From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn Amid Trade Barriers, Plant Activity Declines

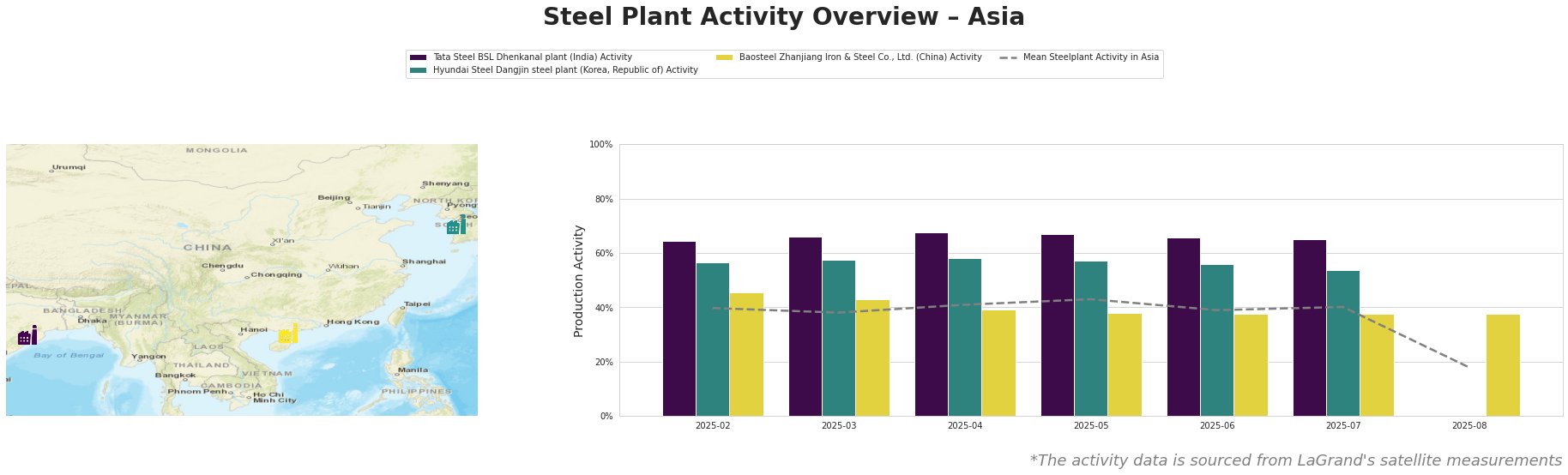

Asia’s steel market is exhibiting a negative sentiment due to increasing trade barriers and declining plant activity. The trend aligns with news regarding rising protectionism with the “Thailand launches circumvention investigations into wire rod and cold rolled steel from China” showing increased trade pressure. However, no direct link to production data could be established. Activity shifts have been observed via satellite.

Mean steel plant activity across Asia shows a notable decline, plummeting to 18% in August from a range of 38% to 43% in the preceding months. Tata Steel BSL Dhenkanal plant in India maintained a relatively stable activity level, hovering between 65% and 67% from February to July. Hyundai Steel Dangjin plant in South Korea also showed consistent activity, ranging from 54% to 58% over the same period. Baosteel Zhanjiang in China exhibited a slight decline from 45% in February to a stable 38% from May onward. The significant drop in average activity in August is driven by missing values for Tata and Hyundai.

Tata Steel BSL Dhenkanal plant, an integrated steel plant in Odisha, India, utilizes both BF and DRI processes with a crude steel capacity of 5.6 million tonnes. Satellite data indicates a stable activity level from February to July, ranging from 65% to 67%. Activity data for August is missing. There is currently no identifiable correlation to developments covered in “EU anti-dumping duties: Japan is under attack, Egypt has received relief“, “Thailand launches circumvention investigations into wire rod and cold rolled steel from China” or “The EC has reduced anti-dumping duties on hot-rolled steel for Ezz Steel and Nippon Steel“.

Hyundai Steel Dangjin plant in South Korea, with a crude steel capacity of 16.6 million tonnes, primarily uses BF and BOF processes, producing both semi-finished and finished rolled products. The plant’s activity remained relatively stable between 54% and 58% from February to July. August Activity data is missing. There is currently no identifiable correlation to developments covered in “EU anti-dumping duties: Japan is under attack, Egypt has received relief”, “Thailand launches circumvention investigations into wire rod and cold rolled steel from China” or “The EC has reduced anti-dumping duties on hot-rolled steel for Ezz Steel and Nippon Steel”.

Baosteel Zhanjiang Iron & Steel, a major integrated steel producer in Guangdong, China, relies on BF and BOF processes with a crude steel capacity of 12.5 million tonnes. The plant’s activity experienced a slight decline from 45% in February to a consistent 38% from May through August. Given that “Thailand launches circumvention investigations into wire rod and cold rolled steel from China” specifically names Baoshan Iron & Steel Co. in relation to circumvention of anti-dumping duties on cold rolled steel sheet products, there is a possibility that this situation contributed to the slight production decrease, but no definitive correlation can be established.

The final duties imposed following the publication of “EU anti-dumping duties: Japan is under attack, Egypt has received relief” are expected to take effect in October, specifically impacting Japanese steel exporters like Nippon Steel (30.4% duty) and Tokyo Steel (6.9% duty) shipping into the EU. In preparation, steel buyers should immediately diversify their sourcing options away from Japanese suppliers to mitigate potential price increases and supply disruptions once the duties are enforced in October. This is especially relevant for hot-rolled steel. Given the “Thailand launches circumvention investigations into wire rod and cold rolled steel from China”, Procurement professionals should closely monitor developments related to Chinese steel exports, particularly wire rod and cold rolled steel. Although no direct production decrease can be established due to the announcement itself, procurement teams should explore alternative sources for these products to reduce risks associated with potential trade restrictions and duties. The sharp drop in overall plant activity in August, combined with trade action reports, signals a potential supply contraction. Buyers should immediately strengthen relationships with existing suppliers outside of Japan and China and explore opportunities to secure long-term contracts to ensure supply stability during this period of uncertainty.