From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Chinese Tinplate Duties & Plant Activity Shifts Impact Supply Dynamics

The Asia steel market faces potential shifts in supply dynamics due to recent EU anti-dumping duty adjustments on Chinese tinplate and fluctuating steel plant activity levels. The European Commission’s revisions, as reported in “EU amends AD on tinplate from China” (Published: 2025-07-24T22:00:00Z) and similar articles, impact key Chinese exporters, potentially diverting supply to or from Asian markets. Observed activity changes at Jianglong Acheng Iron & Steel Co., Ltd. show a trend, but no direct link to the EU duties can be established.

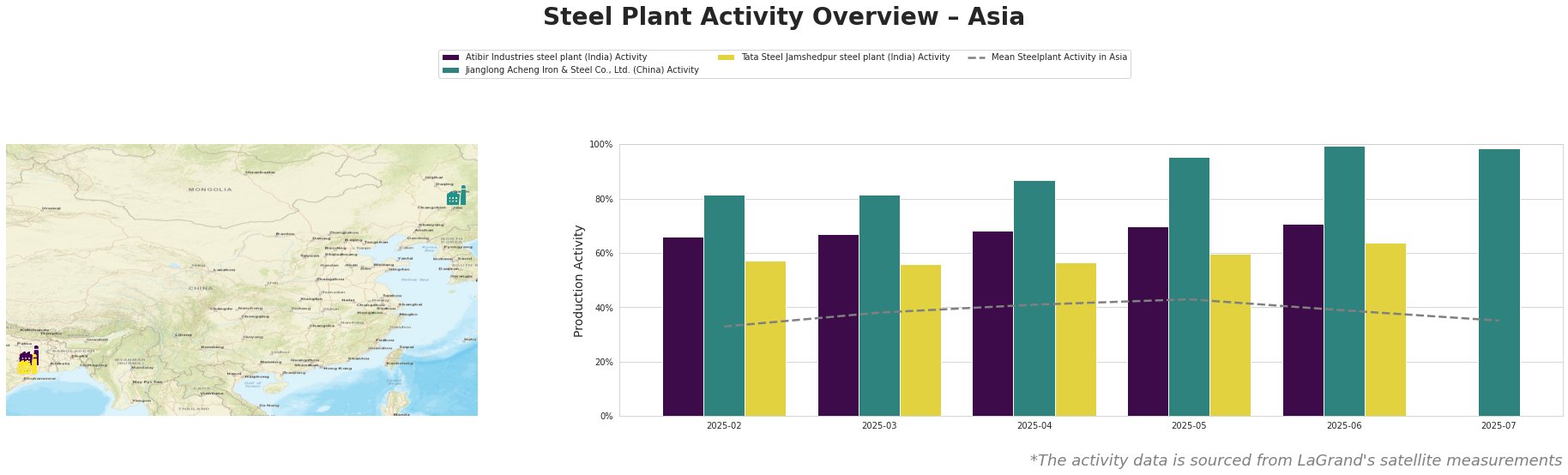

The mean steel plant activity in Asia fluctuated, peaking at 43% in May 2025 and dropping to 35% in July. Atibir Industries in India remained consistently above the mean, ranging from 66% to 71%. Jianglong Acheng Iron & Steel in China saw a significant increase, peaking at 100% in June 2025, before slightly declining to 98% in July. Tata Steel Jamshedpur showed a gradual increase from 57% to 64% between February and June, but data for July is missing.

Atibir Industries, a 600 ttpa capacity integrated steel plant in Jharkhand, India, primarily utilizes BOF technology fed by its blast furnace. Its activity remained relatively stable and above the Asian average, showing a slight increase from 66% in February to 71% in June. There is no clear relationship between these stable, strong activity levels and the EU’s anti-dumping duty adjustments on Chinese tinplate or organic coated steel.

Jianglong Acheng Iron & Steel Co., Ltd., a 1100 ttpa capacity integrated BF/BOF steel plant in Heilongjiang, China, produces finished rolled products, including coated steel, for the automotive and energy sectors. Its activity surged from 82% in February to 100% in June, before slightly declining to 98% in July. This increased activity might be linked to anticipation of or reaction to the EU’s anti-dumping measures on tinplate, but no direct evidence confirms this.

Tata Steel Jamshedpur, a major integrated steel plant in Jharkhand, India, with a 10,000 ttpa capacity, produces finished rolled products like wire and tinplate. Its activity showed a steady increase from 57% in February to 64% in June. Although Tata Steel produces tinplate, no direct correlation can be drawn between the EU’s anti-dumping duties on Chinese tinplate and the observed activity levels. However, the recent news that the “EU amends AD on tinplate from China” could impact the plants activity and margins going forward.

The EU’s imposition of duties on organic coated steel, as detailed in “EU imposes final Chinese duties on organically coated steel“, could indirectly impact demand for specific steel products in Asia, especially given Jianglong Acheng’s production of coated steel. Given these duty adjustments and activity shifts, steel buyers should:

- Monitor tinplate supply chains closely: The EU’s amended anti-dumping duties on Chinese tinplate, per “EU amends advertising on tinplate from China“, may cause Chinese suppliers to seek alternative markets, potentially increasing tinplate supply in Asia and driving down prices. Procurement teams should be prepared to negotiate pricing, but factor in transit times and other logistical challenges.

- Diversify sourcing for coated steel: Given the EU’s duties on Chinese organic coated steel detailed in “EU imposes definitive Chinese organic coated steel duties“, buyers reliant on Chinese sources should evaluate alternative suppliers in Asia.

- Assess impact of Chinese production shifts: The observed activity increase at Jianglong Acheng Iron & Steel, without a direct link to EU duties, warrants close monitoring. Procurement teams should assess the company’s capacity for increased exports to ensure order fulfillment amid the plant’s high utilization rate. A close understanding of their client structure will allow procurement teams to make more informed decisions.