From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Surge Offsets Korean Dip Amid EU Trade Shifts

Asia’s steel market shows a mixed picture, with strong activity in China contrasting with a decline in South Korea, while EU trade policy changes create uncertainty. The activity data, which indicates plant-level changes, cannot be directly linked to the provided news articles concerning EU trade policies. The EU news highlights potential implications for global steel trade, particularly concerning quotas and safeguard measures, but these are not directly reflected in observed Asian steel plant activity during this period.

The European Commission’s actions, as detailed in “EU postpones country-specific quotas on angles, shapes and sections to August” and “European Commission launches consultation on new EU steel measure post-2026“, introduce uncertainty for steel traders and buyers, potentially impacting global supply chains, though no direct impact on observed Asian steel plant activity can be established based on the provided data.

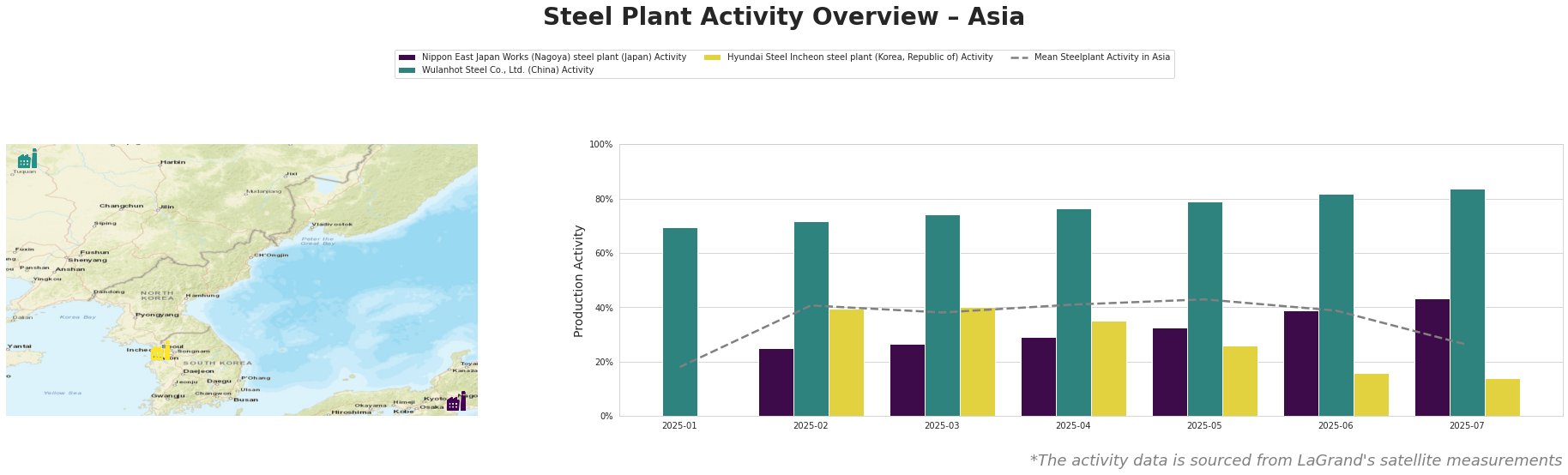

The mean steel plant activity in Asia fluctuated throughout the observed period, peaking at 43% in May and then dropping significantly to 26% in July.

Nippon East Japan Works (Nagoya) steel plant, an integrated BF-BOF steel plant with a 6000 ttpa crude steel capacity producing semi-finished and finished rolled products like plates and steel pipes, showed a steady increase in activity, rising from 25% in February to 43% in July. This rise occurred despite the overall decline in mean Asian activity but cannot be directly linked to the provided news articles on EU trade policy.

Wulanhot Steel Co., Ltd., a Chinese integrated BF-BOF steel plant with a 1050 ttpa crude steel capacity focused on finished rolled products like bars, showed a consistent upward trend in activity, climbing from 70% in January to 84% in July. This relatively high activity level, significantly above the Asian average, highlights China’s strong steel production. The German steelmakers call for swift implementation of European steel and metals plan article mentions global overcapacity, but without specific data on Chinese production, a direct link cannot be established.

Hyundai Steel Incheon steel plant, an electric arc furnace (EAF) plant with a 4800 ttpa crude steel capacity producing rebar and H-sections, experienced a notable decline in activity from 40% in February and March to just 14% in July. This sharp decline contributes significantly to the drop in the overall Asian average and raises concerns about South Korean steel production levels. The reasons for this decline cannot be established from the provided news articles.

Given the rising activity at Wulanhot Steel in China, steel buyers should consider:

- Diversifying sourcing: Explore options to secure steel from alternative sources outside of South Korea, given the decline at the Hyundai Steel Incheon plant. The rising output from Wulanhot Steel could present a viable alternative.

- EU Market Monitoring: Closely monitor announcements and details regarding the “European Commission launches consultation on new EU steel measure post-2026” and the implications of delayed quota implementation (“EU postpones country-specific quotas on angles, shapes and sections to August“) as these could affect global trade flows and pricing. Although, there is no direct evidence of how the EU consultation effects the steel plant activity.