From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Uncertainty Amidst Trade Tensions and Production Fluctuations

Asia’s steel market is exhibiting a negative sentiment due to escalating trade tensions and fluctuating production levels. Observed steel plant activity levels do not show direct relationships with the events described in “Liveblog USA unter Trump: Xi hatte nur einen schlechten Moment | FAZ“, “Liveblog USA unter Trump: Trump würdigt Charlie Kirk mit höchster Auszeichnung“, “Liveblog USA unter Trump: Trump verteidigt Einschränkung der Pressefreiheit im Pentagon“, and “Liveblog USA unter Trump: US-Richterin stoppt Trumps Massenentlassungen im „Shutdown“ | FAZ“. However, “Trump threatens 100 percent tariffs on China, calls off meeting with Chinese president” directly impacts the market outlook by introducing significant uncertainty.

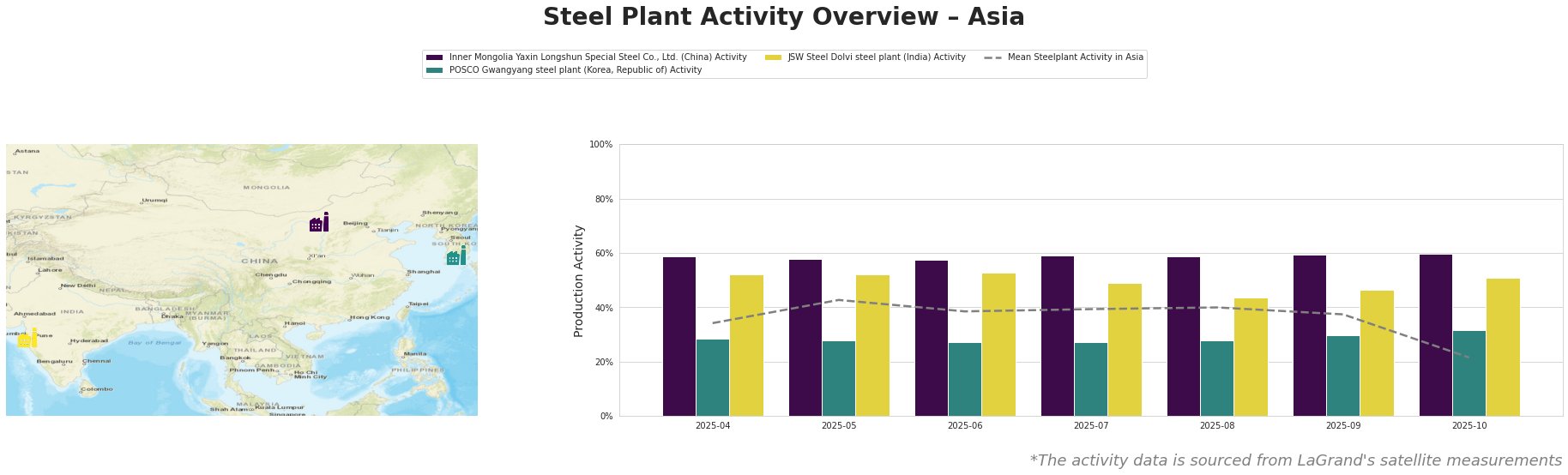

The mean steel plant activity in Asia experienced a significant drop in October 2025, falling to 22.0% from 37.0% in September. Inner Mongolia Yaxin Longshun Special Steel Co., Ltd. maintains relatively high and stable activity levels. POSCO Gwangyang steel plant shows slightly increasing activity, while JSW Steel Dolvi steel plant exhibited more volatile activity.

Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., a Chinese integrated steel plant with a 2000ktpa BOF capacity, has shown consistently high activity, hovering around 59-60% throughout the observed period. While the plant has ResponsibleSteel Certification, no direct correlation can be established between this and its activity levels. There is also no clear link between its activity and the news articles provided.

POSCO Gwangyang steel plant, a major South Korean integrated steel producer with a 23000ktpa BOF capacity and diverse product portfolio, has exhibited relatively low activity compared to the regional average, fluctuating between 27% and 32%. The plant holds ResponsibleSteel Certification, however, there is no observable link between this and plant activity. There is no direct link found between its activity and the news articles.

JSW Steel Dolvi steel plant, an Indian integrated steel plant utilizing both BF and DRI routes with a 5000ktpa EAF capacity, showed a decrease from 52% in April/May to 44% in August, then rose again to 51% in October. The plant possesses ResponsibleSteel Certification, though there is no evident correlation with the plant’s activity level. There is no direct connection to the provided news articles.

The threat of 100% tariffs on Chinese imports, as reported in “Trump threatens 100 percent tariffs on China, calls off meeting with Chinese president,” creates considerable downside risks for steel buyers. While Inner Mongolia Yaxin Longshun Special Steel Co., Ltd.’s activity remained high, the potential tariffs could significantly disrupt export markets and increase domestic competition within China, indirectly affecting its future operations and profitability.

Evaluated Market Implications:

Given the potential for significant trade disruptions stemming from “Trump threatens 100 percent tariffs on China, calls off meeting with Chinese president” and the observed drop in mean steel plant activity in Asia, steel buyers should:

- Diversify Procurement: Reduce reliance on Chinese steel sources to mitigate the impact of potential tariffs. Prioritize securing supply from alternative sources like India or South Korea.

- Monitor Contract Clauses: Review existing contracts and incorporate clauses addressing tariff risks and force majeure events to protect against unforeseen price increases or supply disruptions.

- Consider Forward Purchasing: Explore forward purchasing options from non-Chinese suppliers to lock in prices and secure supply before potential tariff implementations drive up costs. This is particularly relevant given the stable production from POSCO Gwangyang.

- Closely Monitor Policy Developments: Stay informed about trade policy updates and their potential impact on steel prices and availability.