From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Chinese Exports Surge Amidst Rising Indian and Stable Japanese Production

Asia’s steel market presents a positive outlook, driven by increasing Chinese exports and sustained production in key regions. Recent increases in scrap imports in Pakistan and steel bar exports from China, as highlighted in “Pakistan’s scrap imports up 1.7 percent in Apr from Mar” and “China’s steel bar exports increase by 48.1 percent in Jan-Apr,” suggest shifting trade dynamics. These shifts do not directly correlate with observed activity changes at the monitored steel plants.

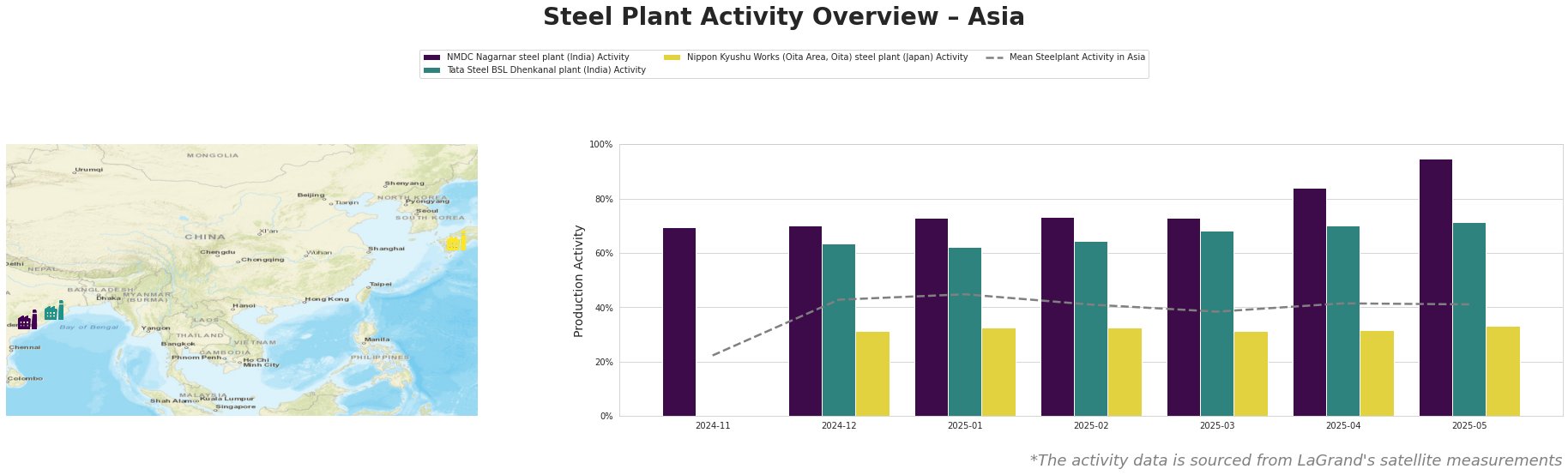

The mean steel plant activity in Asia fluctuated, starting at 22% in November 2024 and reaching a high of 45% in January 2025, before stabilizing around 41% between February and May 2025. NMDC Nagarnar steel plant (India) consistently showed high activity, peaking at 95% in May 2025, significantly above the Asian average. Tata Steel BSL Dhenkanal plant (India) showed a stable activity level between 62% and 71%. Nippon Kyushu Works (Oita Area, Oita) steel plant (Japan) maintained steady activity around 31-33%. No direct connections could be established between the observed plant activity data and the provided news articles concerning U.S. steel trade dynamics or Pakistan’s scrap imports.

NMDC Nagarnar steel plant, located in Chhattisgarh, India, boasts a crude steel capacity of 3000 ttpa utilizing BOF technology integrated with a BF. The plant’s activity has steadily increased, reaching 95% in May 2025, a significant rise from 70% in November 2024. This surge indicates robust production, potentially driven by domestic demand. There is no clear connection that can be established between the activity and any of the provided news headlines.

Tata Steel BSL Dhenkanal plant in Odisha, India, has a larger crude steel capacity of 5600 ttpa, employing both BF and DRI methods alongside a CONARC EAF. Activity at this plant remained relatively stable, fluctuating between 62% and 71% over the observed period. The consistency in activity levels suggests steady operations.There is no clear connection that can be established between the activity and any of the provided news headlines.

Nippon Kyushu Works (Oita Area, Oita) steel plant in Japan, with a 10000 ttpa crude steel capacity based on BF and BOF processes, showed the least activity fluctuation, remaining consistently around 31-33%. This stability may reflect a deliberate production strategy or be influenced by regional market conditions.There is no clear connection that can be established between the activity and any of the provided news headlines.

Given the rise in Chinese steel bar exports, as indicated by “China’s steel bar exports increase by 48.1 percent in Jan-Apr,” and the consistent activity at the Japanese plant, steel buyers should anticipate increased supply of steel bars in the Asian market. Buyers reliant on imported steel from China should closely monitor shipping costs and potential trade policy adjustments. Consider diversifying suppliers and securing contracts with the Japanese plant.