From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn: China’s Production Dip and Japanese Output Decline Signal Weak Demand

Asia’s steel market is facing increased downward pressure, primarily driven by production cuts in key regions. The “China’s crude steel production fell 7% in April, m-o-m” indicates a significant contraction, although “China’s crude steel output up 0.4 percent in Jan-Apr, drops 6.82 million in Apr” suggests some earlier resilience. These production changes contrast with the news that “World crude steel output up 0.3 percent in April,” but global numbers do not fully reflect the situation in Asia. This report will further examine the satellite-observed activity levels of key Asian steel plants.

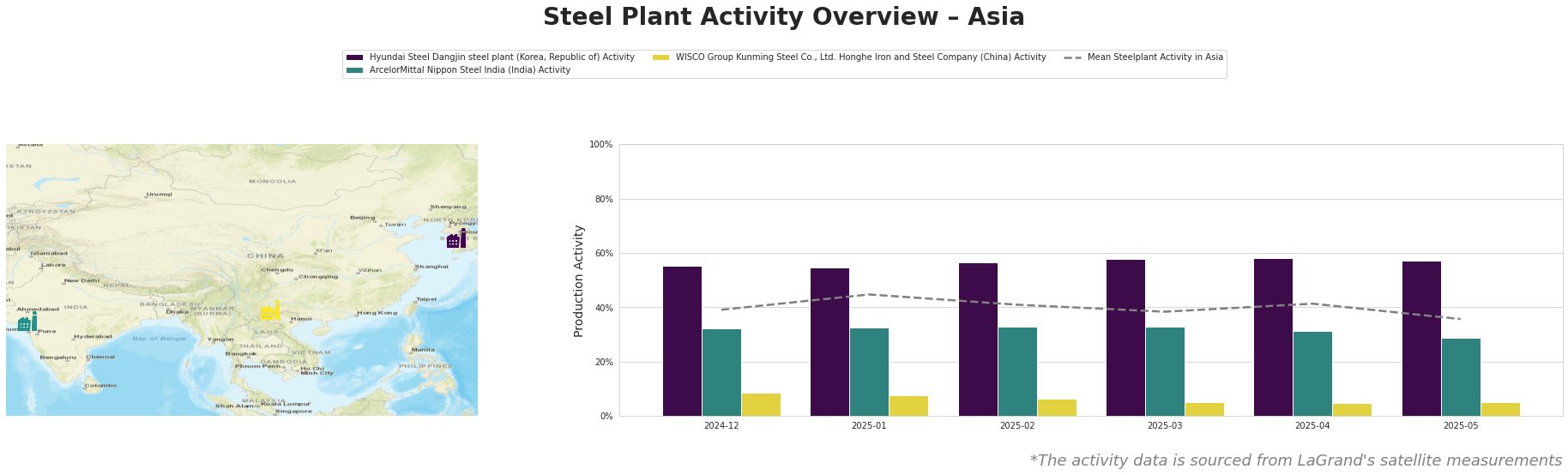

The mean steel plant activity in Asia has decreased from 45% in January to 36% in May, indicating a general downturn in activity across the region.

Hyundai Steel Dangjin steel plant (Korea, Republic of): This integrated steel plant, with a capacity of 16.6 million tonnes of crude steel and both BOF and EAF production routes, has maintained a relatively stable activity level, fluctuating between 55% and 58% throughout the observed period. The plant’s activity level is consistently above the mean for Asia. “Global crude steel production edges down 0.3% y-o-y in April” and “Global crude steel production decreased 0.3% year-on-year in April” mention South Korea’s overall production decrease of 2.5%. Although this report does not allow us to directly correlate this national-level news to specific plant activity, it suggests that Hyundai Steel’s relatively stable, high activity may be outperforming the national average.

ArcelorMittal Nippon Steel India (India): This plant, utilizing both BF and DRI routes with a crude steel capacity of 9.6 million tonnes, experienced a gradual decrease in activity from 33% in January to 29% in May. This decrease aligns with “Global crude steel production edges down 0.3% y-o-y in April” and “Global crude steel production decreased 0.3% year-on-year in April” which highlights India’s production increase of 5.6% in April driven by strong automotive demand. The decreasing plant activity contradicts the national trend.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company (China): This smaller, integrated BF/BOF plant with a capacity of 1.15 million tonnes has consistently low activity levels, ranging from 9% in December to 5% in recent months. This aligns with “China’s crude steel production fell 7% in April, m-o-m,” supporting the observed slowdown in Chinese steel production. This particular plant’s very low activity is well below the Asian average, suggesting potential operational or market-specific issues.

The news that “Japanese crude steel output down 6.4 percent in April” coupled with decreasing activity in some of the observed plants points to a broader weakening of demand in Asia.

Given the observed trends and cited news, here are actionable insights:

- Supply Disruptions: The sharp decrease in Chinese crude steel production, as reported in “China’s crude steel production fell 7% in April, m-o-m,” combined with persistently low activity at WISCO Group Kunming Steel, suggests potential disruptions in the supply of finished steel products, particularly bars, wire, and hot-rolled strip. Buyers reliant on these products should consider diversifying suppliers or securing inventory.

- Procurement Actions: Steel buyers, specifically those sourcing from India, need to monitor the divergence between national production increases (“Global crude steel production edges down 0.3% y-o-y in April” and “Global crude steel production decreased 0.3% year-on-year in April” noting India’s 5.6% rise) and decreasing activity at ArcelorMittal Nippon Steel India. It is important to assess potential risks associated with reliance on this plant due to a gradual decrease in activity from 33% in January to 29% in May. Consider alternative sources to mitigate potential supply constraints.

Overall, the Very Negative sentiment in the Asia steel market is justified by decreased production in key regions and declining activity at several observed steel plants. Procurement professionals should proactively mitigate risks by diversifying supply sources and carefully monitoring the production trends of their key suppliers.