From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Exports Surge Amidst Inventory Build-Up, India Ramps Up Exports

Asia’s steel market presents a mixed picture. While China sees a significant increase in semi-finished steel exports, as reported in “China’s semi-finished steel exports up 292% in January-August 2025,” and “China’s semis exports up 12% in August from July, up 292% in Jan-Aug 2025,” domestic inventories are also on the rise, according to “Stocks of main finished steel products in China up 2.3 percent in mid-Sept 2025.” India is also increasing its steel exports, according to “India Raises Steel Exports by 22% in April–August 2025“. Satellite data reveals varying activity levels across major steel plants in the region, but no immediate link between these levels and the news about increased Chinese exports can be established, although the rise of domestic inventories in China might correlate to the increased Chinese exports in a second step.

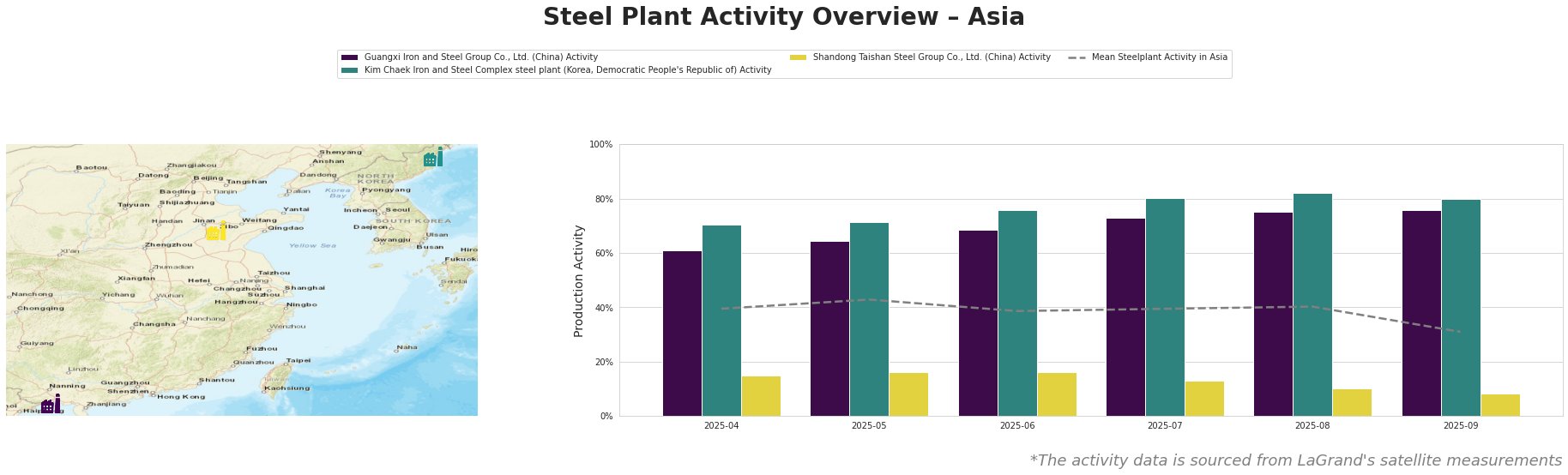

The mean steel plant activity in Asia has fluctuated, peaking at 43% in May and dropping significantly to 31% in September. Guangxi Iron and Steel Group Co., Ltd. consistently shows activity levels well above the Asian average, reaching 76% in September. Kim Chaek Iron and Steel Complex also demonstrates strong activity, peaking at 82% in August but decreasing slightly to 80% in September. Shandong Taishan Steel Group Co., Ltd. shows persistently low activity levels, dropping to a low of 8% in September. A direct link between these activity variations and the provided news articles cannot be established.

Guangxi Iron and Steel Group Co., Ltd., an integrated BF-based steel plant in Guangxi, China, with a crude steel capacity of 9.2 million tons and a significant production of cold-rolled coil, hot-dip galvanized coil, and color-coated sheet, has consistently operated at high activity levels. Its activity increased steadily from 61% in April to 76% in September, indicating stable or growing production. There is no clear correlation that can be established between the strong observed plant activity and any of the above-mentioned articles.

Kim Chaek Iron and Steel Complex, a large integrated steel plant in North Hamgyeong, Democratic People’s Republic of Korea, with a crude steel capacity of 6 million tons producing both semi-finished and finished rolled products, including hot-rolled and cold-rolled products, plate, wire rod, seamless tube, and hot-dip galvanized steel, has demonstrated the highest activity levels among the observed plants, peaking at 82% in August. The plant’s activity remains very high, although decreasing slightly to 80% in September. There is no clear correlation that can be established between the strong observed plant activity and any of the above-mentioned articles.

Shandong Taishan Steel Group Co., Ltd., an integrated BF-based steel plant in Shandong, China, with a crude steel capacity of 5 million tons specializing in hot-rolled coil, cold-rolled coil, and stainless steel, has consistently exhibited the lowest activity levels. The plant’s activity continued to decline, reaching a low of 8% in September. There is no clear correlation that can be established between the week observed plant activity and any of the above-mentioned articles.

Given the rising steel inventories in China reported in “Stocks of main finished steel products in China up 2.3 percent in mid-Sept 2025,” combined with increased exports reported in “China’s semi-finished steel exports up 292% in January-August 2025,” steel buyers should anticipate potential downward pressure on Chinese steel prices in the short term. Procurement professionals should consider negotiating with Chinese suppliers to capitalize on this potential price decrease and diversify supply chains to mitigate risks associated with reliance on a single market and prepare for increased import competition from India, as reported in “India Raises Steel Exports by 22% in April–August 2025“.