From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Production Slowdown Amidst Trade and Environmental Pressures

Asia’s steel market shows signs of contraction due to complex interplay of environmental policies, trade tensions, and production adjustments. This assessment is based on satellite-observed plant activity coupled with insights drawn from the Italian steel industry’s concerns about global trade dynamics, as articulated in “Federacciai president eyes global trade rules redefinition,” and the impact of environmental regulations as highlighted in “‘Ideological’ Green Deal undermines EU competitiveness: Federacciai.” While these articles focus on the EU, their concerns about trade diversion and competitiveness are relevant to Asia, even though a direct, explicit link between the news articles and satellite-observed activity in Asia cannot be established.

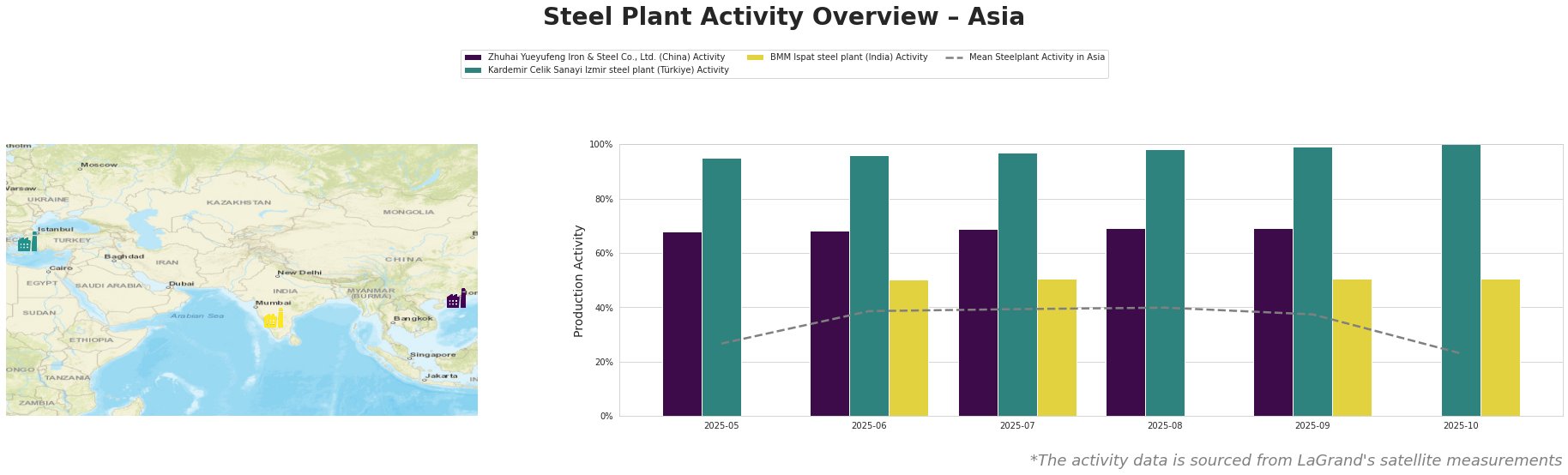

The mean steel plant activity in Asia exhibited fluctuation, peaking at 40% in August before declining sharply to 23% in October. Zhuhai Yueyufeng Iron & Steel Co., Ltd., a BF/BOF integrated plant in China, showed a consistently moderate activity level around 68-69% throughout the observed period. Kardemir Celik Sanayi Izmir, an EAF-based plant in Türkiye, operated at very high activity levels, steadily increasing to 100% in October. BMM Ispat steel plant in India, which relies on both DRI and EAF processes, maintained a stable, moderate activity level around 50-51% when observations were available.

Zhuhai Yueyufeng Iron & Steel Co., Ltd., with a crude steel capacity of 3.05 million tonnes per annum (mtpa) using BF/BOF technology, showed stable activity around 68-69%. This stability does not reflect concerns raised in “Federacciai president eyes global trade rules redefinition,” regarding potential trade diversions from China, as there is no observed decrease in activity.

Kardemir Celik Sanayi Izmir, with a 1.25 mtpa EAF-based capacity, showed a strong upward trend, reaching peak activity in October. This growth trajectory does not explicitly align with the challenges highlighted in “The Italian Steel Industry Federation calls on the EU to adopt industrial policies for the industry’s survival“, given that there’s no immediate EU policy impact directly visible in their operational data.

BMM Ispat, an integrated DRI-based plant with a 2.2 mtpa crude steel capacity, demonstrated stable activity around 50-51%. The observed stability provides no direct confirmation of impacts related to concerns raised in “‘Ideological’ Green Deal undermines EU competitiveness: Federacciai,” as the plant’s activity remains constant despite broader discussions about environmental regulations.

The recent drop in the mean steel plant activity in Asia, coupled with broader concerns about trade and environmental policies, warrants cautious procurement strategies. Given the high activity at Kardemir Celik Sanayi Izmir and its EAF production, steel buyers should consider securing supply contracts from this plant, particularly if EAF-produced steel aligns with their sustainability targets. The stable activity at BMM Ispat, combined with its DRI-based production, makes it a reliable source for semi-finished products; however, buyers should closely monitor potential disruptions given the overall negative market sentiment. While Zhuhai Yueyufeng Iron & Steel Co., Ltd. shows stable production, procurement professionals should actively explore alternative sources to mitigate risks associated with potential trade policy shifts and focus on diversifying supply chains.