From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Production Volatility Amidst EU Import Shifts

Asia’s steel market displays production volatility, potentially influenced by global trade dynamics. While a direct link to Asian steel plant activity from the news articles concerning EU steel consumption, imports, and exports is not established, the global steel market is interconnected, and shifts in one region can influence others. The articles “Real steel consumption in the EU fell by 5.5% y/y in Q1 – EUROFER“, “Steel imports to the EU fell by 3% y/y in Q2 – EUROFER“, “Steel exports from the EU fell by 12% y/y in Q2 – EUROFER“, “EUROFER: EU’s finished steel imports down seven percent in Q2 2025” and “EU’s finished steel imports down seven percent in Q2 2025” highlight weakening demand and trade flow changes in the EU, potentially impacting Asian export opportunities and creating uncertainty in the market.

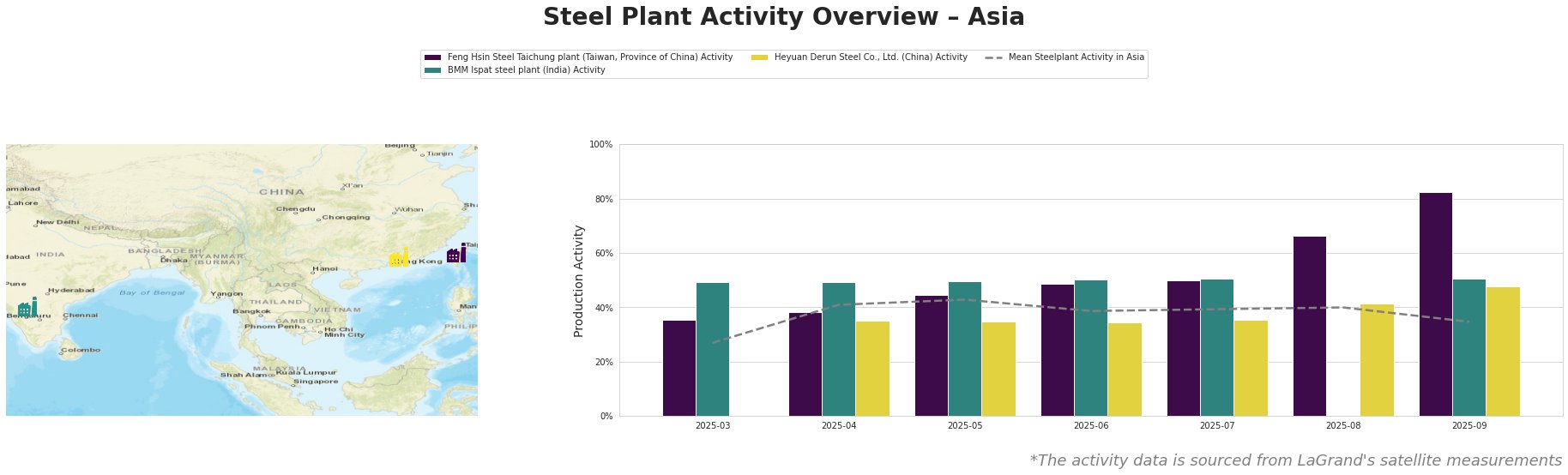

Across Asia, mean steel plant activity fluctuated, peaking in May 2025 at 43% and subsequently declining to 35% by September 2025. The Feng Hsin Steel Taichung plant demonstrated a notable surge in activity, reaching 82% in September 2025. BMM Ispat steel plant exhibited relatively stable activity around 50%, while Heyuan Derun Steel Co., Ltd. showed lower activity levels that peaked in September 2025.

Feng Hsin Steel Taichung plant: This Taiwanese plant, with an EAF-based crude steel capacity of 1.2 million tonnes, primarily produces semi-finished and finished rolled products such as rebar. The plant’s activity increased steadily, culminating in a significant rise to 82% in September 2025. The spike in activity at Feng Hsin Steel is not directly attributable to any specific event in the provided news articles.

BMM Ispat steel plant: Located in Karnataka, India, this integrated steel plant has a crude steel capacity of 2.2 million tonnes, utilizing BOF, EAF, and DRI processes. Its main products are bars, rebar, and flats, serving the building and infrastructure sectors. The plant’s activity remained relatively stable at around 50% throughout the observed period. No direct correlation between the BMM Ispat plant activity and the EU steel market news can be established based on the provided information.

Heyuan Derun Steel Co., Ltd.: This Chinese plant in Guangdong province has a crude steel capacity of 1.2 million tonnes, using EAF technology to produce hot-rolled rebar and billet. Activity at Heyuan Derun Steel Co., Ltd. remained relatively low and stable, increasing to 48% in September. There is no direct connection to EU market news.

Given the overall negative sentiment driven by the news of declining steel consumption and shifting trade flows in the EU, and the concurrent observed volatility in Asian steel plant activity, including significant increases in some plants, the following market implications and procurement actions should be considered:

- Potential Supply Disruptions: The rising activity at the Feng Hsin Steel Taichung plant could suggest increased supply in specific product categories like rebar, potentially impacting regional pricing. Conversely, the general downward trend in average activity in Asia could lead to supply constraints if demand unexpectedly increases.

- Recommended Procurement Actions:

- For steel buyers focused on rebar and related long products in Asia: Monitor Feng Hsin Steel’s output and pricing strategies closely, as its increased activity could offer opportunities for competitive sourcing.

- For steel buyers in general: Given the overall uncertainty and the potential for supply fluctuations, diversify your supplier base and consider hedging strategies to mitigate risk. Closely monitor global trade flows and policy changes, as these factors could significantly impact regional steel markets, as highlighted by the provided news articles. Actively seek more information from your supply chain to get better insights on production and capacity utilization in order to avoid surprises.