From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Exports Surge Amidst Fluctuating Iron Ore and Coal Imports; Mixed Plant Activity Signals Volatility

Asia’s steel market presents a mixed picture driven by increased Chinese exports and fluctuating raw material imports. According to “China increased steel exports by 10% y/y in January-August,” Chinese steel exports have risen significantly, while “China’s iron ore imports down 1.6 percent in January-August” indicates a complex import dynamic influenced by changing demand and pricing. While no direct link can be established between these news and plant activity data, the rise in exports might be partially supported by domestic production levels.

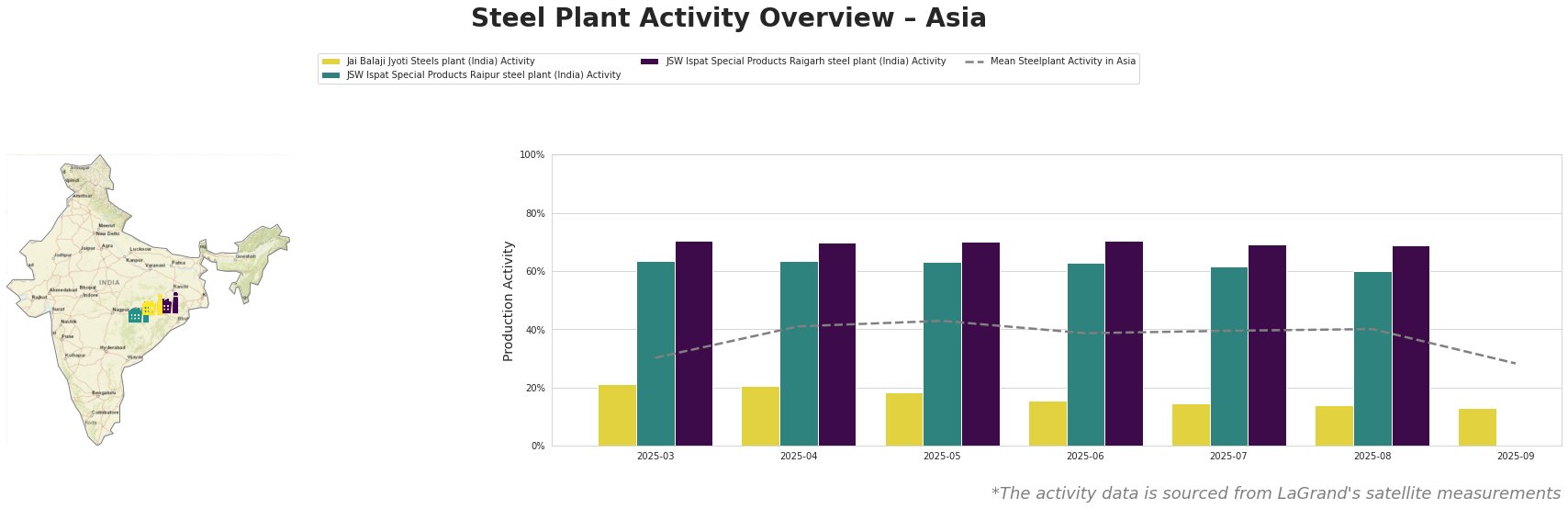

Overall steel plant activity in Asia averaged between 39% and 43% from April to August 2025, before experiencing a significant drop to 28% in September. The JSW Ispat Special Products Raigarh steel plant (India) consistently operated at a high activity level (69-71%), while the Jai Balaji Jyoti Steels plant (India) exhibited significantly lower activity levels that dropped steadily from 21% in March to 13% in September. The JSW Ispat Special Products Raipur steel plant (India) showed moderate activity levels compared to other plants, hovering between 60 and 64 percent.

Jai Balaji Jyoti Steels plant, a DRI- and EAF-based plant in Odisha (India) with a crude steel capacity of 92 ttpa, has experienced a steady decline in activity from 21% in March to 13% in September. This downward trend does not appear to be directly linked to any of the provided news articles, suggesting possible plant-specific or localized market factors influencing production.

JSW Ispat Special Products Raipur steel plant, Chhattisgarh (India), utilizes DRI and EAF technologies with a 1500 ttpa crude steel capacity. Activity ranged between 60 and 64 percent from March to August, showing a slight decrease to 60% in August. The activity levels do not correlate directly with the trends reported in “China’s coal imports decrease by 12.2 percent in January-August 2025” or “Prices for iron ore rose in early September amid expectations of a recovery in demand” indicating that this plant’s activity may be driven by other factors than Chinese material demand.

JSW Ispat Special Products Raigarh steel plant, also located in Chhattisgarh (India), demonstrates consistently high activity around 70%. This integrated BF/DRI/EAF plant, boasting a 1500 ttpa crude steel capacity, shows stable production, potentially benefitting from its diversified production process and captive power plant. No clear correlation can be established between the plant’s stable high production levels and the provided news.

The rise in Chinese steel exports, as highlighted in “China increased steel exports by 10% y/y in January-August,” coupled with volatile raw material imports as detailed in “China’s iron ore imports down 1.6 percent in January-August” and “China’s coal imports decrease by 12.2 percent in January-August 2025“, suggests potential supply chain vulnerabilities. The significant drop in overall steel plant activity in Asia during September warrants caution.

Procurement Actions:

* Steel Buyers: Given the increased Chinese exports, explore diversifying steel sourcing options outside of China to mitigate potential supply disruptions, especially focusing on regions where plant activity remains robust (e.g., plants similar to JSW Ispat Special Products Raigarh steel plant). Closely monitor the coal and iron ore supply chains to China for advanced warning of production capacity adjustments.

* Market Analysts: Focus on tracking localized Indian steel production indicators, in addition to the Chinese market, to gain a more granular understanding of potential regional supply fluctuations.