From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Pressure: Scrap Decline and Plant Activity Slowdown

Asia’s steel market is under pressure due to declining scrap consumption and macroeconomic instability. Observed changes in plant activity levels do not show a direct relation to the news articles “Global scrap consumption declined in most regions in Q1,” “Global scrap market under pressure from macroeconomic instability – BIR,” and “Prices are not going up: scrap is suffering from weak demand and currency fluctuations,” although the articles report a downturn in demand from Asia.

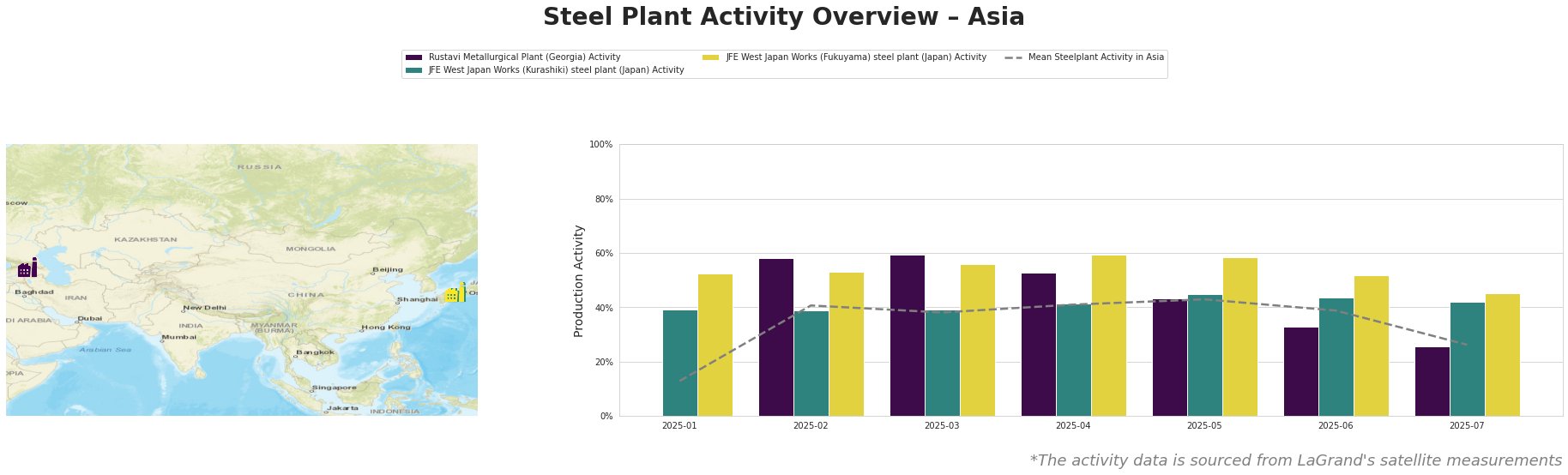

Mean steel plant activity in Asia peaked in May at 43.0% and then dropped significantly to 26.0% in July. The Rustavi Metallurgical Plant initially operated above the mean, peaking at 59% in March before dropping to 26% in July, matching the overall Asian mean. JFE West Japan Works (Kurashiki) steel plant showed relatively stable activity between 39.0% and 45.0%, ending the period at 42.0%. JFE West Japan Works (Fukuyama) steel plant demonstrated the highest levels of activity, peaking at 59.0% in April and ending at 45.0% in July. The significant drop in the mean Asia activity and the Rustavi plant activity in July does not have a direct link to provided news, but could be related to the low demand and price drop mentioned in the articles.

The Rustavi Metallurgical Plant, an integrated BF-EAF steel plant in Georgia with a crude steel capacity of 120 ttpa and iron capacity of 725 ttpa, primarily produces pig iron, square billets, and rebar. The plant’s activity dropped from 59% in March to 26% in July, mirroring the average Asian decline. The drop could be linked to reduced global steel production as mentioned in the article “Global scrap consumption declined in most regions in Q1,” although no direct connection can be confirmed.

JFE West Japan Works (Kurashiki) steel plant, an integrated BF-BOF steel plant in Japan with a crude steel capacity of 10,000 ttpa and iron capacity of 11,284 ttpa, focuses on semi-finished and finished rolled products such as hot-rolled and coated sheets. The Kurashiki plant’s activity remained relatively stable, fluctuating between 39% and 45%, with a slight decrease to 42% in July. This stability contrasts with the general downward trend in Asia and the news article “Prices are not going up: scrap is suffering from weak demand and currency fluctuations” which describes lower demand and a decline in scrap prices. The reason for that stability is not clear and may be related to a strong focus on national markets instead of export.

JFE West Japan Works (Fukuyama) steel plant, another integrated BF-BOF steel plant in Japan, boasts a crude steel capacity of 13,000 ttpa and iron capacity of 13,438 ttpa, producing similar products to the Kurashiki plant. The Fukuyama plant’s activity also decreased, from a peak of 59% in April to 45% in July. This drop could be linked to the weak consumer demand in Asia and strong Chinese steel export mentioned in the news article “Prices are not going up: scrap is suffering from weak demand and currency fluctuations,” even if no explicit connection can be stated.

Given the observed decline in Asian steel plant activity, coupled with reports of macroeconomic instability and declining scrap consumption, steel buyers should anticipate potential supply disruptions in the region.

Procurement Action: Buyers relying on Rustavi Metallurgical Plant for rebars should explore alternative suppliers due to the plant’s significant activity drop and align their inventories to prevent shortages. In case of supply shortages from the Rustavi Metallurgical Plant explore supply capabilities from the JFE West Japan Works.