From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Export Surge & Tianjin’s Production Boost Drive Bullish Outlook

Asia’s steel market demonstrates strong momentum, primarily fueled by China’s robust export activity. According to “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography,” Chinese steel exports surged in July, continuing a trend of strong performance throughout the year. While “China’s iron ore imports decrease by 2.3 percent in January-July 2025” indicates a slight year-on-year decrease in iron ore imports, July saw an increase, suggesting sustained production levels to support these exports. These trends are partially reflected in the observed plant activity.

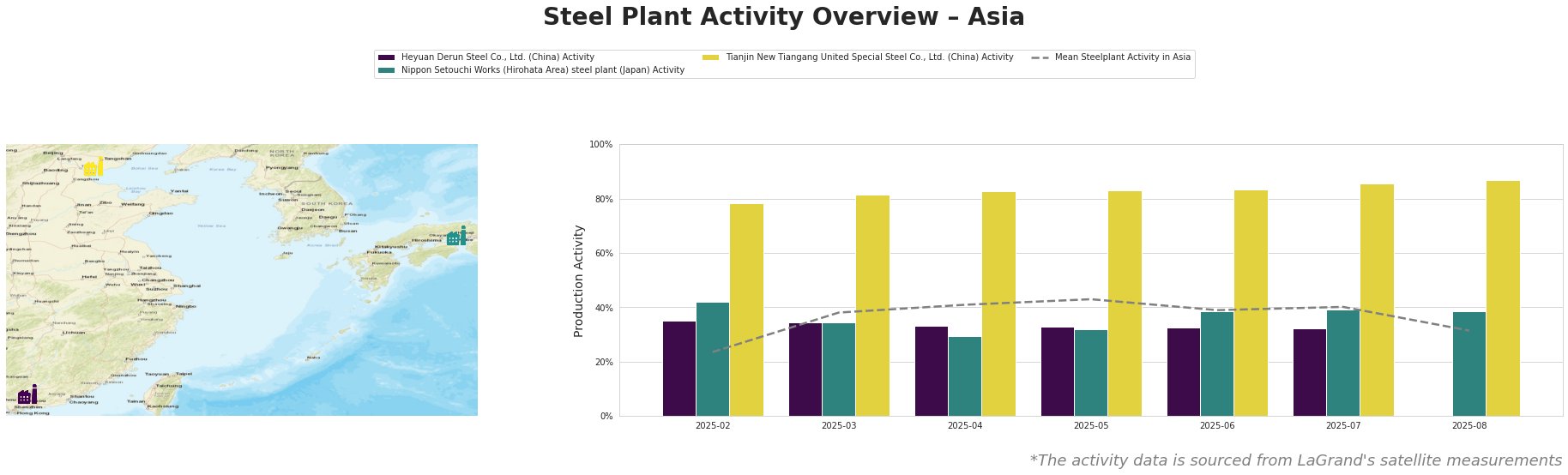

The mean steel plant activity in Asia shows fluctuations but remained around 40% between April and July before dropping significantly in August. Heyuan Derun Steel Co., Ltd. consistently operated below the mean activity level. Nippon Setouchi Works maintained a relatively stable activity level around the mean, while Tianjin New Tiangang United Special Steel Co., Ltd. consistently demonstrated significantly higher activity than the mean across all periods. The drop in overall activity level for the month of August is likely due to missing data for Heyuan Derun Steel Co., Ltd. (China) and might not accurately reflect actual market trends.

Heyuan Derun Steel Co., Ltd., located in Guangdong, China, primarily uses electric arc furnaces (EAF) to produce 1.2 million metric tons of crude steel annually, focusing on hot-rolled rebar and billets. Its activity remained consistently below the Asian average, showing a gradual decrease from 35% in February to 32% in July. No direct connection can be established between this trend and the provided news articles.

Nippon Setouchi Works (Hirohata Area) in the Kansai region of Japan has a crude steel capacity of 2.816 million metric tons per year, mainly produced via the BOF process. It produces sheets. The plant’s activity fluctuated, starting at 42% in February, dropping to 29% by April, and then recovering to 39% by July, where it remained until August. No direct link can be established between these fluctuations and the provided news articles.

Tianjin New Tiangang United Special Steel Co., Ltd., an integrated steel plant in Tianjin, China, boasts a crude steel capacity of 4.5 million metric tons via the BOF process and 3.32 million tons of Iron production. Its activity consistently trended high, beginning at 78% in February and increasing to 87% by August. This aligns with the “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography” article, suggesting that increased production is contributing to China’s export capacity.

Given the strong export performance highlighted in “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography” and the high activity levels at Tianjin New Tiangang United Special Steel Co., Ltd., steel buyers should anticipate stable supply from this plant, particularly for angle steel and continuous casting billets. However, buyers should also monitor potential price increases due to strong demand, especially in light of the discussed shift in geography to the Middle East. For buyers reliant on Heyuan Derun Steel, diversify supply to avoid disruption.