From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Production Dips, Semi-Finished Exports Surge, India Remains Stable

Asia’s steel market presents a mixed picture, with China experiencing production cuts while exports of semi-finished products rise significantly. According to “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025” and “China cuts steel production to 73 million tons in September“, Chinese steel production has decreased. While “China’s semi-finished steel exports rise 215.43% in January – September 2025” reports a surge in semi-finished product exports. The satellite data provides insights into steel plant activity, but no direct linkage can be established between specific plant activity changes and these news articles.

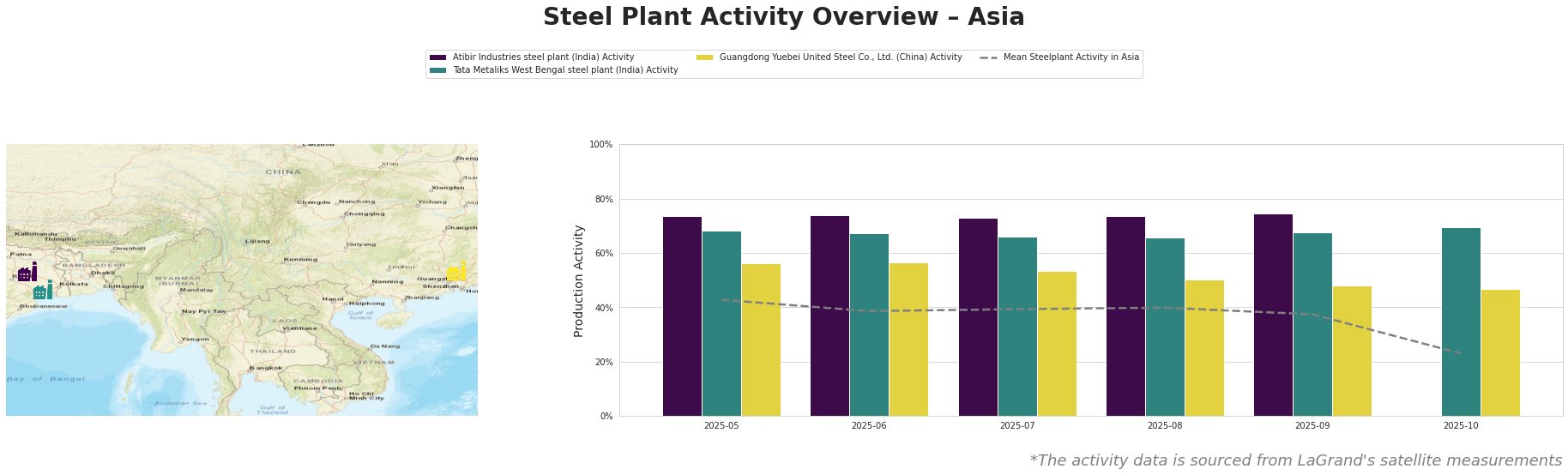

Overall, the mean steel plant activity across Asia has declined significantly, reaching 23.0% in October 2025. Atibir Industries in India shows consistently high activity between 73% and 75% from May to September. Tata Metaliks in West Bengal demonstrates stable activity between 66% and 70%. Guangdong Yuebei United Steel in China shows a decreasing trend from 56% in May to 47% in October. No direct link between satellite activity data and news articles could be established.

Atibir Industries, an integrated steel plant in Jharkhand, India, uses BF and BOF technologies and has a crude steel capacity of 600 ttpa. Observed activity remained consistently high from May to September 2025. Given India’s seemingly stable production and Atibir’s stable production, no direct correlation can be explicitly made between Atibir’s activity and the news articles concerning China’s production changes.

Tata Metaliks, located in West Bengal, India, also operates as an integrated BF-BOF plant, with a crude steel capacity of 255 ttpa. Satellite data indicates stable activity between May and October 2025. As with Atibir Industries, no direct relationship to the provided news articles can be established regarding Tata Metaliks’ operational activity.

Guangdong Yuebei United Steel Co., Ltd., located in Guangdong, China, has a crude steel capacity of 2000 ttpa, utilizing BF, BOF, and EAF technologies to produce finished rolled products like rebar. Satellite data shows a decreasing activity trend from May to October 2025. While the overall decline in China’s steel production is reported in “China’s crude steel output totals 73.49 million mt in Sept, down 2.9% in Jan-Sept 2025” and “China cuts steel production to 73 million tons in September,” a direct correlation between those reports and the satellite-observed activity drop at Guangdong Yuebei United Steel cannot be explicitly established with the provided information.

Based on the information provided, steel buyers should be aware of potential supply disruptions originating from China due to reported production cuts.

Procurement Actions:

* Monitor Chinese Export Prices: Given the surge in semi-finished steel exports from China, as reported in “China’s semi-finished steel exports rise 215.43% in January – September 2025“, closely monitor export prices from China. If production cuts continue, this surge may be temporary and prices could rise.

* Evaluate Indian Suppliers: Since Atibir Industries and Tata Metaliks in India show stable activity, explore opportunities to diversify supply chains and reduce reliance on Chinese steel sources.