From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: EU-US Trade Deal Impact and Plant Activity Decline

Asia’s steel market is facing downward pressure due to the potential ramifications of the EU-US trade deal, though direct impact on Asian plants cannot be clearly established based on provided news and activity data. Specifically, while the articles “Zolldeal mit den USA Planungssicherheit – aber zu einem hohen Preis,” “EUROFER on US-EU deal: Pressure on steel industry persists,” “EU steelmakers criticize trade agreement with the US over 50% steel tariffs,” “US and EU strike trade deal, imports from EU subjected to 15 percent tariff,” “EU-US deal places ‘huge burden’ on steel sector“, “The EU’US agreement places a “huge burden” on the steel sector,” and “EU-US deal puts ’huge burden’ on steel sector” detail concerns about the European steel industry following the trade agreement, no explicit connection to changes in Asian steel plant activity can be substantiated based on the provided information.

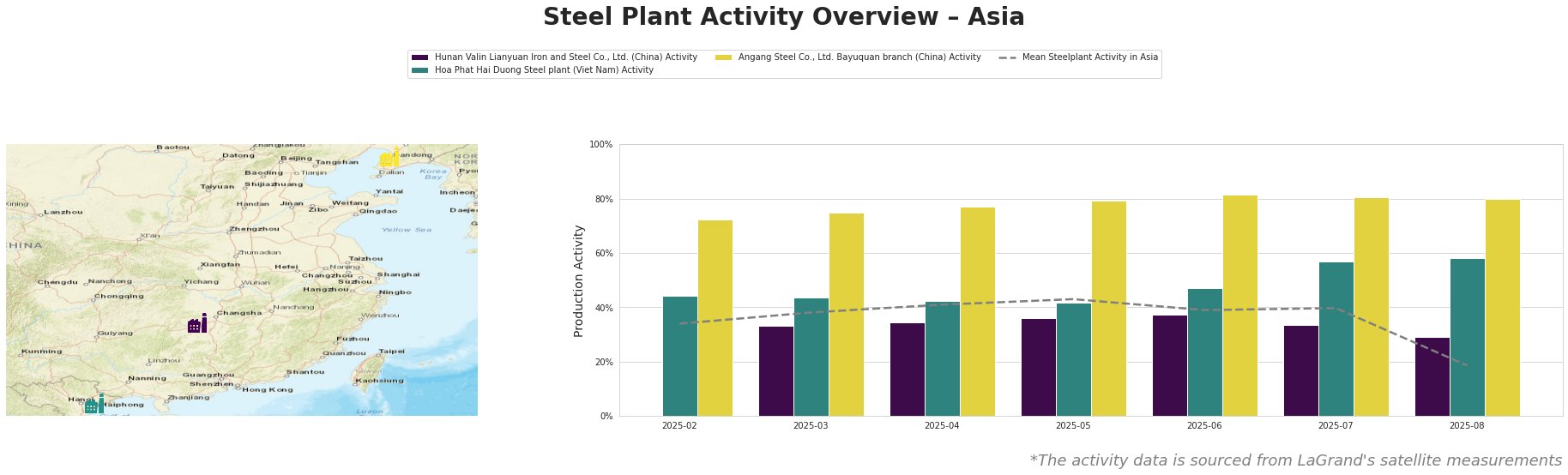

The mean steel plant activity in Asia increased from February (34%) to May (43%) 2025, and then decreased, reaching 19% in August 2025.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., an integrated BF/BOF steel plant in Hunan, China, producing 9,000 thousand tons of crude steel annually, exhibited an activity level consistently below the Asian mean. Its activity fluctuated slightly between March (33%) and June (37%) before experiencing a notable drop to 29% in August. No direct link between this decline and the news regarding the EU-US trade deal can be established.

Hoa Phat Hai Duong Steel plant, an integrated BF/BOF steel plant in Hai Duong, Viet Nam, producing 2,500 thousand tons of crude steel annually, shows activity levels above the Asian mean. Activity increased from February (44%) to July (57%) and remained high in August (58%). No direct link between this activity and the news regarding the EU-US trade deal can be established.

Angang Steel Co., Ltd. Bayuquan branch, an integrated BF/BOF steel plant in Liaoning, China, producing 6,500 thousand tons of crude steel annually, consistently operated at the highest activity level of the observed plants, well above the Asian mean. The plant’s activity peaked in June at 81% and remained high at 80% in July and August. No direct link between this sustained high activity and the news regarding the EU-US trade deal can be established.

Based on the sharp decline in mean steel plant activity, especially in August 2025, but without direct links to the provided EU-US trade deal news:

- Potential Supply Disruption: A significant decline in overall Asian steel production activity in August may indicate upcoming supply constraints.

- Recommended Procurement Action: Steel buyers should carefully monitor inventory levels and consider securing supply contracts, particularly for products sourced from regions exhibiting lower activity, such as Hunan Valin Lianyuan Iron and Steel Co., Ltd.