From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Uncertainty as EU Quotas Impact Production

In Asia, the steel market faces increasing uncertainty due to the implications of EU import quotas, although a direct relationship between these quotas and activity levels in Asia could not be definitively established through satellite-observed changes in activity levels. The exhaustion of EU steel import quotas, as highlighted in “Most EU steel import quotas nearly exhausted as Q2 ends,” “Most EU steel import quotas are almost exhausted by the end of the second quarter,” and “EU steel quotas reflect shifting trade dynamics after US tariffs,” may create indirect pressures on Asian steel producers.

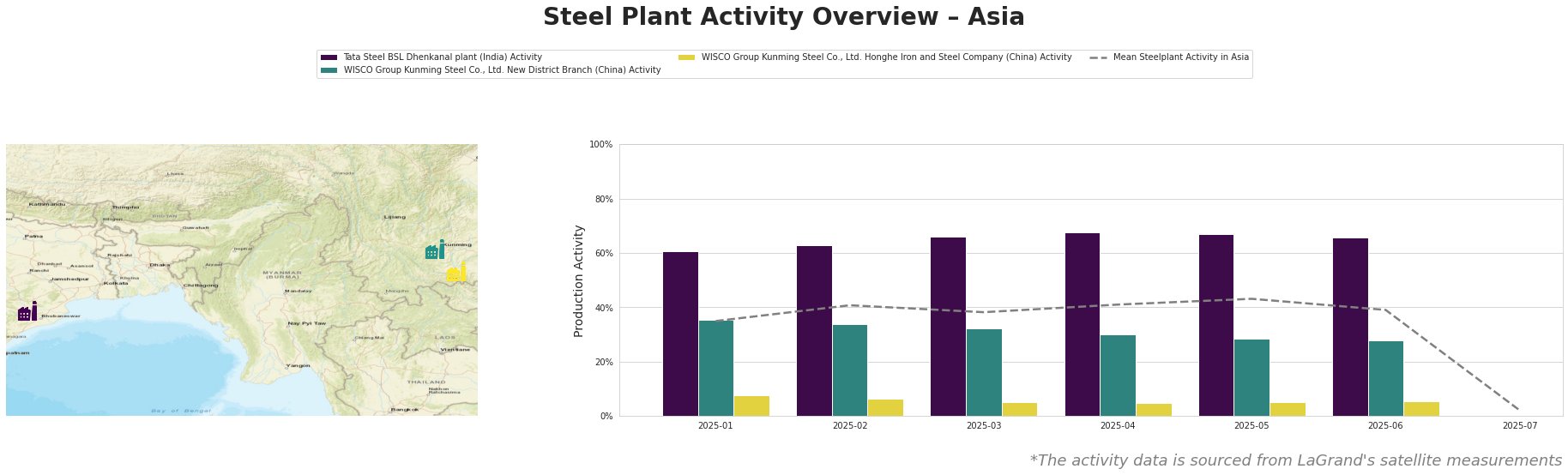

The mean steel plant activity in Asia shows a gradual increase from January (35.0%) to May (43.0%), followed by a decrease to 39.0% in June, culminating in a sharp drop to 2.0% in July.

Tata Steel BSL Dhenkanal plant in India maintained a relatively high activity level, ranging from 61.0% to 67.0% between January and June. This is consistently above the mean activity level for the region, suggesting stable production for the period, though it mirrors the regional average in its recent drop.

WISCO Group Kunming Steel Co., Ltd. New District Branch in China shows a steady decline in activity from 35.0% in January to 28.0% in June. Its activity consistently falls below the regional mean.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company in China shows very low activity levels, fluctuating between 5.0% and 8.0% from January to June. This is significantly below the regional mean.

The Tata Steel BSL Dhenkanal plant, an integrated steel plant in Odisha with a crude steel capacity of 5.6 million tonnes per annum (MTPA) utilizing both BF and DRI processes, demonstrated consistently high activity levels from January to June, peaking at 67.0% in April and May before decreasing to 66.0% in June. The significant activity drop in July mirrors the regional average but cannot be directly linked to the EU quota news articles, and may reflect other market conditions or maintenance shutdowns.

The WISCO Group Kunming Steel Co., Ltd. New District Branch, a BF-based plant in Yunnan with a 2.8 MTPA crude steel capacity, exhibited a declining activity trend from 35.0% in January to 28.0% in June. The sharp drop in July is consistent with the regional average. Despite producing finished rolled products, including hot-rolled strip and galvanized sheet, no explicit connection between this decline and the EU quota news could be established, and it may be influenced by local or domestic factors.

The WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company, another BF-based plant in Yunnan with a 1.15 MTPA crude steel capacity, maintained very low activity levels between 5.0% and 8.0%. Similar to the New District Branch, no direct link between these activity levels and the EU quota situation could be established, and local operational or market factors likely play a more significant role.

Evaluated Market Implications:

Based on the news articles, the near exhaustion of EU import quotas for steel from various countries, including those in Asia, suggests that Asian steel producers may face increased challenges in exporting to the EU market. The satellite data shows recent average production decreases in Asia.

Recommended Procurement Actions:

- Diversify Export Markets: Steel buyers and analysts should advise Asian steel producers to explore and diversify their export markets beyond the EU, particularly focusing on regions with less restrictive trade policies.

- Monitor Domestic Demand: Closely monitor domestic demand within Asian countries to absorb potential excess supply resulting from reduced EU exports.

- Negotiate Contract Terms: Steel buyers should negotiate contract terms that allow for flexibility in adjusting order volumes and delivery schedules, given the potential for supply chain disruptions.

- Evaluate Alternative Suppliers: Steel buyers, particularly those in the EU, should evaluate alternative steel suppliers from regions with available quota capacity to mitigate potential supply shortages.

- Monitor Further Policy Changes: The market participants should closely monitor policy changes, particularly trade restrictions and tariffs, to proactively adjust their procurement strategies and mitigate potential risks.