From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Climate Focus & Stable Production Signal Continued Demand

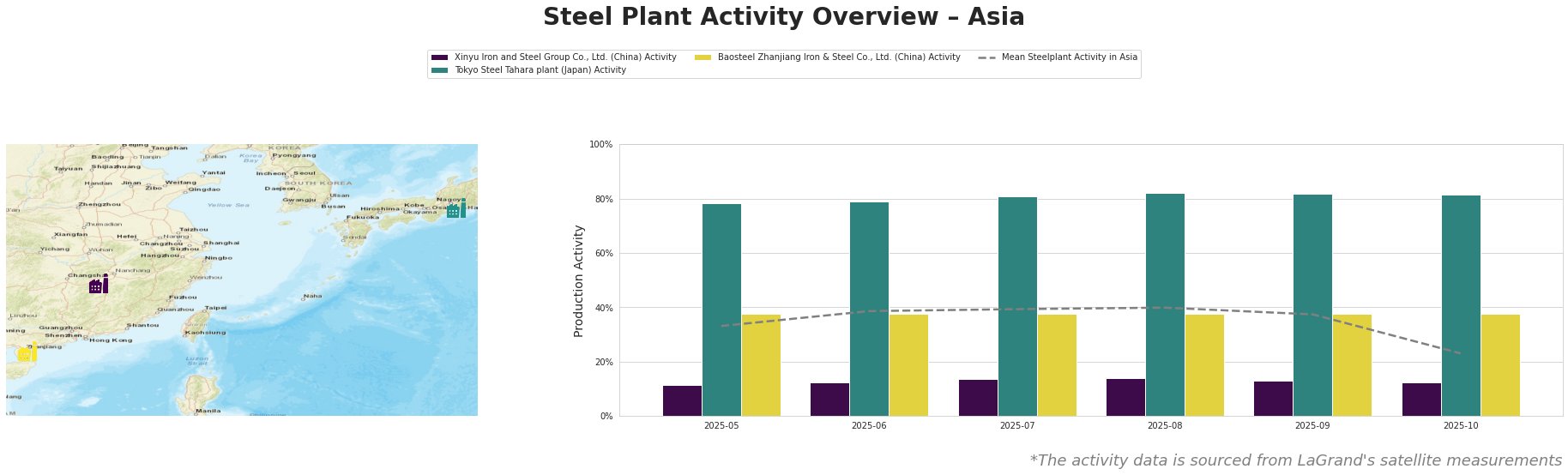

Asia’s steel market demonstrates overall stability amidst global climate policy shifts, with high activity at key plants like Tokyo Steel Tahara, contrasting with lower average levels across the region. This report synthesizes observed production data with news regarding international climate agreements, specifically citing “Cop: EU, China join Brazil in carbon market coalition,” which highlights the potential impact of emerging carbon markets on the steel industry. We have found no direct connections between observed plant activity and the other news articles provided.

The mean steel plant activity in Asia initially rose from 33% in May to a peak of 40% in August before declining to 23% in October, representing a significant decrease. Xinyu Iron and Steel Group Co., Ltd. consistently operated at low levels (11-14%), substantially below the Asian average. Tokyo Steel Tahara plant maintained a high activity level of around 80% throughout the observed period, consistently exceeding the average. Baosteel Zhanjiang Iron & Steel Co., Ltd. operated at a stable 38% activity level throughout the period.

Xinyu Iron and Steel Group Co., Ltd., located in Jiangxi, China, has a crude steel capacity of 10,000 thousand tonnes per annum (ttpa), relying on integrated BF-BOF processes to produce finished rolled products like medium, thick, and extra thick plates for the energy, building/infrastructure, and transport sectors. Activity at this plant remained consistently low, at around 12%, and significantly below the regional average. There is no direct connection that can be established between the observed activity and the provided news articles.

Tokyo Steel Tahara plant, situated in Chūbu, Japan, boasts a crude steel capacity of 2,500 ttpa, utilizing EAF technology to produce semi-finished and finished rolled products like hot rolled coils, steel sheets, and square steel pipes. This plant showed exceptionally high activity levels, consistently around 80%, significantly exceeding the Asian average. The high activity suggests strong regional demand for its products. There is no direct connection that can be established between the observed activity and the provided news articles.

Baosteel Zhanjiang Iron & Steel Co., Ltd., located in Guangdong, China, has a crude steel capacity of 12,528 ttpa, relying on integrated BF-BOF processes and DRI for hot rolled plates, cold rolled sheets, and hot-dip galvanized plates. Its activity remained constant at 38%, near the regional average during the first months. There is no direct connection that can be established between the observed activity and the provided news articles.

Given the sustained high activity at Tokyo Steel Tahara plant, procurement professionals should consider securing contracts with Tokyo Steel early to ensure a stable supply of hot rolled coils and steel sheets. The formation of the “Cop: EU, China join Brazil in carbon market coalition” suggests a future where carbon pricing may impact steel production costs. Analysts should closely monitor the development and implementation of these carbon markets to assess potential price increases, especially for steel produced via carbon-intensive methods. Diversifying suppliers across different production methods (EAF vs. BF/BOF) could mitigate risk associated with carbon pricing impacts.