From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn Amid Trade Uncertainty and Plant Activity Dip

Asia’s steel market is showing signs of downturn influenced by trade uncertainties and fluctuating plant activity. Observed declines at Shandong Iron and Steel Co., Ltd. Laiwu Branch coincide with concerns raised in “Stock market today: Dow, S&P 500, Nasdaq futures slide ahead of fresh inflation data, as Trump renews tariff threat” regarding renewed tariff threats, although a direct causal link cannot be conclusively established. However, the potential positive impact suggested by the news about the “Handelsstreit: Einigung mit China auf Abbau von Exportbeschränkungen” does not seem to have materialized in a noticeable activity increase across the region.

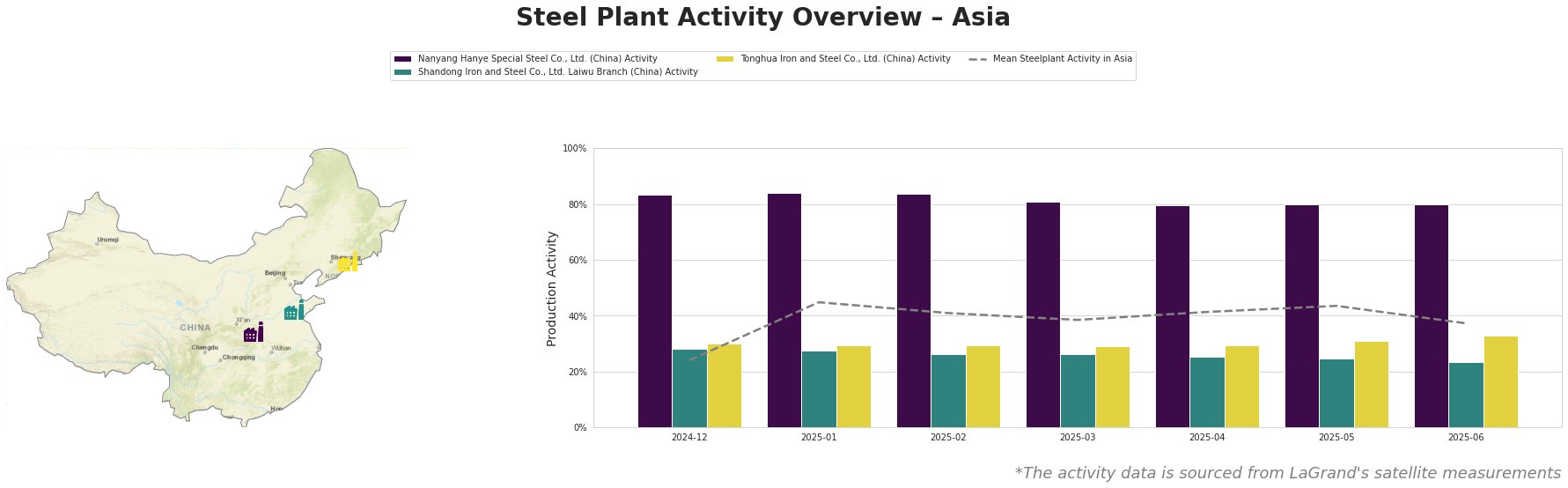

The mean steel plant activity in Asia peaked in January 2025 at 45.0%, declining to 37.0% by June 2025. Nanyang Hanye Special Steel Co., Ltd. consistently operated far above the mean, maintaining high activity levels around 80-84% throughout the observed period. Shandong Iron and Steel Co., Ltd. Laiwu Branch showed a steady decline from 28.0% in December 2024 to 23.0% in June 2025, consistently remaining below the regional mean. Tonghua Iron and Steel Co., Ltd. showed relatively stable activity, fluctuating between 29.0% and 33.0%, also generally below the mean. The most significant deviation from the mean is observed at Nanyang Hanye Special Steel Co., Ltd., but no direct link to the provided news articles can be explicitly established.

Nanyang Hanye Special Steel Co., Ltd., an integrated BF-BOF steel plant in Henan with a crude steel capacity of 2.588 million tonnes, specializing in medium-thick, special, and extra-thick steel plates, has maintained a consistently high activity level around 80% throughout the period. Despite the overall market uncertainties, its stable production suggests a strong, potentially vertically integrated supply chain, aligning with its access to iron ore and met coal through Longcheng Special Materials Co. Ltd. and Henan Longcheng Group Co. Ltd., respectively. There is no clear correlation between its activity and the provided news.

Shandong Iron and Steel Co., Ltd. Laiwu Branch, another integrated BF-BOF/EAF steel plant in Shandong with a larger crude steel capacity of 6.94 million tonnes, producing section steel, bars, special steel, and plate and strip, experienced a decline in activity from 28.0% in December 2024 to 23.0% in June 2025. This decline might be influenced by the renewed tariff threats reported in “Stock market today: Dow, S&P 500, Nasdaq futures slide ahead of fresh inflation data, as Trump renews tariff threat,” potentially impacting its export prospects and domestic demand.

Tonghua Iron and Steel Co., Ltd., a BF-BOF integrated steel plant in Jilin with a crude steel capacity of 4.6 million tonnes, produces plates, building materials, profiles, pipes, and special steel, catering to diverse sectors like automotive, construction, energy, and transport. Its activity levels have remained relatively stable between 29% and 33% during the observed period. This stability could reflect a diversified product portfolio that mitigates the impact of specific market fluctuations. No explicit link to the provided news articles can be established.

The observed decline in activity at Shandong Iron and Steel Co., Ltd. Laiwu Branch, coupled with the overall negative market sentiment reflected in “Marktbericht: US-Handelsdeal mit China bringt keinen Impuls,” suggests potential supply constraints for section steel, bars, special steel, plate, and strip.

Recommended Procurement Action: Steel buyers should diversify their supply base, particularly for products sourced from Shandong Iron and Steel Co., Ltd. Laiwu Branch. Given the trade uncertainties highlighted in “Stock market today: Dow, S&P 500, Nasdaq futures slide ahead of fresh inflation data, as Trump renews tariff threat,” explore securing supply contracts with plants less exposed to potential tariff impacts or with robust domestic demand, such as Nanyang Hanye Special Steel Co., Ltd., which has demonstrated consistently high activity. Continuously monitor market dynamics and news related to trade policies to adapt procurement strategies proactively.