From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Downturn: China Production Cuts Deepen Uncertainty

The Asian steel market faces continued downward pressure, primarily driven by reduced Chinese production. The situation is reflected in the news articles “China cut steel production to a four-year low in October” and “China reduced steel production by 12.1%,” and the satellite observations confirm this trend with a significant drop in overall plant activity. While the Klöckner article does not describe activity changes in Asia directly, it illustrates the wider context of price pressure affecting steel businesses. A direct relationship between Klöckner’s Q3 shipments and the plant activity data cannot be established based on the provided information. The article “Asian steel market to remain under pressure in Q4 – S&P Global” provides a key overall context for this analysis.

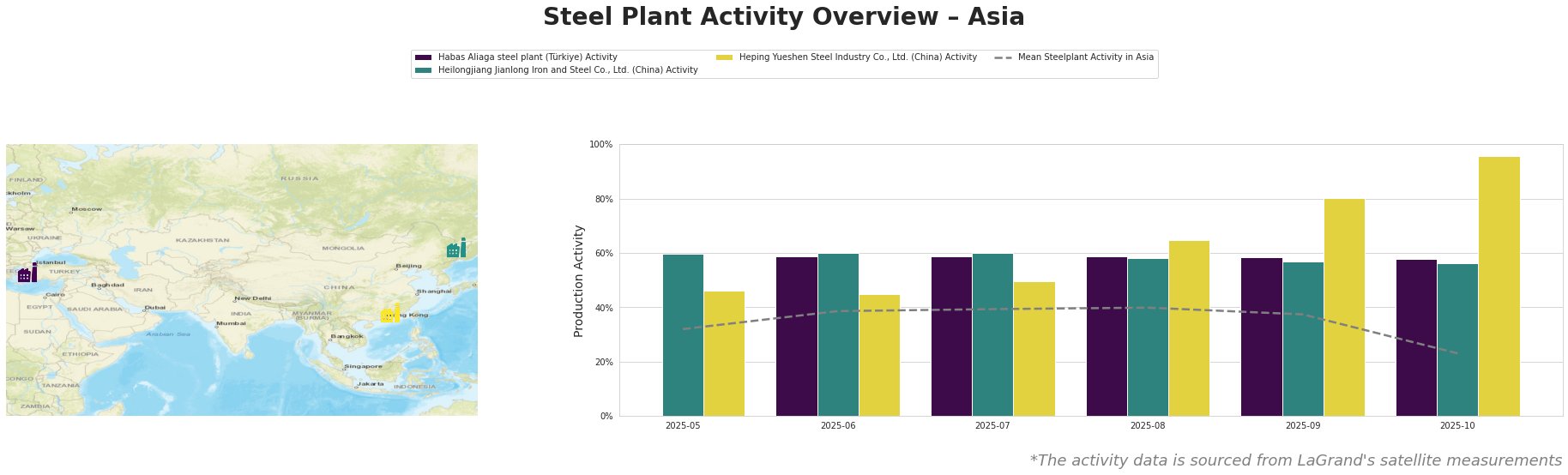

The mean steel plant activity in Asia decreased sharply in October 2025 to 23.0%, a significant drop from 37.0% in September and a high of 40.0% in August. Habas Aliaga steel plant (Türkiye) activity remained relatively stable at around 59%, slightly below the Asian average in the recent months. Heilongjiang Jianlong Iron and Steel Co., Ltd. (China) activity also remained relatively stable over the observed months but saw a slight drop to 56.0% in October. Heping Yueshen Steel Industry Co., Ltd. (China) activity sharply increased to 96.0% in October.

Habas Aliaga steel plant a Turkish steel plant using EAF technology with a crude steel capacity of 4.5 million tonnes per annum, showed stable activity at around 59% over the last months, indicating consistent production. No explicit connection between Habas Aliaga’s activity and the provided news articles can be established.

Heilongjiang Jianlong Iron and Steel Co., Ltd., a Chinese integrated steel plant using BF/BOF technology with a crude steel capacity of 2 million tonnes per annum, experienced a slight decline in activity to 56.0% in October. This decline aligns with the broader trend of production cuts in China reported in “China cut steel production to a four-year low in October” and “China reduced steel production by 12.1%,” reflecting the impact of weakening domestic consumption and government pressure on production discipline.

Heping Yueshen Steel Industry Co., Ltd., a Chinese steel plant using EAF technology with a crude steel capacity of 1.4 million tonnes per annum, exhibits a contrasting trend, with activity levels reaching 96.0% in October, significantly above the Asian average. The increase cannot be directly linked to any news article. This might be explained with focus on niche products, as the plant produces mainly rebar with electric arc furnaces.

The decreased mean steel plant activity in Asia, combined with news of production cuts in China, indicates potential supply disruptions, particularly from integrated mills using BF/BOF technology. Steel buyers should prioritize diversifying their supply base and securing supply agreements with plants outside of China where possible, particularly those using EAF technology, to mitigate risks associated with potential production cuts in China. Given Heping Yueshen Steel Industry Co., Ltd.’s increased activity, procurement professionals seeking rebar may explore the company as a potential supplier. Buyers dependent on Chinese steel should closely monitor production announcements and inventory levels.