From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Downturn: Demand Weakness and Production Cuts Signal Further Price Declines

Asia’s steel market faces significant headwinds, with weakening demand and production adjustments across the region. The situation in Asia mirrors concerns highlighted in the article “Assofermet Acciai: September starts with weak demand for Italian steel, and CBAM and US tariffs add to uncertainty,” albeit with different drivers. While that article focuses on European uncertainty related to CBAM and US tariffs, the underlying theme of weak demand and potential oversupply is mirrored in Asia. Satellite data reveals activity reductions in key Asian steel plants, potentially reflecting the conditions described in the article, however, no direct link can be established.

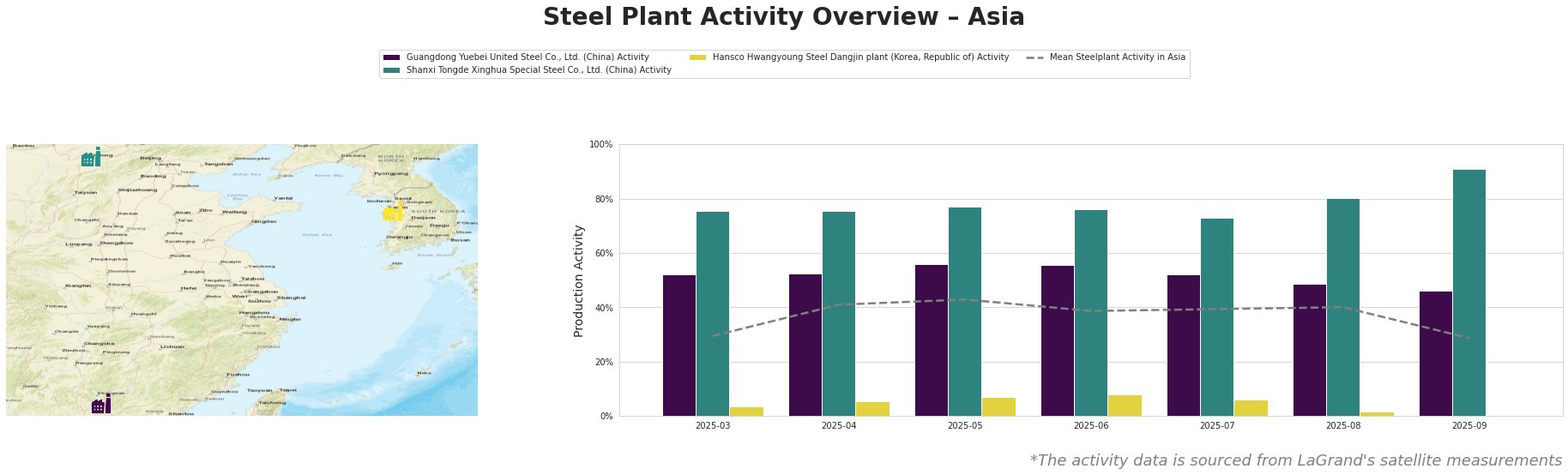

The average steel plant activity across the observed Asian plants shows a clear decline, dropping from 40% in August to 29% in September, indicating a broad slowdown.

Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant producing rebar for the building and infrastructure sectors, saw its activity decrease from 56% in June to 46% in September. This decrease aligns with the weak construction sector conditions mentioned in “Assofermet Acciai: September starts with weak demand for Italian steel, and CBAM and US tariffs add to uncertainty” reflecting potential reduced demand for rebar.

Shanxi Tongde Xinghua Special Steel Co., Ltd., another integrated steel plant producing rebar, demonstrated a notable increase in activity, rising from 80% in August to 91% in September. This trend diverges from the overall market sentiment. No clear connection to the news articles can be established.

Hansco Hwangyoung Steel Dangjin plant, an EAF-based plant producing billet and rebar, experienced a dramatic activity drop, plummeting from 8% in June to 0% in September. The near cessation of activity suggests potential production halts or significant maintenance. While the Assofermet Acciai articles discuss weak demand, no specific link can be made between these articles and the Dangjin plant’s activity.

The observed decline in average steel plant activity in Asia, particularly at Guangdong Yuebei United Steel and Hansco Hwangyoung Steel Dangjin plant, suggests a weakening demand environment. The contrasting increase in activity at Shanxi Tongde Xinghua Special Steel warrants further investigation to ascertain the specific factors driving its production.

Market Implications & Procurement Actions:

Given the overall negative market sentiment and declining plant activity, steel buyers should:

- Prioritize short-term contracts: The uncertainty in demand suggests that securing longer-term contracts at current prices carries significant risk. Focus on shorter-term agreements to capitalize on potential price declines.

- Monitor Guangdong Yuebei United Steel Co., Ltd. output: The observed decline in activity at this plant, coupled with the broader weakness in the construction sector, suggests a potential indicator for broader rebar demand and pricing trends.

- Investigate Hansco Hwangyoung Steel Dangjin plant’s downtime: Buyers reliant on this plant for billet and rebar should investigate the reasons behind the near-complete production halt and explore alternative supply sources to mitigate potential disruptions.