From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn Amid Trade Actions and Production Slowdowns

Asia’s steel market faces increasing headwinds due to trade restrictions and production adjustments. The recent imposition of anti-dumping duties by Vietnam on hot-rolled steel from China, as reported in “Vietnam has imposed definitive anti-dumping duties on hot-rolled steel products from China,” may contribute to observed activity changes. Satellite data indicates an overall downturn in steel plant activity across Asia. However, no direct causal link can be established with the China’s extension of duties (“China extends AD duties on stainless steel for another five years“) given that the observed plants are not specialized on Stainless Steel.

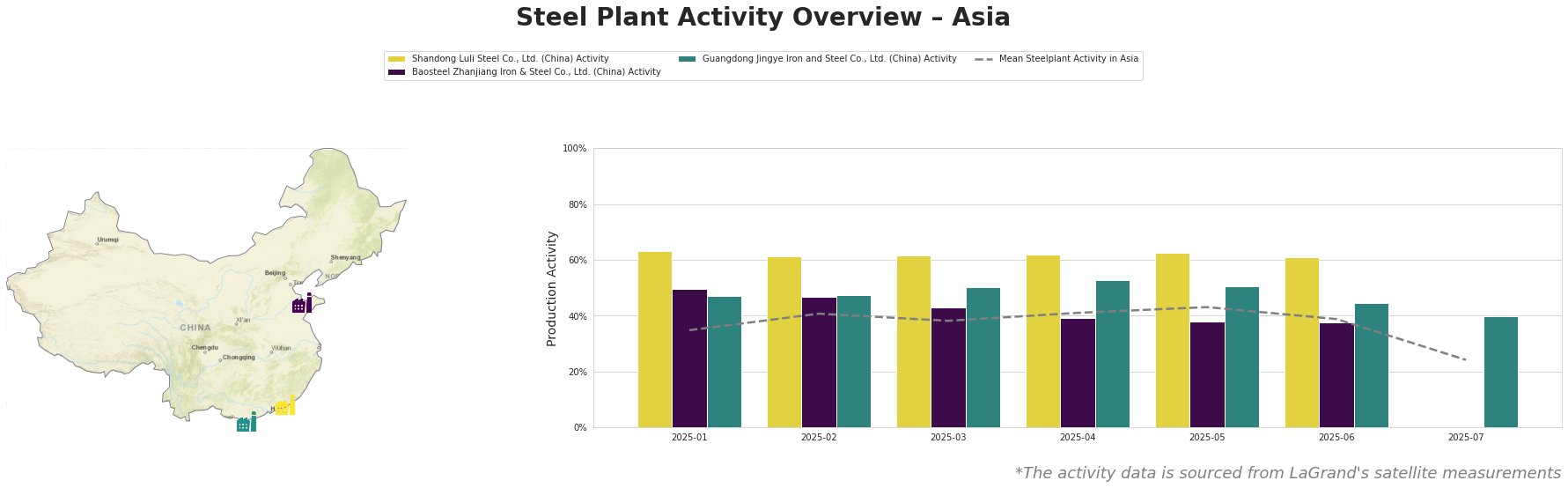

The average steel plant activity in Asia shows a declining trend, dropping significantly to 24% in July. This contrasts with levels between 35% and 43% observed in the first half of the year.

Shandong Luli Steel Co., Ltd., a Shandong-based integrated steel plant with a 1.4 million tonne BOF capacity, maintained a relatively stable activity level around 62% throughout the observed period until June 2025. However, no activity data is available for July, and no direct connection can be established with any of the news articles.

Baosteel Zhanjiang Iron & Steel Co., Ltd., located in Guangdong, possesses a substantial 12.5 million tonne BOF capacity and a 1 million tonne Hydrogen based shaft furnace. Its activity gradually decreased from 50% in January to 38% in June, with no data available for July. No direct connection can be established with any of the news articles.

Guangdong Jingye Iron and Steel Co., Ltd., another Guangdong-based integrated plant with a 1.2 million tonne BOF capacity, showed fluctuating activity between 45% and 53% during the first half of the year, dropping to 40% in July. The decline in July coincides with the Vietnam’s anti-dumping duties, as reported in “Vietnam has imposed definitive anti-dumping duties on hot-rolled steel products from China,” which might indirectly affect Guangdong Jingye Iron and Steel Co., Ltd., because of the location in Guangdong.

The observed drop in activity levels, particularly at Guangdong Jingye Iron and Steel Co., Ltd., combined with the Vietnam’s anti-dumping duties on Chinese hot-rolled steel, may indicate potential supply disruptions in the hot-rolled steel market. For steel buyers sourcing hot-rolled steel from China, particularly from Guangdong-based producers, it is advisable to:

- Diversify sourcing: Explore alternative suppliers outside of China, particularly in regions not subject to anti-dumping duties from Vietnam, to mitigate potential supply shortfalls.

- Monitor price volatility: Closely track price fluctuations in the hot-rolled steel market and consider hedging strategies to manage price risks.

- Assess inventory levels: Evaluate current inventory levels and adjust procurement plans to ensure adequate supply in the face of potential disruptions.