From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: Trump Tariffs & Rare Earth Curbs Threaten Supply

In Asia, steel markets are facing increased uncertainty due to escalating trade tensions between the US and China. The potential impact of these tensions is exacerbated by China’s recent export restrictions on rare earths, as mentioned in “China verschärft Exportbeschränkungen für seltene Erden“. While a direct link between the rare earth restrictions and immediate steel plant activity cannot be established based solely on the provided data, the news hints at broader supply chain vulnerabilities. Further adding to market concern is the article “China-USA: Trump dreht an der Zollschraube: 100 Prozent auf China-Importe” which outlines plans for increased US tariffs on Chinese goods that would take effect November 1, 2025.

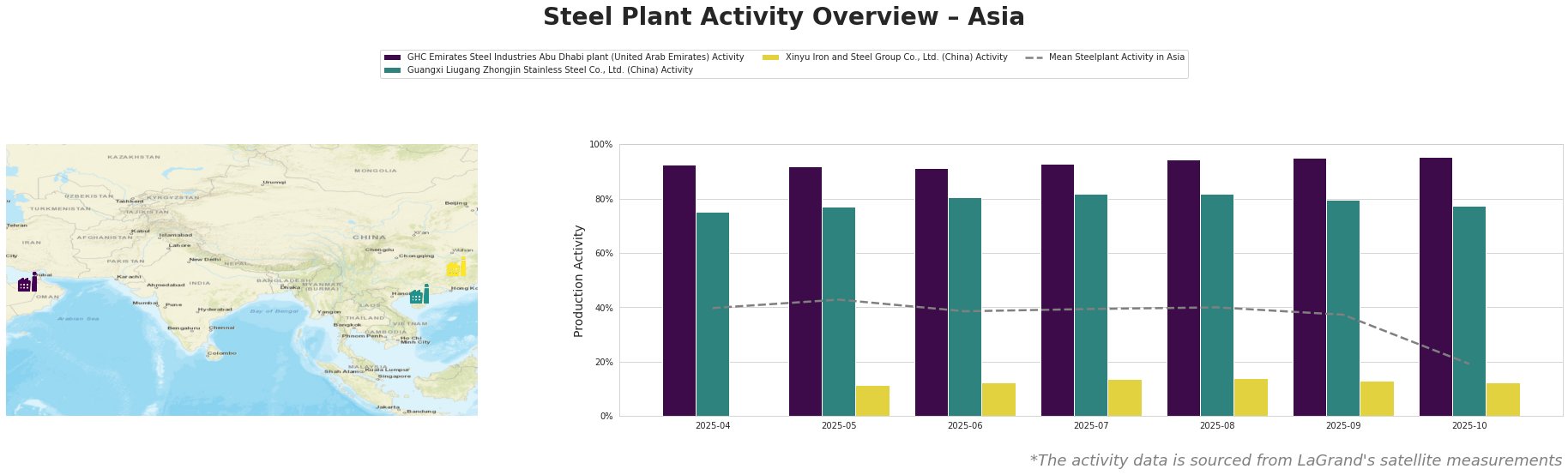

Overall, the mean steel plant activity in Asia dropped significantly in October 2025 to 19.0, down from 37.0 in September, marking a substantial decrease.

GHC Emirates Steel Industries Abu Dhabi plant, a DRI-based EAF steelmaker with a 3.5 million tonne crude steel capacity, primarily produces semi-finished and finished rolled products for the automotive, building, energy, and transport sectors. The plant’s activity remained consistently high throughout the observed period, peaking at 95.0 in September and October 2025. While the overall Asian mean activity dropped significantly, the GHC Emirates plant has remained stable. No direct correlation to the named news articles can be established based on this observation.

Guangxi Liugang Zhongjin Stainless Steel Co., Ltd., an integrated BF-BOF stainless steel producer in China with a 1.2 million tonne crude steel capacity, manufactures stainless steel coils. The activity level at this plant remained relatively stable from April to September, fluctuating between 75.0 and 82.0. In October, the activity dipped slightly to 78.0. Given the plant’s location in China and its production of stainless steel coils, the potential tariffs highlighted in “Trump Announces Additional 100% China Tariff, Tech Controls” could indirectly affect its export prospects, although this is not immediately evident in the October activity data.

Xinyu Iron and Steel Group Co., Ltd., a major integrated BF-BOF steel producer in Jiangxi, China, has a crude steel capacity of 10 million tonnes. Its main products include plates and sheets for the energy, building, and transport industries. Activity remained low, fluctuating between 11.0 and 14.0. The limited activity data makes it hard to connect observed trends to the provided news articles.

The combination of potential tariffs, as mentioned in “Trump kündigt Extra-Zölle von 100 Prozent für China an“, and rare earth export restrictions raises concerns about potential supply disruptions, particularly affecting companies reliant on Chinese-sourced materials.

Recommended Procurement Actions:

- Steel Buyers Focused on US Markets: Given the potential 100% tariffs on Chinese imports discussed in “Zollstreit: „Moralische Schande“ – Trump kündigt zusätzliche Zölle in Höhe von 100 Prozent gegen China an,” steel buyers in the US should immediately explore alternative supply sources outside of China to mitigate potential price increases and supply chain disruptions.

- For Companies Reliant on Rare Earth Elements: Due to China’s export restrictions (“China verschärft Exportbeschränkungen für seltene Erden“) and associated supply vulnerabilities of essential raw materials, conduct an immediate risk assessment of the supply chain, specifically focusing on identifying dependencies on Chinese rare earth minerals. Investigate alternative sources or materials to reduce reliance on Chinese exports.