From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: EU Quota Impacts Analyzed Amidst Varying Plant Activity

Asia’s steel market is showing signs of adjustment as EU import quotas shift trade dynamics. The satellite-observed activity levels at key Asian steel plants offer insights into these adjustments, although direct connections to the EU quota news are limited. The article “EU steel quotas reflect shifting trade dynamics after US tariffs” and “EU steel quotas reflect the change in trade dynamics after the introduction of US tariffs” suggest a complex interplay of factors influencing trade patterns. The report “The EU is massively exhausting steel quotas: Turkey, China and Vietnam are ahead” confirms significant exhaustion of steel import quotas into the EU since the new quota period began on July 1. Direct linkage between quota exhaustion and observed plant activity is difficult to establish due to a lack of specific product breakdowns in activity levels.

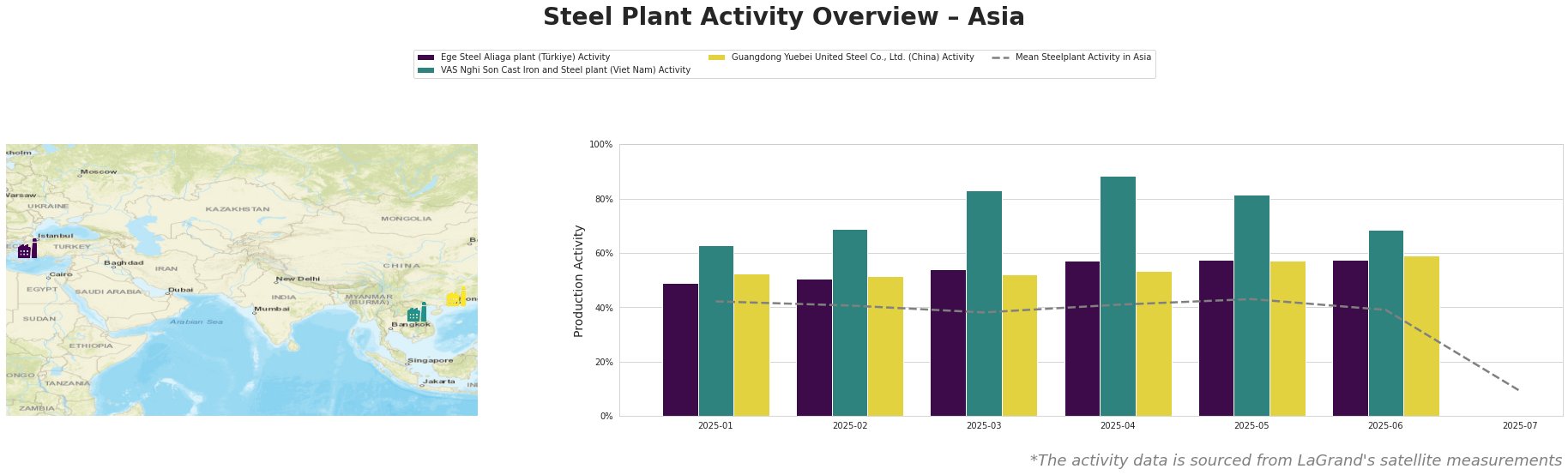

The mean steel plant activity in Asia saw a considerable drop to 9% in July, after hovering around 40% for the first half of the year. The VAS Nghi Son plant in Vietnam showed peak activity levels early in the year.

Ege Steel Aliaga plant (Türkiye): Located in İzmir, Turkey, this plant has a crude steel production capacity of 2 million tonnes per annum (ttpa) using electric arc furnaces (EAF). It produces semi-finished and finished rolled products, including rebar and wire rod. Activity at Ege Steel Aliaga remained relatively stable from January to June, peaking at 58% in May and June. This stability does not directly correlate with the quota exhaustion reports as highlighted in “The EU is massively exhausting steel quotas: Turkey, China and Vietnam are ahead,” although the plant’s product focus (rebar, wire rod) aligns with some of the affected quota categories. No direct relationship between the reports on EU quota exhaustion and Ege Steel plant activity can be clearly established based on the provided information.

VAS Nghi Son Cast Iron and Steel plant (Viet Nam): Situated in Thanh Hoa, Vietnam, this plant has a crude steel capacity of 3.15 million ttpa, relying on EAF technology. Its product range includes billet, rebar, and wire rod. The VAS Nghi Son plant demonstrated high activity levels, peaking at 88% in April, before experiencing a notable decrease to 69% by June. The decrease in June may be linked to the rapid exhaustion of EU quotas reported in “A number of countries have already exceeded their steel import quotas to the EU for Q3“, where Vietnam exceeded its quota for metal-coated and organic-coated sheets. The steep decline in activity in July cannot be further explained.

Guangdong Yuebei United Steel Co., Ltd. (China): This plant, located in Guangdong, China, possesses an iron production capacity of 800,000 ttpa utilizing a blast furnace (BF) process and EAF. It specializes in finished rolled products, particularly rebar, catering to the building and infrastructure sectors. Activity at Guangdong Yuebei United Steel showed a slight increase from January to June, reaching 59%. The news “Most EU steel import quotas are almost exhausted by the end of the second quarter” and “Most EU steel import quotas nearly exhausted as Q2 ends” reported China using up its quota for long products and light profiles which could partially explain the upwards trend. The significant drop in mean activity across all plants is not reflected in the activity of the Guangdong Yuebei plant.

Evaluated Market Implications:

The exhaustion of EU quotas, as detailed in multiple news articles, coupled with the observed fluctuations in steel plant activity levels, suggests potential supply disruptions, particularly for rebar and wire rod.

Recommended Procurement Actions:

* Diversify supply sources: Steel buyers should proactively explore alternative suppliers outside of Turkey, Vietnam and China to mitigate risks associated with potential quota restrictions and reduced production capacities suggested by the July decline in mean activity.

* Monitor quota utilization rates: Closely track EU quota utilization rates for specific steel products and countries, as detailed in the news articles, to anticipate potential supply constraints and adjust procurement strategies accordingly. Pay close attention to “EU steel quotas reflect shifting trade dynamics after US tariffs”.

* Assess alternative product specifications: Procurement professionals should evaluate the feasibility of using alternative steel product specifications or materials to reduce reliance on products subject to quota limitations, based on the information on the type of steel that each plant produces.

* Factor in transit times: Consider increased transit times and potential delays due to heightened customs scrutiny and import restrictions when planning steel procurement, especially when sourcing from countries nearing or exceeding their EU quotas.