From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Export Surge & India’s Growth Counterbalance Production Cuts

Asia’s steel market presents a mixed outlook. China’s rising exports are a key factor, as highlighted in “IREPAS Meeting: 2025 set to be record year for China’s steel exports” and “IREPAS meeting: 2025 will be a record year for Chinese steel exports.” These exports are driven by stagnant domestic demand, while India and the ASEAN region show strong consumption growth, according to “Anastasiia Kononenko: Consumption growth outlook rather strong for both India and ASEAN region.” Satellite data shows a divergence in plant activity, with no direct links explicitly explained in these articles.

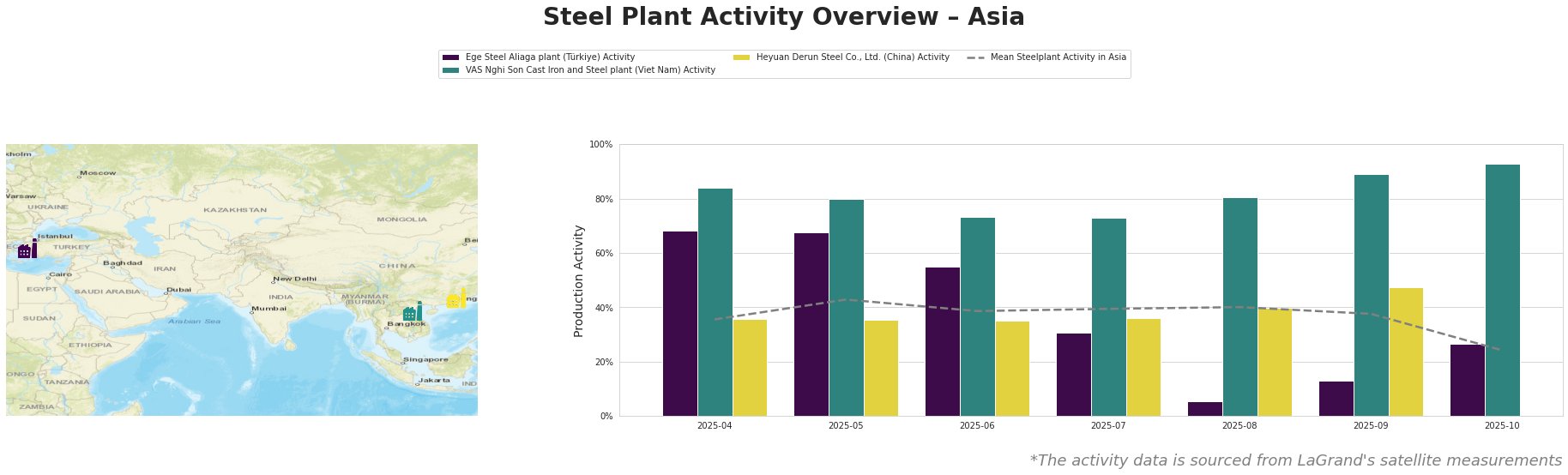

The mean steel plant activity in Asia fluctuated, peaking at 43% in May and then declining to 24% in October. Ege Steel Aliaga plant (Türkiye) experienced a sharp decline in activity, dropping from 68% in April and May to only 5% in August, then slightly recovering to 27% in October. VAS Nghi Son Cast Iron and Steel plant (Viet Nam) shows a consistently high activity level, increasing from 84% in April to 93% in October. Activity at Heyuan Derun Steel Co., Ltd. (China) remained relatively stable, with a slight peak at 48% in September.

Ege Steel Aliaga plant, an EAF-based mill in Turkey with a 2 million tonne crude steel capacity producing rebar and wire rod, experienced a significant activity drop to 5% in August, then slightly recovering to 27% in October. This decline, given the plant’s reliance on electric arc furnaces, could be related to the raw material concerns (scrap availability, rising freight costs for Turkish suppliers) cited in “Raw Material Suppliers at IREPAS: Global trade conditions are “devastating” due to uncertainty“.

VAS Nghi Son Cast Iron and Steel plant, a Vietnamese EAF-based mill with a 3.15 million tonne capacity for billet, rebar and wire rod, shows a strong upward trend in activity, reaching 93% in October. This increase aligns with the positive outlook for steel consumption and production in the ASEAN region presented in “Anastasiia Kononenko: Consumption growth outlook rather strong for both India and ASEAN region“, with capacity expansions in Vietnam.

Heyuan Derun Steel Co., Ltd., a Chinese EAF-based mill in Guangdong with a 1.2 million tonne capacity producing rebar and billet, showed relatively stable activity. There is no directly attributable connection from the news articles.

Evaluated Market Implications:

The rise of Chinese steel exports, especially rebar and wire rod, as reported in “IREPAS Meeting: 2025 set to be record year for China’s steel exports,” combined with stable-to-increasing activity at Heyuan Derun Steel Co., Ltd. (China), suggests a potential oversupply of these products in the Asian market. Meanwhile, the significant drop in activity at Ege Steel Aliaga plant (Türkiye) implies a potential supply disruption for Turkish-sourced steel.

-

Recommended Procurement Action for Steel Buyers: Given the anticipated surge in Chinese exports, buyers in Asia should aggressively negotiate prices for rebar and wire rod with Chinese suppliers, while being aware of potential trade restrictions and tariffs as reported in “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry“.

-

Recommended Action for Market Analysts: Closely monitor Turkish steel prices and import data, particularly from alternative sources, as a result of the disruption in production at Ege Steel Aliaga Plant. Continuously monitor ASEAN market dynamics in the context of capacity expansion in Vietnam.