From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Green Mandates Fuel Optimism Amidst Plant Activity Shifts

China’s aggressive push for renewable energy adoption in key industries, highlighted in news articles like “China expands green energy targets in industrial sectors,” “China has ordered industrial giants to switch to renewable energy” and “China mandates renewable power use for industry,” is driving positive market sentiment in Asia. These mandates, however, may not yet have a discernible impact on overall Asian steel plant activity as observed via satellite. While these news articles signal long-term shifts, a direct real-time relationship cannot be explicitly established to any observed changes.

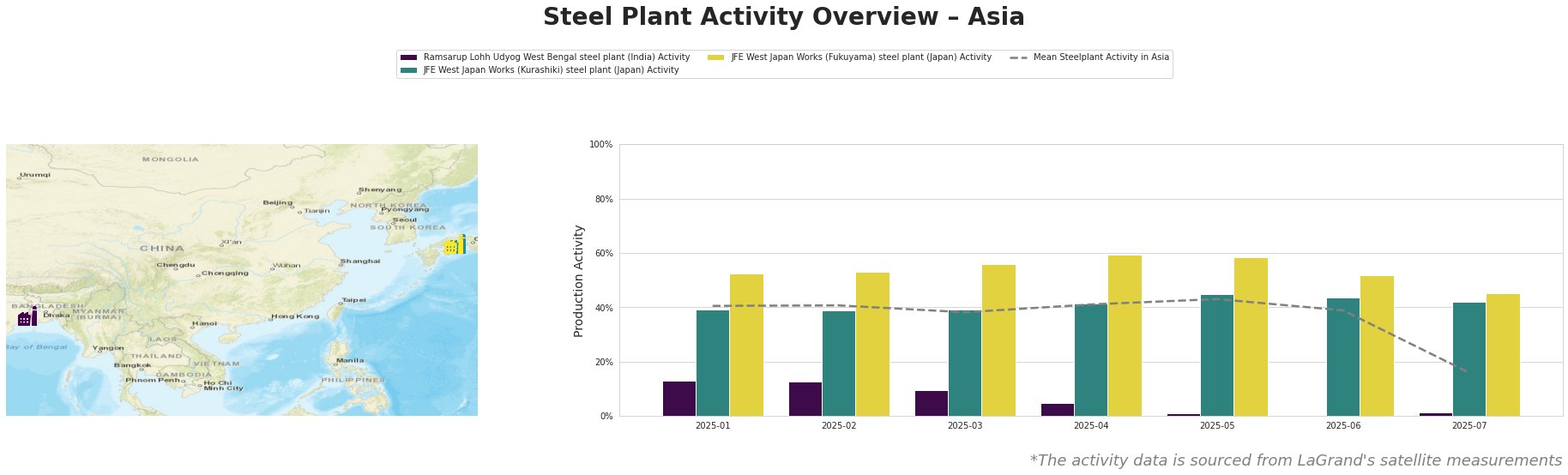

Across Asia, the average steel plant activity has fluctuated between 38% and 43% from January to May 2025, before experiencing a sharp decline to 16% in July. Ramsarup Lohh Udyog in West Bengal has consistently operated well below the Asian average, showing near-zero activity since May 2025 and a steady decline since January. JFE West Japan Works (Kurashiki) has operated consistently around the mean and JFE West Japan Works (Fukuyama) steel plant has shown above-average activity through May 2025 before declining. No explicit connection could be established between these plant level activites and the cited news articles.

Ramsarup Lohh Udyog, a West Bengal-based steel plant with DRI and BF capacity alongside a 70-tonne EAF, focuses on billets, transmission lines, and wires for the energy sector. Its activity has been exceptionally low, with observed activity at only 1% in July, down from 13% in January. This continuous downward trend, culminating in near-zero activity, is not directly relatable to the cited news articles concerning renewable energy mandates in China, suggesting localized operational issues.

The JFE West Japan Works (Kurashiki) steel plant, an integrated BF-BOF facility producing a wide range of flat and long steel products, including hot-rolled, cold-rolled, and coated sheets, has shown more stable activity. Observed values have been near the mean for the observed time range. Activity decreased to 42% in July after peaking at 45% in May, although the drop is smaller than the mean drop. The JFE West Japan Works (Fukuyama) steel plant, similar to Kurashiki in its integrated BF-BOF process and product range, showed a drop from 58% in May to 45% in July, after peaking at 59% in April. While these facilities are ResponsibleSteel certified, no direct link can be established between activity changes and the news articles regarding China’s renewable energy mandates.

Given the sharp drop in overall Asian steel plant activity in July and, more specifically, the very low activity at Ramsarup Lohh Udyog in India, steel buyers should:

- Prioritize diversifying their supply base beyond Ramsarup Lohh Udyog, particularly for products like billets and wires destined for the energy sector, to mitigate potential supply disruptions. This recommendation is based on the observed near-cessation of activity at this specific plant.

- Closely monitor capacity utilization rates across Asia to anticipate future supply fluctuations. The large drop in overall Asian steel production activity may foreshadow larger price increases and/or material shortages.

- Factor potential price increases into procurement budgets, based on China’s increased demand for green energy and the corresponding increased cost for Chinese steel producers. The news articles detail this shift to renewables.