From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Climate Goals Clash with Stable Production Amidst Finance Concerns

Asia’s steel market shows stable production levels despite ongoing climate discussions. Activity trends at key steel plants, observed via satellite, do not immediately reflect the climate finance debates highlighted in “Countries adopt agenda at UN climate talks after delay” or the fossil fuel concerns raised in “Climate plans so far fall short on fossil fuels: E3G“. It is currently not possible to link the climate goal discussions to any steel plant activities, implying no short term disruption.

The lack of updated climate targets from major emitters like China, as noted in “Geht es jetzt schon ums Überleben der Klimaziele?“, contrasts with observed activity levels, suggesting a potential disconnect between policy discussions and immediate production adjustments. This disconnect highlights a potential risk for future supply chain adjustments as climate policies evolve.

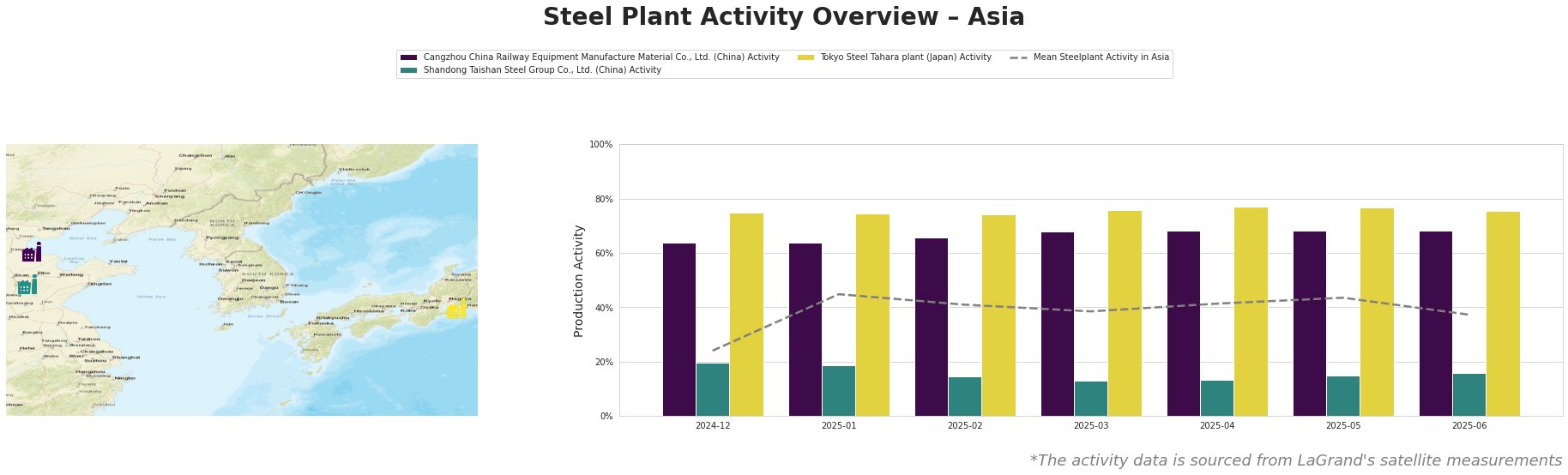

The mean steel plant activity in Asia fluctuated, peaking at 45% in January 2025 and dropping to 37% in June 2025.

Cangzhou China Railway Equipment Manufacture Material Co., Ltd., a Hebei-based integrated BF/BOF steel plant producing high-quality carbon and low-alloy hot-rolled coils for the transport and machinery sectors, exhibited relatively stable activity at 64% to 68% throughout the observed period. The company’s Responsible Steel certification does not appear to have immediately impacted activity levels, nor can any connection be established to the recent climate talks.

Shandong Taishan Steel Group Co., Ltd., an integrated BF/BOF/EAF steel plant in Shandong, experienced fluctuating but overall low activity, ranging from 13% to 20%. The most recent value for June 2025 stood at 16%. The company produces hot and cold-rolled coil, stainless steel, and other products. No direct connection can be established between its activity levels and the provided news articles.

Tokyo Steel Tahara plant, an EAF-based steel plant in the Chūbu region of Japan producing hot-rolled coils, steel sheets, and square steel pipes, maintained a high and relatively stable activity level between 74% and 77% over the period. Given Japan’s mention of phasing down coal in “Climate plans so far fall short on fossil fuels: E3G“, the stable activity at this EAF plant is notable, however a direct connection between these two observations cannot be established from the provided information.

Based on the current data and news, no immediate supply disruptions are apparent in the Asian steel market. However, steel buyers should:

- Monitor Policy Implementation: Closely track the implementation of climate policies in major steel-producing nations like China, particularly in light of the concerns raised in “Climate plans so far fall short on fossil fuels: E3G“. While activity levels are currently stable, future regulations could impact production.

- Assess Climate Finance Impacts: Stay informed on the progress of climate finance discussions, as highlighted in “Countries adopt agenda at UN climate talks after delay“. Delays or disagreements on financial support for developing nations’ climate goals could indirectly affect steel production costs and competitiveness.

- Evaluate EAF vs. BF/BOF Production: Track the relative performance of EAF-based plants like Tokyo Steel Tahara plant compared to BF/BOF plants like Cangzhou China Railway and Shandong Taishan Steel. Should climate policies penalize carbon-intensive production, EAF plants may gain a competitive advantage. However, more information is required to fully assess this potential effect.