From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Uncertainty Amidst US Tariff Threats: July Activity Plummets

In Asia, the steel market is facing increased uncertainty due to potential US tariff implementations. The situation is exacerbated by recent drops in steel plant activity, though direct causation cannot be definitively established. According to “Trump’s tariff pause is set to expire, threatening a trade war flare-up“, the expiration of existing tariffs and potential imposition of new ones are key market drivers. The news article “US to lay out tariff demands in coming days: Trump” further details the US intention to specify tariff demands, potentially impacting steel imports from the region.

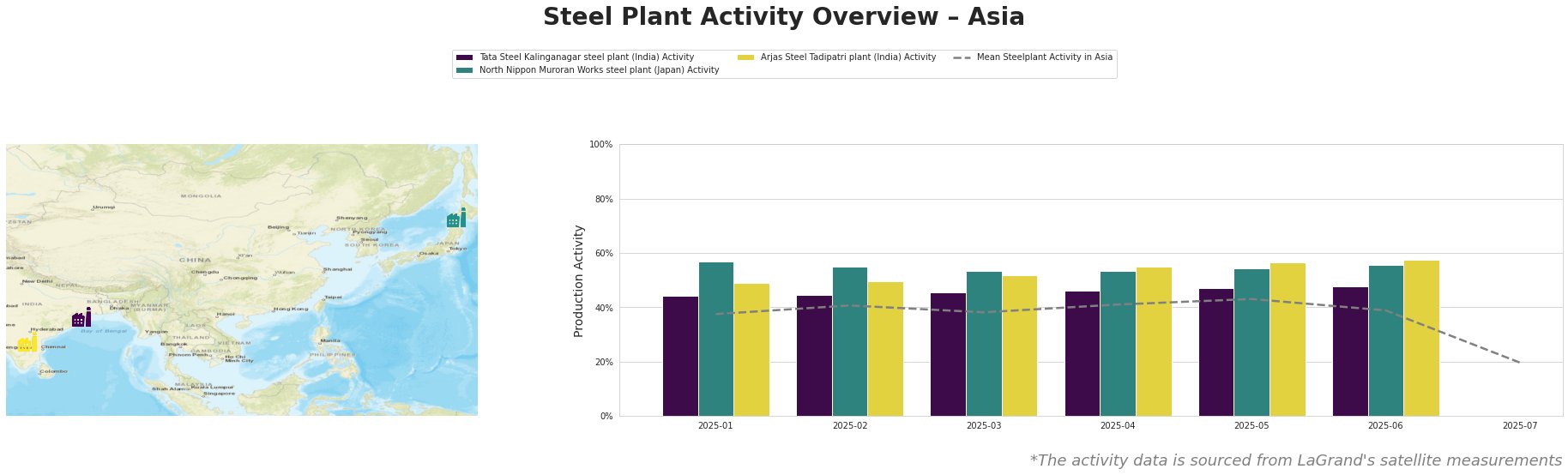

The table shows a significant drop in the mean steel plant activity in Asia, from 39% in June to 20% in July. It should be noted that no full activity values for July exist for the individual steel plants.

Tata Steel Kalinganagar steel plant, located in Odisha, India, is an integrated steel plant with a 3000 ttpa crude steel capacity based on BF/BOF technology, primarily serving the automotive sector. Activity at the plant shows a slight increasing trend from January (44%) to June (48%). However, the missing data for July prevents assessment of any impact from the potential tariff implementations discussed in “Trump’s tariff pause is set to expire, threatening a trade war flare-up“. Therefore, no direct connection can be established between the news articles and the plant’s potential activity change in July.

North Nippon Muroran Works steel plant, situated in Hokkaidō, Japan, has a crude steel capacity of 2598 ttpa utilizing both BF/BOF and EAF technologies, producing semi-finished and finished rolled products like bars and wires for the automotive industry. Plant activity remained relatively stable between January (57%) and June (56%). The article “Trump puts new 25% tariffs on imports from Japan, South Korea” directly names Japan as a target for new tariffs effective August 1st. However, without July activity data, it is impossible to determine whether the anticipation of these tariffs has already impacted production.

Arjas Steel Tadipatri plant, based in Andhra Pradesh, India, operates an integrated BF/BOF steel plant with a 325 ttpa crude steel capacity, producing finished and semi-finished products for various sectors, including automotive and energy. The plant showed a consistent increase in activity from January (49%) to June (57%). Like the other plants, the absence of July data makes it impossible to directly correlate any activity changes with the US tariff announcements.

The potential for significant disruption exists, particularly for steel buyers sourcing from Japan, given the direct targeting of the country with a 25% tariff as reported in “Trump puts new 25% tariffs on imports from Japan, South Korea“.

Evaluated Market Implications:

The news article “Trump puts new 25% tariffs on imports from Japan, South Korea” explicitly targets Japan with a 25% tariff effective August 1, 2025. Given the North Nippon Muroran Works steel plant’s location in Japan, this could lead to supply disruptions. Steel buyers who depend on North Nippon Muroran Works should consider the following actions:

- Diversify sourcing: Actively explore alternative steel suppliers outside of Japan, particularly in regions less exposed to US tariffs.

- Negotiate existing contracts: Review and renegotiate contracts with Japanese suppliers to account for the potential impact of the 25% tariff, focusing on risk-sharing mechanisms.

- Increase inventory: Consider temporarily increasing inventory levels before August 1st to buffer against potential supply chain disruptions.