From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: EV Sales Surge Fuels Optimism Despite Activity Dip in July

Asia’s steel market remains very positive, driven by strong automotive demand. The surge in electric vehicle (EV) sales, highlighted in “Porsche reports electrified vehicle sales surge in H1 2025” and “Volkswagen verkauft fast 50 Prozent mehr E-Autos,” points to continued demand for high-strength steel. Similarly, “CAAM: China’s auto vehicle sales up 11.4 percent in H1 2025” indicates a robust domestic market. While plant activity data indicates an overall dip in July, no immediate correlation to specific production cuts could be established based on the provided news articles.

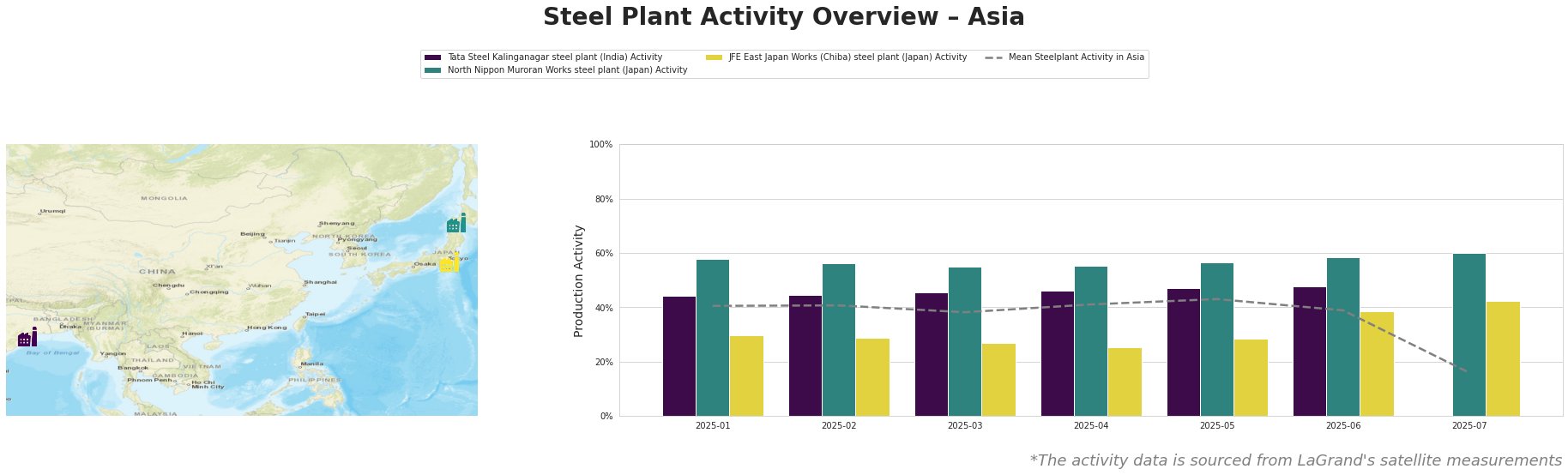

Across Asia, the mean steel plant activity in Asia has been quite volatile in the first half of 2025, ranging from 38% in March to 43% in May, before dropping significantly to 16% in July.

The Tata Steel Kalinganagar plant in India, an integrated BF-BOF steel plant with 3000 ttpa crude steel capacity primarily serving the automotive sector, has shown a steady increase in activity from January to June, rising from 44% to 48%. No data is available for July. This upward trend potentially reflects the growing automotive demand in Asia, but no specific connection to the provided news articles could be explicitly established.

North Nippon’s Muroran Works, a 2598 ttpa capacity plant in Japan utilizing both BF-BOF and EAF technologies and supporting automotive with bars and wires, has shown relative stability in activity levels, ranging from 55% to 58% between January and June, then peaking at 60% in July. This stability, exceeding the mean Asian activity level, could indicate consistent demand for its products.

JFE East Japan Works (Chiba), a major integrated steel plant with 4500 ttpa capacity using BF-BOF technology producing sheets, plates and stainless steel for building/infrastructure, automotive and steel packaging, started the year with a low activity level of 30% in January, rising to 39% in June, and then 42% in July. This increase does not appear to directly correlate with the EV-driven automotive demand. The considerable drop in Asian mean steel plant activity in July does not appear to be significantly influenced by the JFE activity data.

The increasing sales of commercial vehicles in China, as reported in “Commercial vehicle sales in China up 2.6 percent in H1 2025,” may also contribute to the demand for steel, though a direct link to the individual plant activities can’t be established based on the available data.

Given the strong automotive demand, particularly for EVs, and the observed stability in activity at North Nippon Muroran and activity increase in JFE East Japan Works (Chiba), steel buyers should:

- Monitor JFE East Japan Works (Chiba) production trends: Actively monitor the production of JFE East Japan Works (Chiba), as that plant plays an important role in supplying the automotive sector. July’s increase to 42% may be an indication of increasing automotive demand.

- Prioritize securing supply contracts: Given strong automotive demand and a potential slowdown, secure long-term contracts to mitigate the risk of supply shortages and price increases, particularly for high-strength steel used in EV production.