Mixed Amidst Global Uncertainty

Asia’s steel market is facing significant headwinds, with activity levels exhibiting a mixed trend amidst global economic uncertainty. The struggles in the Italian steel market highlighted in the news articles titled “Assofermet: Italian steel market remains uncertain in May amid growing concerns” (published on 2025-06-10T22:00:00Z, 2025-06-10T22:00:00Z, and 2025-06-10T11:59:20Z) reflect broader global anxieties, although a direct relationship to observed Asian steel plant activity cannot be established based on the current information.

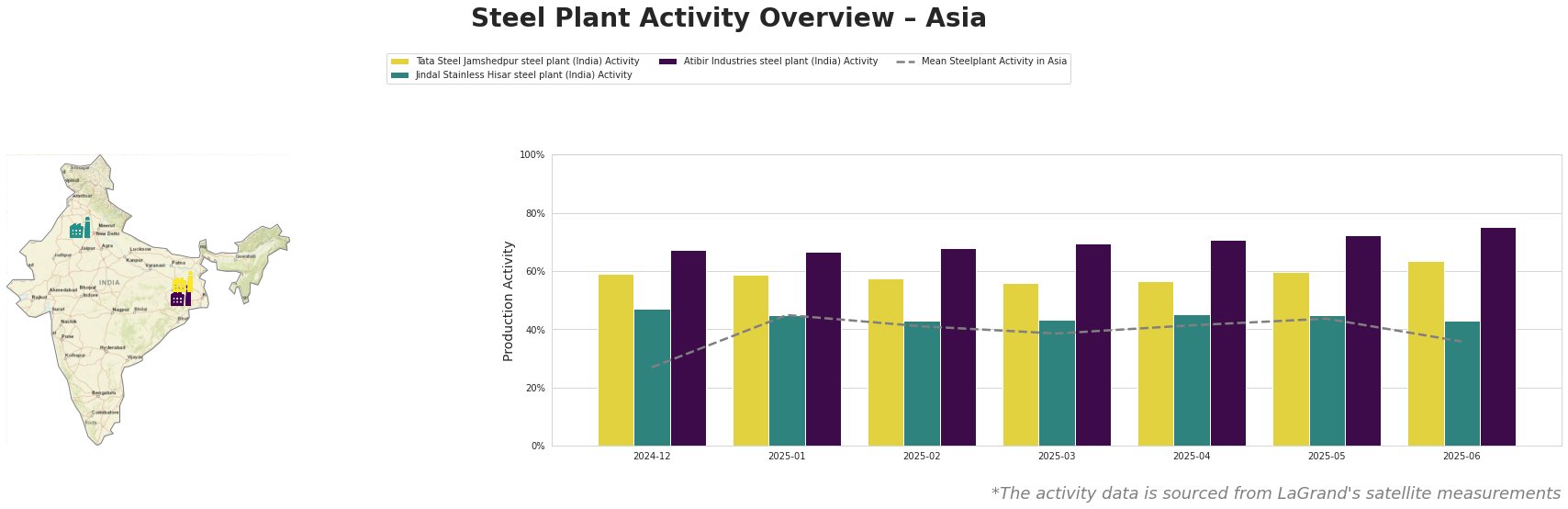

Overall, the mean steel plant activity in Asia has fluctuated, peaking at 45.0% in January 2025 and reaching a low of 36.0% in June 2025. Tata Steel Jamshedpur consistently operated above the Asian mean, reaching 63.0% activity in June 2025. Jindal Stainless Hisar has remained relatively stable, hovering around 45.0%, consistently operating around the Asian mean. Atibir Industries has shown a steady upward trend, reaching 75.0% activity in June 2025, significantly above the Asian mean.

Tata Steel Jamshedpur, an integrated steel plant in Jharkhand with a 10,000 Crudesteel capacity utilizing BF and BOF technologies, demonstrates consistent activity above the Asian average. While its activity slightly decreased from 59.0% to 56.0% between December 2024 and March 2025, it has since rebounded, reaching 63.0% in June 2025. This positive trend occurs despite the general market anxieties expressed in the Assofermet articles, suggesting robust domestic demand or export strategies unrelated to the Italian market. No direct connection between the Tata Steel Jamshedpur activity trend and the provided news articles can be explicitly established.

Jindal Stainless Hisar, an electric arc furnace (EAF) based plant in Haryana with an 800 CrudeSteel capacity, producing stainless steel products, shows relatively stable activity. The plant’s activity has remained within a narrow range, fluctuating between 43.0% and 47.0% and operates close to the mean, indicating that it reflects the overall market sentiment. Given its focus on stainless steel, the weak demand for stainless steel flats mentioned in the Assofermet articles might indirectly influence Jindal Stainless Hisar, but this cannot be definitively confirmed.

Atibir Industries, an integrated steel plant in Jharkhand with a 600 CrudeSteel capacity utilizing BF and BOF technologies, producing crude, semi-finished, and finished rolled products, has exhibited a consistent upward trend in activity. Starting from 67.0% in December 2024, it reached 75.0% in June 2025, significantly outperforming the Asian mean. This strong performance, similar to Tata Steel, seems to counter the overall negative sentiment. No direct connection between the Atibir Industries activity trend and the provided news articles can be explicitly established.

The observed activity trends suggest potential regional disparities within the Asian steel market. While the Assofermet articles highlight challenges in the Italian and potentially broader European steel markets, the consistent and increasing activity at Tata Steel Jamshedpur and Atibir Industries, respectively, indicates relatively strong domestic demand or alternative export markets in Asia.

Evaluated Market Implications:

- Potential Supply Disruptions: The Assofermet articles suggest possible disruptions in the supply of steel to Italy and potentially Europe due to trade tensions and the CBAM. However, these disruptions do not appear to be directly impacting the observed Asian steel plant activities, at least for Tata Steel Jamshedpur and Atibir Industries. Jindal Stainless activity does seem to fluctuate with the mean of Asia.

- Recommended Procurement Actions:

- Steel Buyers: Given the uncertainties highlighted by the Assofermet articles, steel buyers should closely monitor global trade policies and their potential impact on import costs.

- Market Analysts: Continue monitoring Asian steel plant activity, especially at Tata Steel Jamshedpur and Atibir Industries, to identify potential shifts in domestic demand and export strategies. The stability of Jindal Stainless Hisar should be monitored for changes that could indicate weakness in their submarket.