From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: Maintenance Shutdowns Impact Production, Activity Dips

Asia’s steel market faces headwinds due to production adjustments and maintenance shutdowns, despite some producers showing growth. While “India’s JSW Steel Limited sees 14% rise in crude steel output in Q1 FY 2025-26,” coinciding with high activity levels at several key steel plants, the regional mean activity indicates a recent drop. The “Indian company Tata Steel produced 5.26 million tons of steel in April-June,” a near match to the previous year, but impacted by maintenance shutdowns, with no direct connection to satellite-observed activity at specific plants.

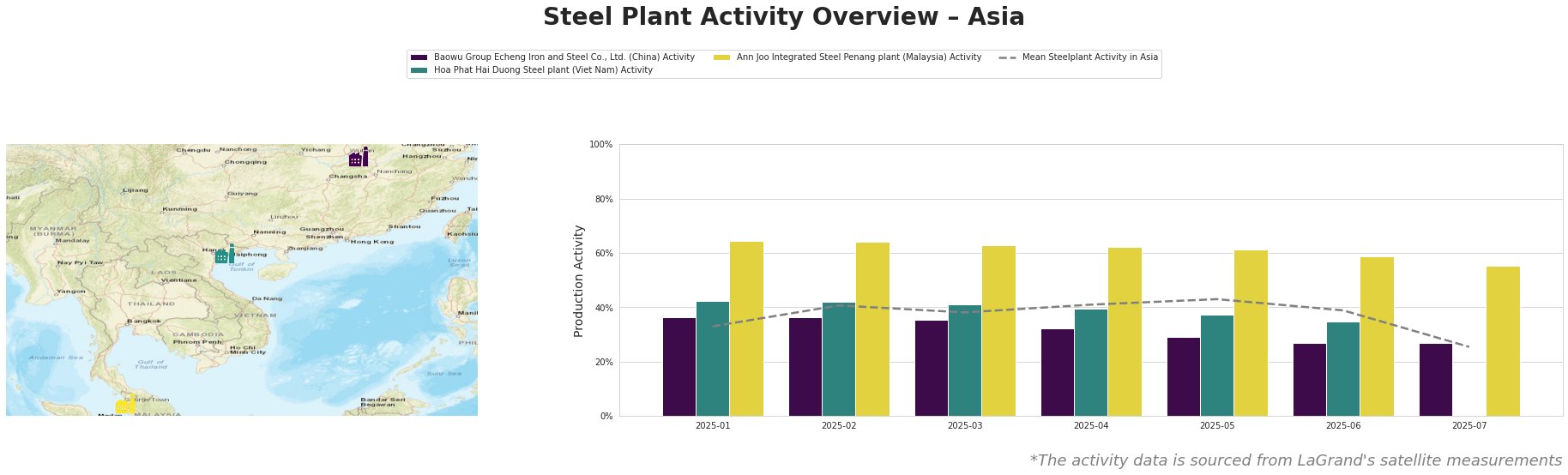

Overall, the mean steel plant activity in Asia has decreased significantly from a peak of 43% in May to 25% in July.

Baowu Group Echeng Iron and Steel Co., Ltd., a major Chinese producer with a 4.4 million tonne BOF-based crude steel capacity and a focus on finished rolled products like high-strength ring chain steel and alloy steel wire rods, has seen a consistent decline in activity levels from 36% in January/February to 27% in July. There is no explicit connection that can be established to the provided news articles, and therefore further analysis of local factors is required.

Hoa Phat Hai Duong Steel plant, a Vietnamese integrated steel plant (BF/BOF) with a 2.5 million tonne crude steel capacity, producing construction steel and hot rolled coil, displayed stable activity levels from January to March (42% and 41% respectively), followed by a gradual decline to 35% in June, and missing data in July. There is no explicit connection that can be established to the provided news articles, and therefore further analysis of local factors is required.

Ann Joo Integrated Steel Penang plant, a Malaysian integrated steel plant (BF/EAF) with a 0.5 million tonne crude steel capacity focused on crude and semi-finished products like pig iron and billets, exhibited consistently high activity levels compared to the regional average, starting at 64% in January/February but decreasing steadily to 55% in July. There is no explicit connection that can be established to the provided news articles, and therefore further analysis of local factors is required.

The decrease in the Asian mean steel plant activity level, coupled with maintenance shutdowns reported by Tata Steel and JSW Steel, suggests potential supply constraints.

Procurement Actions: Steel buyers should proactively engage with suppliers to confirm availability and delivery timelines, specifically for products sourced from regions impacted by maintenance. Due to the general negative sentiment, and lack of plant specific supply-certainty, diversifying supply sources to mitigate risk associated with potential disruptions is recommended. Analysts should closely monitor regional price trends, especially for products like hot-rolled coil and construction steel, which are key outputs of the affected plants.