From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: EV Slowdown & Offshore Wind Challenges Impact Demand, Plant Activity Dips

Asia’s steel market faces potential headwinds from a slowing EV sector and challenges in offshore wind projects, impacting demand and subsequently, production. The recent activity shifts at several key steel plants, as observed via satellite, may be indirectly linked to global trends discussed in articles such as “Why the US auto industry is bracing for an EV winter” and “Offshore-Krise: Dreht sich der Wind bald?“. However, a direct connection to these news items cannot be definitively established for all observed plant activity levels.

Measured Activity Overview

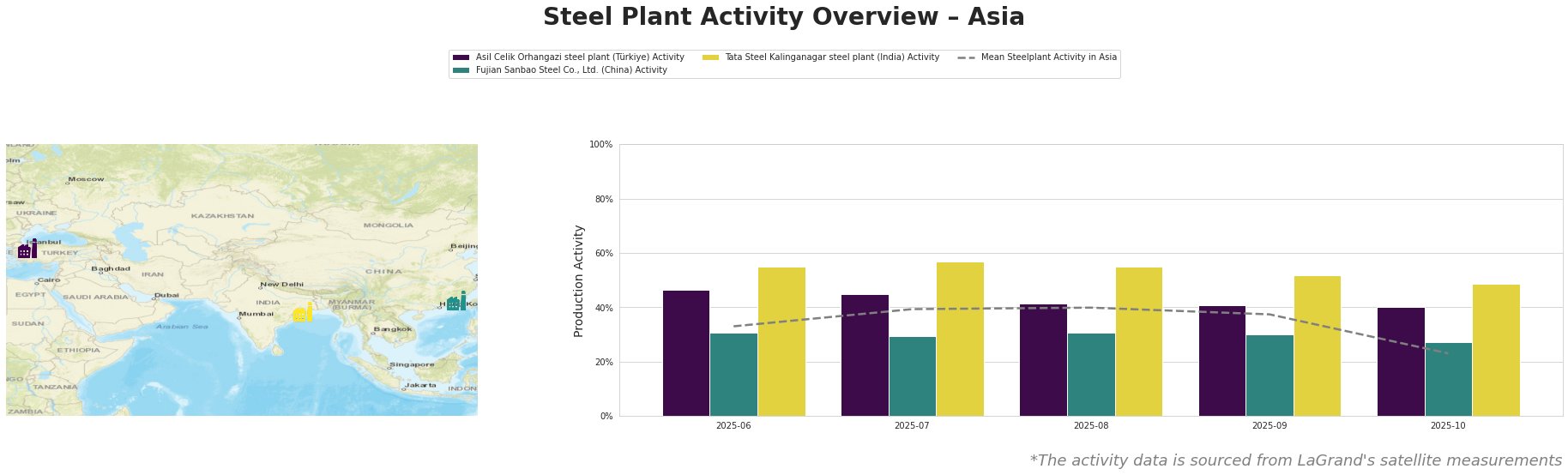

The average steel plant activity across the observed Asian plants saw a significant drop in October, falling to 23% from a high of 40% in August.

Asil Celik Orhangazi steel plant (Türkiye), an EAF-based plant producing 550 ttpa of crude steel with a focus on automotive and energy sectors, showed a moderate decline in activity from 46% in June to 40% in October. While the plant’s end-user sectors include automotive, aligning with the themes of “Why the US auto industry is bracing for an EV winter” and “Auto Industry Faces ‘EV Winter’ Amid Policy Shifts and Supply Chain Woes“, the magnitude of the decrease doesn’t suggest an overwhelming impact. A more precise correlation cannot be established based on the available data.

Fujian Sanbao Steel Co., Ltd. (China), an integrated BF-BOF steel plant with a capacity of 4620 ttpa of crude steel, primarily produces finished rolled and semi-finished products, saw a gradual decrease in activity from 31% in June to 27% in October. It is difficult to establish a connection between this decline and specific news events from the provided articles.

Tata Steel Kalinganagar steel plant (India), an integrated BF-BOF steel plant with a capacity of 3000 ttpa, experienced a decrease in activity from 55% in June to 49% in October. The plant supplies primarily the automotive sector. The article “Why the US auto industry is bracing for an EV winter” notes a slowdown in EV sales. Given Tata Steel Kalinganagar’s automotive focus, this may indicate a demand slowdown, but no explicit causal relationship can be established.

Evaluated Market Implications

The observed decline in steel plant activity in Asia, combined with the challenges highlighted in “Offshore-Krise: Dreht sich der Wind bald?” and “Why the US auto industry is bracing for an EV winter,” suggest potential near-term supply disruptions, especially for steel grades used in the automotive and offshore wind sectors.

Recommended Procurement Actions:

- Steel Buyers Focused on Automotive: Given the potential slowdown indicated by activity at Tata Steel Kalinganagar (India) and the broader EV market concerns, consider diversifying suppliers and securing flexible contracts to mitigate potential price volatility, as demand shifts toward hybrid models per “Why the US auto industry is bracing for an EV winter“.

- Steel Buyers Focused on Offshore Wind: Monitor policy developments and project viability in the offshore wind sector closely, per “Offshore-Krise: Dreht sich der Wind bald?“. Explore alternative steel supply options for these projects.

Disclaimer: This analysis is based solely on the provided data and news articles. The recommendations are intended as guidance and do not guarantee specific market outcomes.