From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Coking Coal Imports Rise Amidst Overall Production Declines

Asia’s steel market presents a mixed picture. While China’s decreasing steel production and iron ore output are evident, increased coking coal imports signal continued, albeit potentially shifting, demand. According to the news articles, “China reduced iron ore production by 3.2% y/y in January-October” and “Global steel production fell by 5.9% y/y in October” indicate a regional slowdown, but the simultaneous increase in “China increased its imports of coking coal by 6.4% y/y in October” suggests ongoing steel production, potentially relying more on imported raw materials. Satellite data provides additional context, but direct links to these news events are not immediately discernible for all plants.

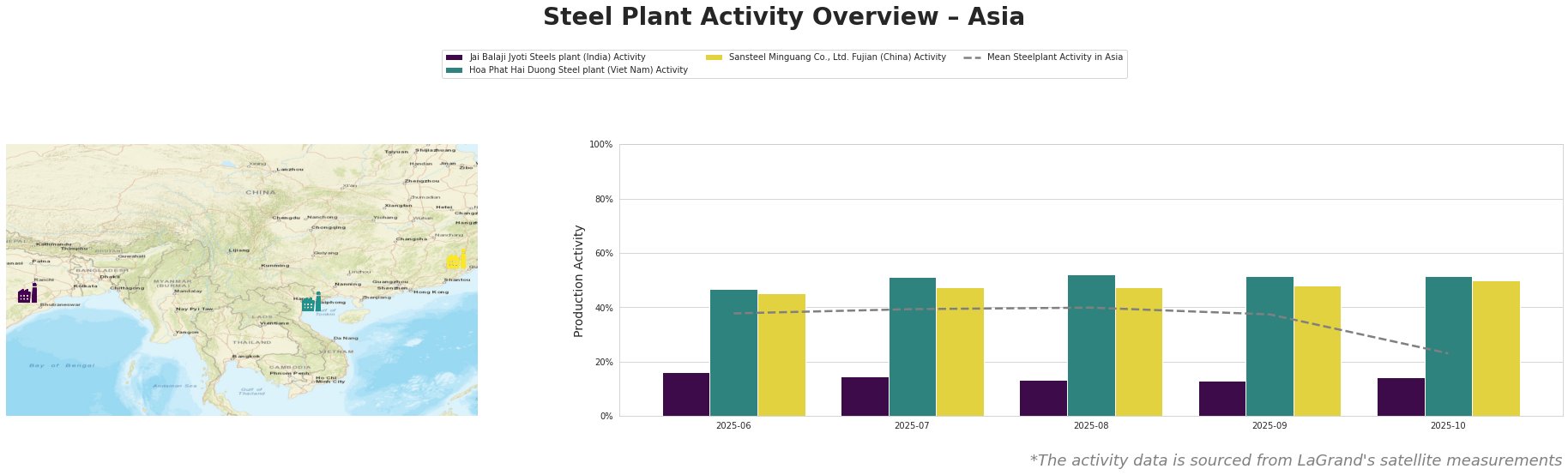

The mean steel plant activity in Asia saw a significant drop in October, falling to 23% from 37% the previous month. Jai Balaji Jyoti Steels plant in India remained relatively stable around 14% throughout the observed period. Hoa Phat Hai Duong Steel plant in Vietnam maintained a consistently high activity level, fluctuating between 47% and 52%. Sansteel Minguang Co., Ltd. in Fujian, China, exhibited stable activity between 45% and 50% during the same period.

Jai Balaji Jyoti Steels plant, located in Odisha, India, primarily uses the DRI-EAF route for its 92 thousand tons per annum (ttpa) of crude steel production. Its product portfolio includes DRI, billets, bars, wire rods, and iron ore. The plant’s activity levels have remained consistently low at around 14% throughout the observed period. No direct connection can be established between these activity levels and the cited news articles.

Hoa Phat Hai Duong Steel plant in Hai Duong, Vietnam, relies on the BF-BOF route with a crude steel capacity of 2.5 million ttpa. Key products include construction steel and hot-rolled coil. The plant has maintained a high and stable activity level, consistently around 50%, even as the overall Asian average declined in October. This stable activity may indicate a degree of insulation from the factors impacting Chinese steel production as reported in “China reduced iron ore production by 3.2% y/y in January-October“.

Sansteel Minguang Co., Ltd. in Fujian, China, operates via the BF-BOF route with a capacity of 6.8 million ttpa of crude steel, producing steel plates, round bars, and construction steel for building, infrastructure, and transport sectors. While “China reduced iron ore production by 3.2% y/y in January-October” and “Global steel production fell by 5.9% y/y in October” report production declines in China, this plant maintained a relatively stable activity level between 45% and 50%, increasing to 50% in October, contrary to the overall trend. This could be attributed to regional demand variations or specific product focus.

The news article “China increased its imports of coking coal by 6.4% y/y in October” suggests that Chinese steel producers are compensating for lower domestic iron ore production by importing more coking coal and, potentially, iron ore, to sustain steel production. This, combined with the overall decline in Asian steel production, as evidenced by the mean activity level dropping to 23%, suggests that steel prices in the region are likely to increase in the short term.

Given the observed market dynamics and reported trends, steel buyers should consider the following procurement actions:

- Diversify sourcing: With China’s domestic iron ore production decreasing, as reported in “China reduced iron ore production by 3.2% y/y in January-October“, buyers who rely solely on Chinese steel should explore alternative sources to mitigate potential supply disruptions. The consistently high activity at Hoa Phat Hai Duong Steel plant in Vietnam suggests it may be a reliable alternative supplier.

- Secure coking coal supplies: Since “China increased its imports of coking coal by 6.4% y/y in October,” the increasing demand for coking coal could lead to higher prices. Steel buyers with integrated BF-BOF facilities should consider securing long-term coking coal contracts to hedge against potential price increases.

- Monitor price fluctuations: Given the reduced production in China, as reported in “Global steel production fell by 5.9% y/y in October,” coupled with stable activity at Sansteel Minguang in Fujian, prices in the region could be volatile. Steel buyers should closely monitor price fluctuations and consider hedging strategies to minimize price risk.