From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Output Dips Amidst Rising Indian Coking Coal Imports

In Asia, steel market sentiment remains neutral amidst fluctuating production and shifting raw material dynamics. The CISA mills’ daily crude steel output down 0.5% in mid-June, stocks rise news article suggests a slight slowdown in Chinese steel production, but it’s unclear if this directly impacts the recent activity levels observed via satellite. Simultaneously, India’s May coking coal imports rise 45pc on year, reflecting increased demand in India, potentially offsetting some effects of China’s production adjustments, while Asian coking coal prices fell in June amid weak demand.

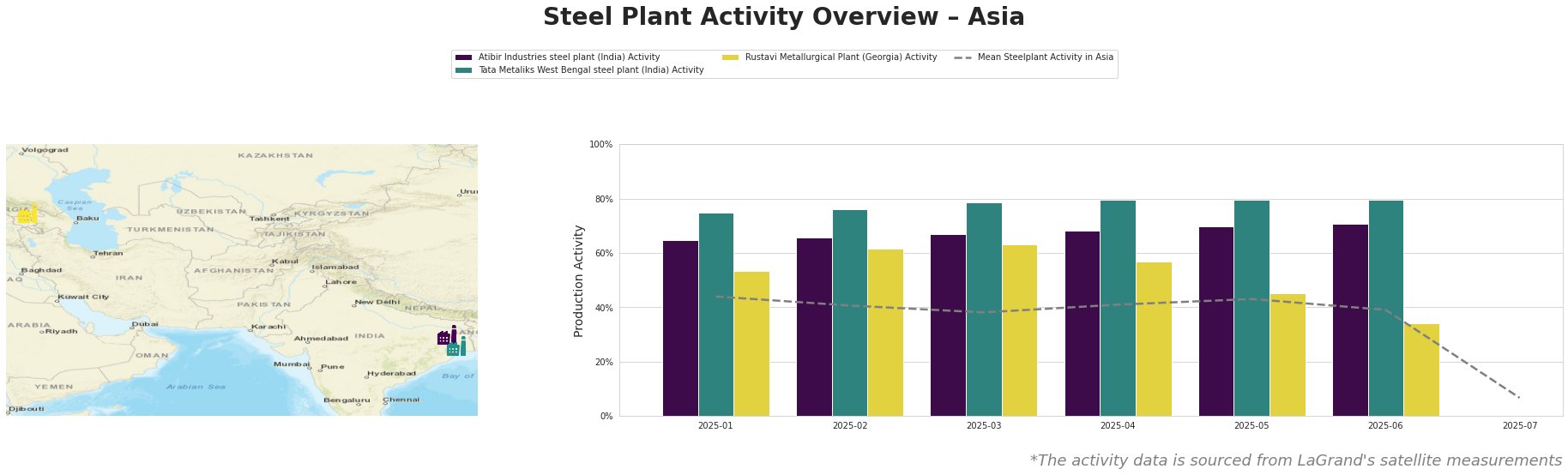

The mean steel plant activity in Asia declined from 44% in January to 39% in June. A sharp decrease to 7% in July suggests a significant disruption but lacks specific details. Atibir Industries (India) demonstrated consistently above-average activity, increasing steadily from 65% in January to 71% in June. Tata Metaliks (India) maintained a high, stable activity level at 80% from April to June, significantly above the Asian average. Rustavi Metallurgical Plant (Georgia) showed a declining activity trend, dropping from 54% in January to 34% in June, significantly below the Asian average, and the most significant drop in the region, signaling potential localized issues. No direct connection between these activity trends and the provided news articles can be explicitly established.

Atibir Industries, an integrated steel plant in Jharkhand, India, with a 600 ttpa BOF capacity, has consistently operated above the average activity level for Asian steel plants, reaching 71% in June. It remains unclear how this performance is directly influenced by the rising Indian coking coal imports mentioned in India’s May coking coal imports rise 45pc on year, as the article details a nationwide trend rather than plant-specific impacts. However, the consistent activity could indicate a stable supply chain and operational efficiency.

Tata Metaliks, a West Bengal-based integrated steel plant with a 600 ttpa BF capacity, has maintained a consistently high activity level of 80% from April to June. The plant primarily produces pig iron and ductile pipes. No direct correlation between this sustained high activity and the provided news articles can be explicitly confirmed. The stable output suggests either pre-existing raw material stockpiles or effective supply chain management mitigating the impact of coking coal price fluctuations.

Rustavi Metallurgical Plant, an integrated steel plant in Georgia utilizing BF, BOF, and EAF technologies, experienced a notable activity decline from 54% in January to 34% in June. No direct link to the provided news articles on coking coal pricing or Chinese steel output can be established. The decline might be attributable to regional economic factors or internal operational challenges not covered in the provided news.

The CISA mills’ daily crude steel output down 0.5% in mid-June, stocks rise report suggests a potential for decreased steel supply from China, potentially creating opportunities for non-Chinese producers if the trend continues. Given that CISA: Coking coal purchase costs in China down 32.26% in Jan-May, steelmakers relying on imported coal may face cost pressures if prices rebound and import costs increase.

Procurement Recommendations:

- For buyers sourcing from India: Closely monitor coking coal import trends and their impact on domestic steel prices. While Tata Metaliks and Atibir Industries currently show stable/increasing production, ensure contract flexibility to account for potential raw material cost fluctuations.

- For buyers dependent on Chinese steel: Evaluate alternative supply sources, particularly from India or Southeast Asia, in anticipation of continued production adjustments as indicated in the CISA report. Review inventory levels to mitigate potential short-term supply disruptions.

- For buyers in the Georgian region: Assess the impact of Rustavi Metallurgical Plant’s declining output on local steel availability. Diversify supply chains to reduce reliance on a single producer.